THE URBAN DEVELOPER LONG LUNCHBNE & MEL (Sold Out), SYD (Limited Tickets)BNE & MEL (Sold Out), SYD (Limited Tickets)

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeMelbourne has chalked up one of the strongest apartment completion rates on record despite high-vacancy rates putting downward pressure on rents according to an industry report.

Almost 15,000 apartments were completed in the 2021 financial year, boosting supply well above demand to increase vacancy rates and drive down rents in Melbourne.

The city’s apartment market revival will be contingent on the reopening of the borders and international migration as the city continues to feel the effects of an oversupply of unit according to Charter Keck Kramer’s State of the Apartment Market report for the first half of 2021.

Low net overseas inbound migration and Covid-19-induced regional migration led to a decline of Victoria’s population of more than 45,000 people in the nine months to March, 2021.

The report showed median asking unit rents had declined 10 per cent in the 12 months to June 2021, while the vacancy rate was about 3.5 per cent.

CKK national director of research and strategy Rob Burgess said the off-the-plan market had remained subdued, particularly in the inner-city area, which had borne the brunt of Covid-19 lockdowns.

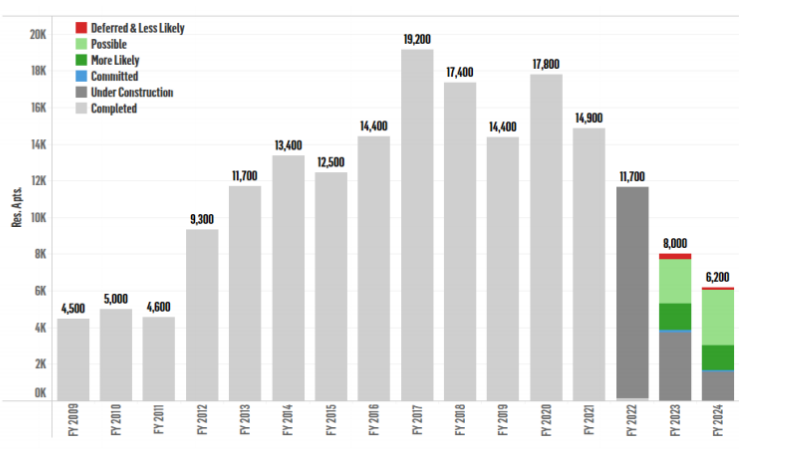

“About 14,900 apartments were estimated to have been completed in FY2021, the fourth highest annual completion rate on record,” Burgess said.

“This is likely to continue to place upward pressure on vacancy rates and downward pressure on rents.”

Melbourne completions over time

^Source: Charter Keck Kramer

But the rate of new completions is about to drop off a cliff, with just 6200 apartments launched in the second half of 2020 and 5800 in the first half of 2021.

“This will translate to a significantly lower completions in the coming years, potentially mitigtating some of the longer-term over-supply risks,” Burgess said.

“The pace of absorption of apartments and the return of rental growth will be dependent on the easing of Covid restrictions and the reopening of international borders.

“A rapid recovery in net overseas migration may see vacancy rates tighten more quickly, placing upward pressure on rents, yields and prices, in turn igniting off-the-plan demand.”

Burgess said there had been a significant shift in apartment stock development in the first of 2021, with just 5800 apartments launched, the lowest number of launches in the past decade, and construction of about 7200 apartments commenced, also at its lowest ebb over the past 10 years.

“[This] represents a decrease of almost 65 per cent on the annual average recorded over the 2015 financial year to 2018 financial year period.

“The average marketing period for apartment projects has increased from around eight months in 2010, to 19 months in the 2021 financial year.

“This reflects both slower sales rates and increased time frames to secure finance.”

A number of inner-city Melbourne suburbs were identified as danger zones for investors recently, where oversupply was a looming issue, including Boxhill, Footscray, Brunswick and South Melbourne.

BuyersBuyers co-founder Pete Wargent said there had been a “race for space” in the past 18 months as buyers abandoned high-density living in Australia’s most populous cities.

Wargent said while this had been good news for house prices, unit markets in high-supply areas were a riskier investment.

“Although demand has dropped sharply given the absence of international students and other visitors, there are still some areas with a high volume of potential new units in the pipeline over the next couple of years,” Wargent said.

"The danger areas aren’t limited to the CBD but are rather found where there are clusters of new developments.”

Melbourne rent prices increased a very negligible 1.8 per cent over the past 12 months as the city emerges from protracted lockdowns.

Melbourne’s apartment supply data is showing continued signs of slowing. A number of approved apartment projects have experienced delays brought on by weakened pre-sale demand, rising land and building costs and stricter funding conditions.

JLL reported signs of settlement default starting to appear, with Melbourne beginning to see apartment sales fall last year as the pandemic began.

“A soft pre-sales environment is seeing some projects abandoned or delayed, as developers reassess their feasibility,” the report stated.

But if the pendulum swings the other way when borders reopen an undersupply of apartments will become an issue with the low number of projects on line.