Brisbane Apartment Market Looks Up

There’s been a lot of recent analysis on the state of Brisbane’s apartment market, and a new report by JLL is weighing in on the positive side of things – suggesting that Brisbane’s unit market has bottomed out and is due to bounce back.

The commercial real estate agency’s Brisbane apartment market report says 2018 will remain rough for Brisbane’s apartment market, but conditions should stabilise as the year progresses.

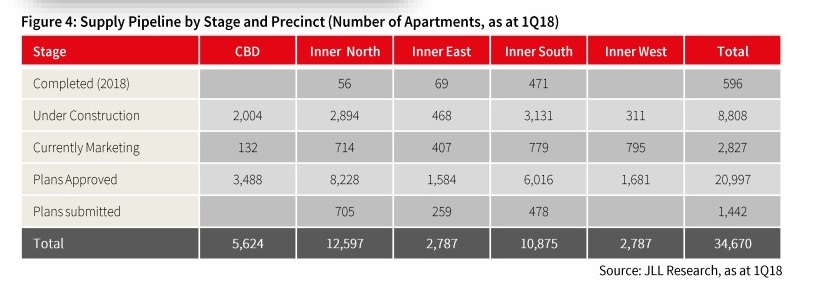

Inner Brisbane has about 8,800 apartments under construction across 46 projects of which almost 70 per cent were sold prior to completion.

Market fundamentals are forecast to remain challenging in the short-term, putting downward pressure on apartment values and rents as apartment supply is absorbed.

Thanks to Queensland’s stable economic outlook, the report expects continued population growth to bolster housing demand across the next few years.

When it comes to supply, completions continue to drop. Apartment approvals fell 30.8 per cent over the 12 months to January 2018.

A total of 3,849 apartment dwellings were approved over this same period with the highest concentration in South Brisbane (25 per cent), Fortitude Valley (15 per cent) and West End (11 per cent).

Commencements are expected to remain limited in the short to medium term as supply is absorbed.

The report faults credit constraints which continue to be the largest hurdle for developers wanting to progress to the construction phase of their projects.

Related: 10,000 Apartments Abandoned in Saturated Brisbane Market: BIS

JLL national director of residential research Leigh Warner says values in the greater Brisbane apartment market only declined by 1.8 per cent in the 12 months to December 2017, which is the slowest rate of decline in some years and the market has shown further signs of stabilisation in early-2018.

When the property market slows, buying opportunity flows

Consolidated Properties chairman Don O’Rorke believes buyers should embrace the slower market conditions as an opportunity to buy counter-cyclically.

“There are multiple indicators that Brisbane’s apartment market is at the bottom of its cycle and the good news is that there are already signs of the market moving upwards,” Rorke said.

Corelogic’s recent property pulse shows there were 48,050 settled house and unit sales in Brisbane across the 12 months to May 2018, with transaction volumes across the city -12.1 per cent lower over the year.

House data sales have fallen by -8.3 per cent over the year to May, while unit sales recorded a greater fall of -19.8 per cent for the same period.

CoreLogic research analyst Cameron Kusher says monthly sales volumes have been trending lower for a number of years and are now slightly lower than the decade average.

“Volumes particularly for units, are likely to see moderate revision in the coming years but are likely to remain lower than they were a year ago,” Kusher said.