Interested in a Corporate TUD+ Membership?Speak to our team today for a special end-of-year discountSpeak to our team for an end-of-year discount

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeInvestors splashed out nearly $10 billion on Australian retail assets in the 12 months to June, smashing the five year average by nearly $3 billion - a 40 per cent rise - as a wide cross section of investors competed for available stock, according to Savills Australia’s latest research.

Savills’ National Head of Research, Tony Crabb, said investors had purchased property worth more than $9.76 billion, up 22 per cent from the $7.96 billion recorded in the previous corresponding period, and up $2.8 billion on the $6.96 billion five year average.

Mr Crabb said all surveyed capital cities – Adelaide, Brisbane, Melbourne, Perth and Sydney – recorded significant rises particularly Melbourne which was up $900 million to $2.77 billion closely followed by Sydney (2.9b up from $2.1b) and Brisbane ($2.71b up from $1.88b).

"This has been a massive result even given the tremendous investment market we have experienced over the last few years,’’ Mr Crabb said.

The figures include a number of major transactions involving Blackstone, Mirvac and Vicinity Centres. Blackstone purchased Vicinity Centre’s Rundle Place and 80 Grenfell Street in the Adelaide CBD in December for $400 million and a three-centre portfolio from Scentre Group for $655.5 million in August.

In May Blackstone also acquired Clifford Gardens in Queensland, together with Forest Hill Chase and Brimbank Shopping Centre in Victoria for $613.3 million, while Mirvac picked up Toombul Shopping Centre in Brisbane for $233 million.

The frenetic retail market looks set to continue into the next financial year with another six Vicinity Centres retail assets on the market and due to close this week, including Maitland Hunter Mall, Hilton Plaza, Monier Village, Tweed Mall, Wodonga Plaza, and Albany Brooks Garden. The properties have a book value of more than $200 million.

Savills’ National Director Retail Investments, Steven Lerche, said while there had been some very significant sales the figures nevertheless reflected a very strong market driven by a number of factors including pent up demand.

"The figures are huge and reflect significant pent up demand driven by retail property’s safe haven status amid continued global economic turmoil. Global cash has and will continue to find Australia a transparent market where it’s easy to do business,’’ Mr Lerche said.

"Over the next six months we will see a continuation of the strong demand but prospective purchasers are likely to find a severe shortage of stock with owners reluctant to part with their prized investments: where will they put their money if they sell?"As a result we are going to see intense competition for any asset that comes to market and that will see falling yields continue to break records,’’ Mr Lerche said.

He said any further interest rate cut by the RBA would add fuel to the fire.

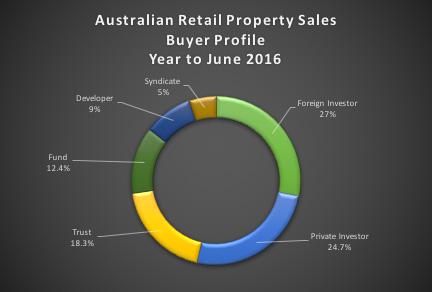

Source: Savills ReasearchMr Crabb said foreign investors were again prominent with 27 per cent of purchases by value followed by private investors (24.7%), Trusts (18.3%) and Funds (12.4%).

"Foreign investors continue to play a key role in Australian property investment markets and while Australia continues to offer a safe, reliable and accessible investment destination, that will not change.

"Retail property has been particularly sought after due to both strong population and housing growth and the underlying value of the non-discretionary spend element,’’ Mr Crabb said.

Retail sales, 12 months to June 2016, at a glance:

Adelaide

$635m down from $765m to June 2015 and up on the $452m five year average

Perth

$752m up from $403m to June 2015 and up on the $690m five year average

Melbourne

$2.77b up from $2.25b to June 2015 and up on the $1.84b five year average

Sydney

$2.9b up from $2.3b to June 2015 and up on the $2.1b five year average

Brisbane

$2.71b up from $2.25b to June 2015 and up on the $1.88b five year average

Totals

$9.76b up from $7.96b to June 2015 and up on the $6.96b five year average

Picture:

The frenetic retail market looks set to continue into the next financial year with another six Vicinity Centres retail assets on the market and due to close this week, including Maitland Hunter Mall (pictured), Hilton Plaza, Monier Village, Tweed Mall, Wodonga Plaza, and Albany Brooks Garden. The properties have a book value of more than $200 million.