Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

There’s hope for the office sector.

That’s the message from the Property Council of Australia’s as it released its first binannual Office Market Report for 2024.

For many in the sector, the past two years have been filled with trepidation as demand for office space and transaction figures dropped.

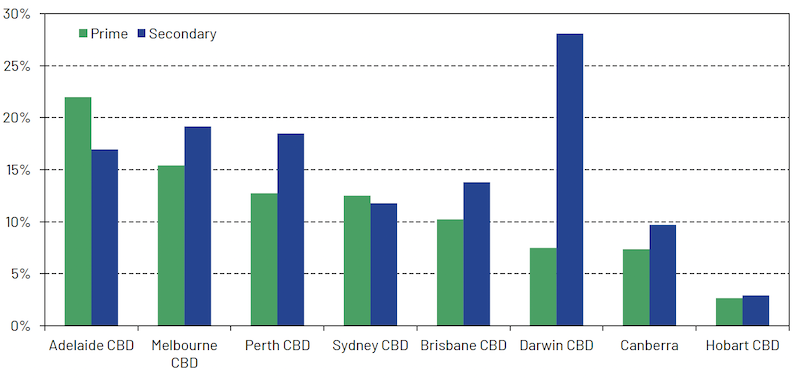

The PCA’s report concurs with JLL research from last week that older office stock is not as desirable to tenants as prime office space—vacancy rates are healthier for prime office space compared to older, lower grade stock.

Nationally, CBD vacancy rates have increased from 12.8 per cent to 13.5 per cent while non-CBD areas are also showing an increased vacancy rate, from 17.3 per cent to 17.9 per cent nationally.

The vacancy rate for CBD prime office space was 12.9 per cent compared to 14.5 per cent for secondary assets.

CBD office vacancy rates also increased for many states. Sydney’s vacancy rate rose from 11.5 per cent to 12.2 per cent, Adelaide’s was up from 17 per cent to 19.3 per cent, Melbourne 14.9 per cent to 16.4 per cent, Darwin 14.3 per cent to 14.4 per cent and Hobart 2.5 per cent to 2.8 per cent.

In Brisbane and Canberra, vacancy rates remained all but stable, rising slightly from 11.6 per cent to 11.7 per cent and from 8.2 per cent to 8.3 per cent respectively.

Meanwhile, Perth stayed strong with the vacancy rate falling from 15.9 per cent to 14.9 per cent.

In every capital city except Sydney and Adelaide the vacancy rate for prime office space was lower than the vacancy rate for secondary assets.

CBD prime vs secondary rates, January, 2024

Property Council chief executive Mike Zorbas said the figures reinforced tenants’ desite for higher-quality spaces.

“The increase in office supply during 2021 and 2022, far surpassing the historical norm, and continued business moves towards high-grade offices explains the results we are seeing,” Zorbas said.

“There is a clear divergence between older, low-quality stock and the new premium office buildings rejuvenating our cities.”

But Zorbas said quality should not be the only consideration.

“Flight to quality aside, it is crucial for governments to champion the significance of our CBDs and the ecosystems of small businesses they support,” Zorbas said.

“Face-to-face interactions remain something almost all people benefit from in a social and a work sense and we are starting to see that routinely recognised as complimentary to the welcome dividends of flexible working.”

Higher than historic levels of supply over five of the past 10 reporting periods have been part of the reason for the vacancy rates in the CBDs.

In the non-CBD markets, supply has been at higher than historic levels over seven of the last ten reporting periods.

But up until the second half of 2025, the PCA report anticipates that supply will remain below historic levels.

Sublease vacancy rates increased in the CBD market.

Melbourne, Sydney and Adelaide recorded sublease vacancy rates above historical averages but rates for the non-CBD market decreased.

CBRE Advisory and Transaction Services senior managing director Tim Courtnall said that transactions in the sector could increase over 2024.

“We expect with financial market stability over the last six months and lower inflation forecasts, 2024 should be reasonably strong from a transactions point of view, however we could see some unexpected headwinds in the second half of the year,” Courtnall said.

Rental growth was also strong in some cities, according to CBRE head of office Tom Broderick.

“In 2023, the Sydney CBD core, Brisbane CBD and Perth CBD had strong effective rental growth due to strong leasing activity and an improved supply outlook,” Broderick said.

“Melbourne and Adelaide lagged behind the rest of the country due to new supply, which pushed vacancy higher.”

Broderick also predicted higher occupancy levels.

“We expect stronger physical occupancy levels in 2024, which will likely end some of the contractionary activity that has occurred over the past few years,” he said.

“Many major corporates are likely to be nearing the end of their “right sizing” phase.

“In addition, high construction costs and declining capital values are likely to reduce medium-term supply in Australia, which will contribute to lower vacancy rates.”

CBRE office leasing head for NSW Rachel Vincent said the flight to quality would not be the only trend in Sydney’s office market during the year.

“Given global economic uncertainty, a mixed business landscape domestically, and elevated interest rates, many occupiers are shifting to a more cautious approach to their real estate decisions,” Vincent said.

“This is likely to drive demand for lower cost alternatives across the CBD and Metro Sydney market over the near term.”

In Melbourne, large occupiers are part of the prediction for 2024.

“While overall tenant demand was strong, there was a noticeable increase in 2000sq m-plus tenant activity, reflecting that finally, more than three years on from Covid, large occupiers have a much greater understanding of their occupancy needs and are prepared to make longer-term commitments,” CBRE office leasing head for Victoria Ashley Buller said.

“Many large occupiers are now mandating office attendance and enforcing penalties for non-compliance.”

State and federal government agencies and large corporations have been behind the vacancy rate figures for Brisbane, moving to better quality spaces and for the first time in more than a decade, it has a limited supply pipeline.

“There was a genuine increase in tenant demand across multiple industry groups in addition to major new demand from the state and Commonwealth governments,” Knight Frank office leasing head for Queensland Mark McCann said.

“With construction costs continuing to be a barrier for new development, we expect the longer-term trend of vacancy reduction to continue over the next 24 months, leading to further growth in face and effective rents.”

There is limited supply in Adelaide and in Perth but the mining, engineering and government sectors are driving the boom in Perth’s office market.

Occupiers have been more cautious in using their capital hence the slower rate of change in vacancy rates in Canberra where construction costs also will continue to have an impact.