Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Home approvals have plummeted, dropping 6.5 per cent during June to round out the weakest financial year in more than a decade.

The total number of homes approved fell to 13,237 last month after a 5.7 per cent rise in May, according to seasonally adjusted data released by the Australian Bureau of Statistics (ABS).

ABS head of construction statistics Daniel Rossi said that during the past 12 months, there had been 162,892 homes approved, compared to 177,936 in the 12 months prior, a 8.5 per cent decrease, in original terms.

“This is the lowest number of homes approved on a financial year basis since 2011-2012,” he said.

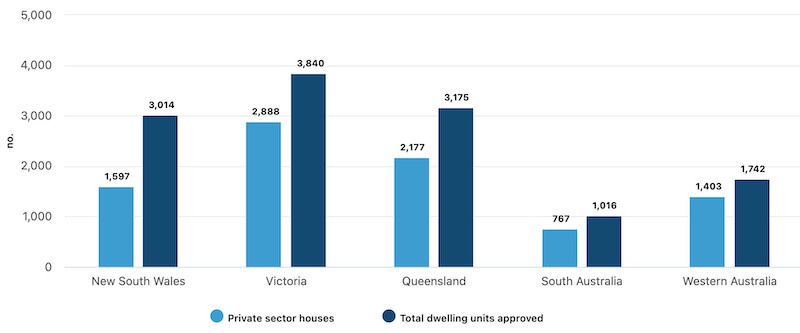

Private sector houses fell by 0.5 per cent in June, mainly driven by NSW, which fell 19 per cent.

“With the latest figure of 1597 private houses approved ... the lowest recorded figure for New South Wales since January 2013,” Rossi said.

Material and labour shortages continue to affect the housing sector, with the average approval value for new houses rising by $19,444 between June 2023 and June 2024.

“Private sector dwellings excluding houses fell by 19.7 per cent in June, reaching the second lowest monthly level recorded since January 2012.

“The June figure represents a yearly fall of 22.1 per cent compared to the same month last year.

“Conditions for apartments remain challenging owing to high construction costs and higher interest rates.”

In original terms, there was 29,388 apartment units approved in the 12 months to June 2024, compared to 40,443 in the previous 12 months.

Total home approvals in the 2023/24 financial year in seasonally adjusted terms increased by 23.3 per cent in Western Australia compared to the previous year.

All other states declined, led by NSW (-17.8 per cent) and Tasmania (-15.1 per cent), followed by South Australia (-9.9 per cent), Queensland (-8.0 per cent) and Victoria (-6.7 per cent).

In original terms, the Australian Capital Territory also increased by 16.8 per cent, while the Northern Territory declined by 38.5 per cent.

Meanwhile, the value of total buildings approved fell 7 per cent to $12.06 billion in June, after a 0.4 per cent rise in May.

The biggest driver of the fall was in non-residential building which fell 16.2 per cent to $4.46 billion.

Total residential building value fell by 0.6 per cent to $7.61 billion, following a 2.7 per cent rise in May.

The value of new residential building fell 2.3 per cent to $6.44 billion.

Home approvals by state, seasonally adjusted

The level of residential alterations and additions reached an all-time high of $1.17 billion in June, rising 10.2 per cent in seasonally adjusted terms.

Property Council Group executive policy and advocacy Matthew Kandelaars said the figures continue to paint a challenging picture for reaching the goal of 1.2 million new homes by 2029.

“That our dwelling approval numbers have hit the lowest number on a financial year basis in over a decade is a clear sign of the challenges we face in delivering the homes Australians need,” Kandelaars said.

“Governments nationwide must use every available measure to help industry deliver the desperately needed supply of new homes.

“We need an invigorated focus on supply-inducing last-mile infrastructure, more construction labour and we need to ensure that first-home buyers are given a better chance of accessing credit for housing.

“To achieve our goal of 1.2 million homes, we need to adopt a proactive mindset and pull every lever available to unlock more supply—including new homes for students, renters and retirees.”

HIA senior economist Tom Devitt said performance across different jurisdictions were starting to diverge, with those outside of NSW and Victoria producing the strongest indicators of a coming recovery.

“Western Australia is leading the way with a recovery in residential building approvals,” Devitt said.

“The weakness of Australia’s two largest states is due to the high cost of delivering a new home to market in Sydney and Melbourne.

“There persists significant uncertainty around the RBA’s battle against inflation. It is up to other policymakers to reduce the cost of construction if Australia were to build sufficient new housing.

“This means easing of tax and regulatory burdens, bringing infrastructure and shovel-ready land to market faster, implementing genuine planning reform and facilitating higher density development in existing suburbs close to jobs and transport.”

Economist Stephen Koukoulas called it “horrible, ugly data”.

He said it was “yet more and more and more data pointing to economic weakness, rising unemployment and disinflation”.

“Throw in the sharp falls in commodity prices and the economic picture for Australia has gone from fragile to bad to downright shocking,” he wrote on LinkedIn.

“The RBA needs to cut interest rates next week to limit the damage.”

Urban Taskforce chief executive Tom Forrest said the data reinforced the downwards trend of housing approvals.

“The downward spiral continues as every metric shows the ongoing story planning systems failing to deliver approvals that deliver feasible DAs for construction,” he said.

“This alone is resulting in fewer applications. The reforms are good, but they have been slow in the making, overly prescriptive and complicated, and come with unwelcome new affordable housing tax impositions which reduce feasibility and increase costs to new home buyers (for the non- affordable housing component of the buildings).

“All up the planning reforms are not keeping up with rising costs in the construction sector, so they have not been effective.

“A whole-of-government paradigm shift is required, that places the focus of housing delivery as the central tenet and innovates within the system to realise housing completions.”