Costs Go Higher as Home Building Declines

New home builds declined but values rose as the construction crisis made its mark on the June quarter.

According to ABS data, total home starts fell 11.8 per cent to 40,720 homes during the June quarter compared to the previous quarter. Commencements fell 15.4 per cent year-on-year.

New houses accounted for 101,820 of the homes under construction.

Private sector apartments and other residential buildings drove the decline, falling 19.6 per cent to 14,529 homes. They have fallen 11.9 per cent since June, 2022.

Private sector house starts fell 6.6 per cent to 25,162 homes after a fall of 2.5 per cent in the March quarter and are down 17.4 per cent for the year.

Meanwhile, the value of total work done for the quarter was up 0.3 per cent on the previous quarter at $31.5 billion—4.6 per cent up on the same period last year.

The rise was driven by new residential building work done, which increased by 1.2 per cent to $15.9 billion and follows a decrease of 0.4 per cent in the March quarter.

Work done on non-residential building rose 0.2 per cent to $13.1 billion and is 6.5 per cent higher for the year.

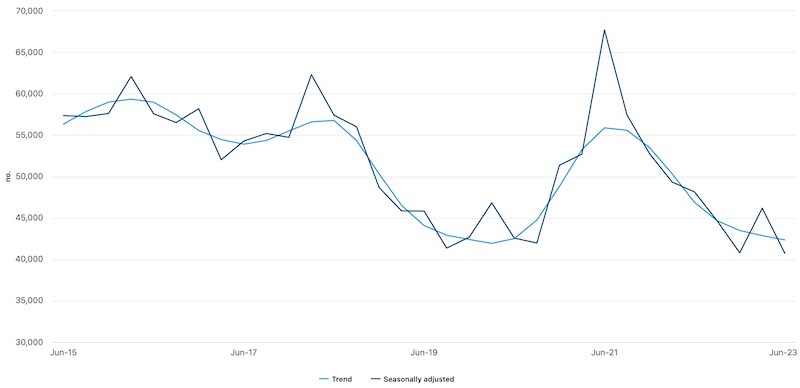

Total home commencements

Work done on alterations and additions to residential buildings fell 5 per cent to $2.6 billion.

The number of homes under construction fell 1.4 per cent to 237,779 homes in the June quarter. New houses accounted for 101,820 of the those under construction.

And in more bad news for the nation’s housing crisis, completions fell during the quarter by 7.5 per cent to 41,669 homes in the June quarter, in seasonally adjusted terms.

Apartments and other residential buildings fell 20.1 per cent to 13,379 homes compared to the previous quarter but are 0.3 per cent higher for the year.

Private sector new house completions fell 1.6 per cent to 27,213 homes. This follows a rise of 3.9 per cent in the March quarter. They are down 3.1 per cent for the year.

The data shows the June 2023 quarter had fewer new homes starting work across Australia than any time during the past decade, Master Builders Australia chief executive Denita Wawn said.

“Today’s results confirm that 2022-23 was the weakest financial year for new home building since 2012-13. New detached house starts are 41 per cent down on the peak two years ago,” she said.

“For higher density homes, the loss has been even worse. Compared with the high activity reached during the mid-2010s, activity has sunk by a whopping 55 per cent.

“Rental inflation has deteriorated sharply at a time when higher density home building has moved firmly into reverse gear. This is no coincidence.

“We have not been supplying the rental market with enough new homes since before the pandemic.

“Government policy needs to be working to reverse this negative trend.”