Home Approvals Lift Again as Apartments Drive Gains

Home approvals have lifted again, up 4.2 per cent in October.

The rise to 15,498 approvals across the month followed a 5.8 per cent increase in September, according to seasonally adjusted data released today by the Australian Bureau of Statistics (ABS).

ABS head of construction statistics Daniel Rossi said the overall rise in October was driven by an increase in apartment developments approved in New South Wales and Victoria, while private homes excluding houses rose 24.8 per cent.

“Meanwhile, private sector house approvals fell by 5.2 per cent in October after reaching a two-year high in September,” he said.

Private sector house approvals fell 5.2 per cent, to 9191 homes after a 4.1 per cent rise in September.

Despite the fall, private sector houses remain 2.4 per cent higher than a year ago.

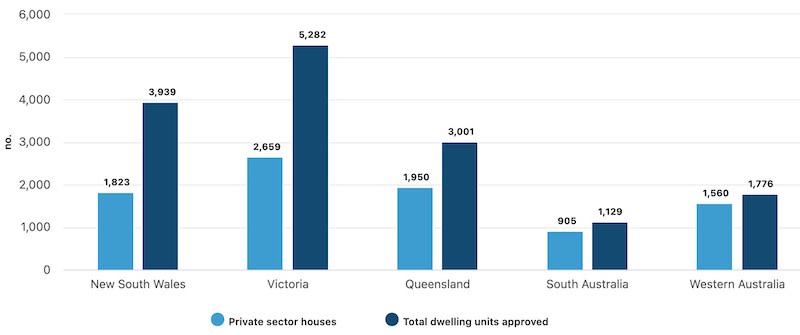

South Australia was the only state with growth in October—a 1 per cent rise. Its 905 private sector houses approved was the highest result for SA since August.

Private sector homes excluding houses rose 24.8 per cent, to 5859, which was 7.1 per cent higher than a year ago.

The October result was driven by a rise in approvals for high-rise apartments, primarily in NSW and Victoria.

For blocks of nine or more storeys, 2782 apartments were approved in October, compared to 1815 in September (in original terms).

This was the most high-rise apartments approved since January this year.

Homes approved by state, October 2024

The value of total building approved fell 3.7 per cent ($13.21 billion), after a 1.2 per cent rise in September.

The value of approved non-residential building dropped 13.4 per cent ($4.89 billion), after a 3.7 per cent September rise.

Total residential building value rose 3.2 per cent ($8.33 billion), made up of a 4.4 per cent rise in the value of new residential building approved ($7.21 billion) and a 4.2 per cent fall in alterations and additions ($1.12 billion), in seasonally adjusted terms.

Oxford Economics Australia senior economist Maree Kilroy said that although the latest approval result for apartments was positive, “we continue to expect a materially higher dropout rate to commencement”.

“After the approval lead, total home commencements are forecast to gain 3 per cent to 163,400 in the 2025 financial year,” Kilroy said.

“Houses will drive the improvement as apartment activity provides an offset. Utility connection bottlenecks and trade labour shortages will make a more aggressive recovery difficult.”

Kilroy said they expected mortgage rate cuts from mid next year “will aid the release of pent-up housing demand, while traction on the housing policy front will become increasingly obvious”.

HIA economist Maurice Tapang said it has been more than a year since the RBA last raised interest rates with the unchanged rate providing some degree of certainty for consumers.

“Households are returning to new home building despite there being no cut to the cash rate. This is because unemployment remains at very low levels, while housing demand remains very strong,” Tapang said.

“Prices of home building materials have also been growing at a more normal pace—the latest data showing a 1.4 per cent annual increase in September.

“Low unemployment, unchanged interest rates, stable growth in materials prices and a return to normal build times are helping lift up the market from its recent trough.”

Master Builders said the data showing new home building approvals nearing a two-year high was good news, but much more improvement was still needed to build the homes Australians desperately need.

MBA chief economist Shane Garret said new home building “has clearly won momentum, but we need to see much more improvement or there is little hope of reaching our Accord’s target of 1.2 million new homes by July 2029.

“Failing to deliver the much-needed homes is having a real cost on Australians. The year to October saw rents increase by another 6.7 per cent on already onerous levels.

“This is a direct result of years of underbuilding of new apartments and units.”