Interested in a Corporate TUD+ Membership?Speak to our team today for a special end-of-year discountSpeak to our team for an end-of-year discount

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Home approvals rose across September, reversing the previous month’s fall.

According to ABS data, the total number of homes approved last month was up 4.4 per to 14,842 after a 3.9 per cent fall in August.

ABS head of construction statistics Daniel Rossi said the rise was driven by increases across all home types.

“Private sector houses reached 9745 approved in September, to be at the highest level since August, 2022,” he said.

“Private homes excluding houses rose by 4.7 per cent but remain at subdued levels after a 13.5 per cent fall in August.”

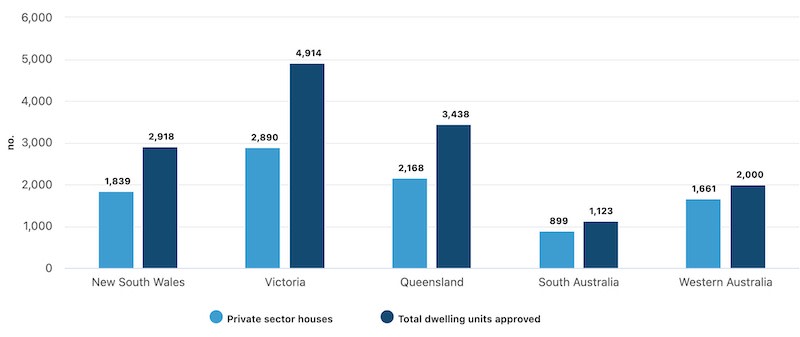

Despite mixed results across the states, private sector house approvals across Australia rose 2.2 per cent, to be 16.7 per cent higher than the same month last year.

South Australia recorded the largest increase of the states at 10.3 per cent. Western Australia also continued to rise, approving 1661 private sector houses, its highest number since May, 2021.

Private sector homes excluding houses rose 4.7 per cent (4653 homes), to be 12.2 per cent lower than a year ago.

The September result was driven by a rise in approvals for high-density apartments. There were 1815 apartments approved in nine or more storey blocks in September, compared to 1201 in August.

The value of total building approved rose 1.4 per cent to $13.61 billion after a 1.1 per cent rise in August.

The value of approved non-residential building rose 3.6 per cent to $5.57 billion following an 11.3 per cent August increase.

Total residential building value was flat at $8.04 billion, which was comprised of a 0.2 per cent rise in the value of new residential building approved ($6.88 billion) and a 1.3 per cent fall in alterations and additions ($1.16 billion), in seasonally adjusted terms.

Oxford Economics Australia senior economist Maree Kilroy said while the positive momentum in house approvals was encouraging, supply issues were again arising in some regions.

This was reverberating through to costs and impacting progress onsite, Kilroy said.

“Apartment starts are running well below their average rate of the past decade and for the most part are treading water in 2024.

“We expect mortgage rate cuts will aid the release of pent-up housing demand, while traction on the housing policy front will become increasingly obvious.

“Significant question marks remain around industry capacity. Australia’s supply of tradies will influence the magnitude and speed of the recovery.”

The Property Council of Australia said it was pleasing to see the number of home approvals rise in September, but warned approvals for apartments remained too low.

“While it is pleasing to see an uplift in the number of homes approved, we won’t meet our housing targets unless we keep increasing this at pace,” Property Council group executive, policy and advocacy Matthew Kandelaars said.

“Consistent results like this, month after month, are essential.

“It is particularly apparent that we are just not building apartments at the levels we used to, and those approvals remain below where they need to be.”

Master Builders Australia chief economist Shane Garrett said there was still a long way to go to meet the Housing Accord’s goal of 1.2 million new homes.

“For new home building approvals, September was the best month we’ve seen since May last year,” he said.

“Home building approvals seem to be finding some momentum—but the challenge of ending the housing crisis is still formidable.

“The past year has seen less than 168,000 new homes approved for building, well below the 240,000 homes needed per year.

“More action is still needed to bring down the high costs and timelines associated with building to encourage even more people into the new home building market.”