Housing loan values fell in September, the first decline after seven straight rises, but well ahead of the same period last year.

Fresh Australian Bureau of Statistics data shows that the total value of new housing loans fell 0.3 per cent in September to $30.2 billion.

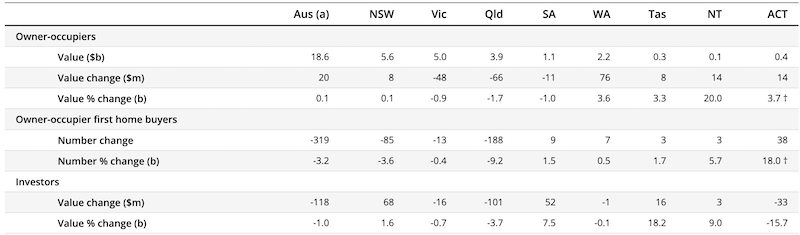

The value of new investor loans fell 1 per cent to $11.6 billion—29.5 per cent higher than September of last year and slightly below the record high of January 2022.

The value of owner-occupier loans rose 0.1 per cent to $18.6 billion, which was 13.1 per cent higher than September 2023.

Owner-occupier first home buyer loans fell 3.3 per cent to $5.2 billion, 8.8 per cent higher than the same month last year.

ABS head of finance statistics Mish Tan said that during the past 18 months, the average size of loans approved increased for owner-occupiers and investors.

“However, the growth in investor loans was also driven by increases in the number of loans being approved,” Tan said.

“Investor activity remains at high levels in response to the recent growth in house prices and rental yields.”

The number of new owner-occupier first home buyer loans fell 3.2 per cent in September, 2 per cent higher than last year.

“In September there were 9686 loans to first home buyers across Australia. Victoria made the largest contribution, with 3146 loans, followed by NSW with 2250 and Queensland with 1845,” Tan said.

Oxford Economics Australia senior economist Maree Kilroy said mortgage affordability and the deposit hurdle were testing new limits, which had prevented first home buyer demand from growing as fast as other buyer cohorts.

“The fundamentals of demand and supply, with rising listing volumes and softer buyer interest are taking steam out of price growth in most markets,” Kilroy said.

“We expect momentum will soften further as interest rates remain on hold and cause the national median all-dwelling price to increase closer to 4 per cent in the 2025 financial year.

“The rate-cutting cycle will bring much-needed relief to mortgage holders and prospective buyers.

“We forecast all-dwelling prices will increase by at least 7 per cent in the 2026 financial year, with the first cash rate cut by the RBA not expected until June quarter next year.”