Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Australian housing construction was in positive territory across the September quarter but it was not enough to make up ground on National Housing Accord targets.

Fresh Australian Bureau of Statistics data shows work began on 43,247 new homes in the September quarter, a 4.6 per cent increase from the June quarter and a 13.9 per cent rise compared to the same period last year.

However, ABS building approvals data, released on January 7, indicates ongoing market volatility, with total home approved falling 3.6 per cent to 14,998 in November 2024.

Private sector house approvals declined 1.7 per cent to 9,028, while approvals for homes excluding houses dropped more significantly by 10.8 per cent to 5285.

Detached house construction led the growth, with new starts increasing 20.5 per cent since June, 2024 and a 5.3 per cent rise over the year to September, 2024.

Private sector house commencements totalled 27,651 homes, while other residential commencements rose 3.8 per cent to 14,677 homes.

Property Council group executive policy and advocacy Matthew Kandelaars said Australia was already behind its housing targets just three months into the National Housing Accord period.

“Few expected we’d be meeting our welcome and ambitious housing target from day one, but it’s doing its job by providing transparency about who is lagging and by how much,” Kandelaars said.

Domain chief of research and economics Dr Nicola Powell said while construction growth was positive, market pressures continued to influence buyer and homeowner behaviour.

“High construction costs and project feasibility continue to put pressure on the property market, where buyers are seeking affordable, medium to high-density housing,” Powell said.

“Research indicates up to 30 per cent of homeowners are planning renovations in the next 12 months.

“Of those, nearly half are opting to renovate rather than move, reflecting the growing trend homeowners are choosing to improve their current properties rather than face the pressures of the property market.”

Master Builders Australia chief executive officer Denita Wawn said the strong rebound in detached house construction was welcomed but highlighted ongoing challenges in meeting housing targets.

“Our performance in apartment construction will be the key to whether we meet the target. Apartment construction levels remain too low because the investment appetite is not there,” Wawn said.

Wawn said multiple factors were hampering construction activity across the sector.

“Low productivity, labour shortages, costly and restrictive CFMEU pattern agreements, a lack of supporting infrastructure and a high inflationary environment all contribute to project costs not stacking up,” Wawn said.

The total value of building work completed rose 0.3 per cent to $38.5 billion in seasonally adjusted terms.

New residential building work increased 2.2 per cent to $20.1 billion, following a 1.2 per cent rise in the June quarter.

The value of total residential building approvals fell 0.5 per cent to $8.36 billion in November, while non-residential building approvals rose substantially by 18.4 per cent to $5.96 billion.

Building approval performance varied significantly across states, with Western Australia (18.1 per cent) and Queensland (7.3 per cent) recording increases, while Victoria (-12.9 per cent), New South Wales (-9.9 per cent), Tasmania (-4.2 per cent), and South Australia (-1.6 per cent) all had declines in total approvals.

Current construction rates indicate Australia will commence approximately 825,000 new homes over the next five years, falling short of the Housing Accord target by about 350,000 homes.

The annual construction rate reached 165,048 new homes in the year to September 2024, well below the required 200,000 annual target.

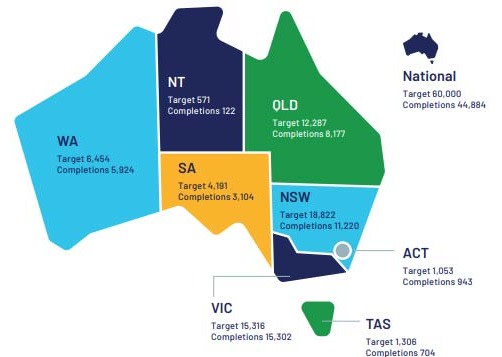

Analysis shows that 60,000 new homes are needed every quarter to meet the Housing Accord’s 2029 target.

The September quarter’s completion of 44,884 homes represents a significant shortfall, with the Northern Territory trailing furthest behind, delivering 78.6 per cent fewer homes than its quarterly target of 571.

Victoria is marginally missing its target of 15,316 quarterly completions by 0.1 per cent.

There were 220,265 homes under way in the September quarter, with 87,672 of those new houses.

Kandelaars said the next Federal parliament needed “laser focus” to help states and territories meet the targets.

“It’s evident from today’s data that some states are far better placed than others, but all need a serious and immediate kick into action,” Kandelaars said.

“The most urgent priorities are for states and territories to address affordability-killing taxes on new homes, cut red tape to boost productivity and address critical shortages of skilled labour.”

“If we don’t start as we intend to finish, we’ll be kicking into a gale at the final break, making the job near impossible. There’s no time to waste and we can’t afford to slip any further behind.”