A jump in the value of investor home loans is more due to a lift in the number of loans being approved rather than higher home prices, new data reveals.

The total value of new housing loans rose 3.9 per cent in July to $30.6 billion, with the value of new investor loans up 5.4 per cent to $11.7 billion, according to the Australian Bureau of Statistics.

That was 35.4 per cent higher than July of 2023.

ABS head of finance statistics Dr Mish Tan said investors had continued to record the largest growth in new loans during the past year, increasing more than a third in value since July 2023, from $8.6 billion to $11.7 billion.

“This is close to the record high of $11.8 billion reached in January 2022,” Tan said.

“The increased investor activity we’re seeing in the lending statistics is mostly because more loans are being approved and is only partly driven by higher dwelling prices.”

The value of owner-occupier loans rose 2.9 per cent to $18.9 billion, 21.4 per cent higher than July last year.

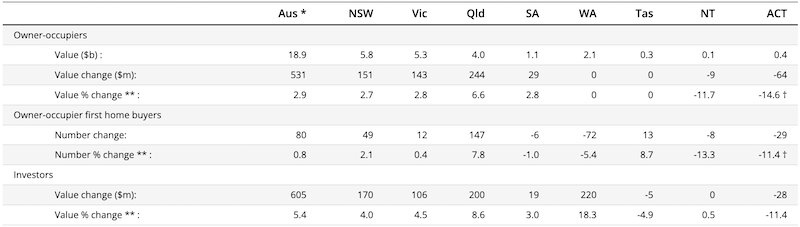

Housing loan commitments by property, purpose, state—July 2024

The value of new owner-occupier first home buyer loans rose 0.8 per cent in July, 19.7 per cent higher than the same period in 2023.

Nationally, the average size of new owner-occupier loans and new investor loans reached the same all-time high of $641,000 in July.

The value of new loan commitments for total fixed-term personal finance rose 2.2 per cent to $2.7 billion and was 20.2 per cent higher compared to a year ago. Lending for the purchase of road vehicles rose 4.9 per cent in the month.

Canstar data insights director Sally Tindall said the average new owner-occupier loan size “just hit another record high as borrowers continue to dig a little bit deeper to get in that winning bid”.

“This data suggests across the country, the average owner-occupier with a 20 per cent deposit is now shelling out over $800,000 for a property and committing to an estimated repayment that’s almost $4,000 a month.”