New investor loans rose more than 34 per cent in August compared with the same period last year as market confidence continues to improve.

According to fresh data from the Australian Bureau of Statistics, new home loans were up 1 per cent in August to $30.4 billion.

ABS head of finance statistics Mish Tan said the value of new investor loans rose 1.4 per cent to $11.7 billion, 34.2 per cent higher than August, 2023 and close to the previous peak in January 2022.

The value of owner-occupier loans rose 0.7 per cent to $18.7 billion, 16.8 per cent higher than August, 2023.

However, comparing the month’s combined values of owner-occupier and investor housing loans with August, 2023 showed differences between states, Dr Tan said.

“There were state-by-state variations in the year leading up to August’s modest housing loan rises. Lending in Queensland grew strongly in the past 12 months and was the key driver behind the August increase,” Tan said.

“The total value of lending for housing in Queensland rose by just over 40 per cent in the past 12 months.

“This $2 billion rise was more than any other state.”

The number of owner-occupier first-home buyer loans fell by 1.5 per cent to 9869 loans in August compared with the previous month.

“First home buyer loans were 9.2 per cent higher compared to last August but slightly down on July,” Dr Tan said.

“Much of the growth compared to 2023 came from Queensland. Despite this, Victoria continued to have nearly one third of Australia’s first home buyers.”

HIA chief economist Tim Reardon said the data revealed that the number of housing loans issued for the purchase and construction of a new home in the three months to August was 9.1 per cent higher than at the same time the previous year.

“This increase in lending comes off a very low base, with lending for new home purchase and construction remaining about the lowest levels since 2002,” Reardon said.

“Market confidence in new home building has been improving with a pause in interest rate changes for 11 months, low levels of unemployment and an acute shortage of housing.

“First home buyers are increasingly active as buying a home provides protection from the acute shortage of rental homes. The Government should be looking at removing the restrictions that prevent many first-time home buyers from getting a loan.”

Meanwhile, the pace of rental price growth is slowing as more available stock comes to market, according to data for the third quarter of 2024.

The PropTrack Market Insight Report found that median advertised rents rose by 7 per cent over the past year to $610 a week—the weakest annual rental price growth since September, 2021.

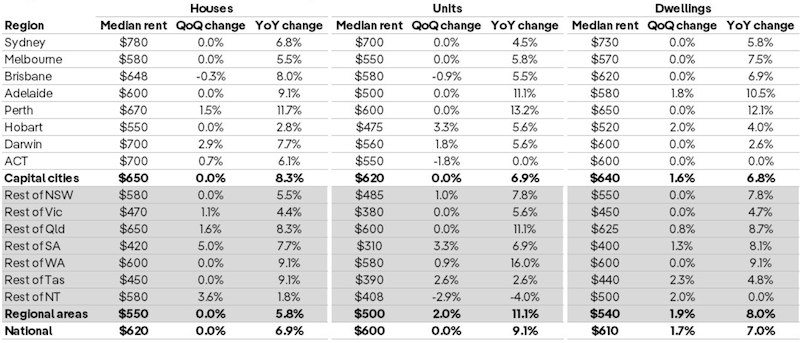

Median weekly advertised rents were $610 in the September 2024 quarter, up 1.7 per cent on the previous quarter with capital city advertised rents rising 1.6 per cent to $640 a week over the quarter.

Regional rents grew by 1.9 per cent to $540 a week.

Capital city rents increased 6.8 per cent over the year, the weakest growth since December 2021, while regional rents rose 8 per cent year-on-year.

Annual growth in unit rents (up 9.1 per cent) remained stronger than annual growth in house rents (up 6.9 per cent), with the gap narrowing to just $20 a week.

Hobart, regional NSW and regional Tasmania were the only markets to see stronger rental growth during the past year compared to the year prior.

Report author Cameron Kusher, PropTrack economic research director, said that although the cost of renting remained higher than a year ago, the pace of price growth had slowed.

“This reflects an easing of rental market pressures, which we expect to continue,” Kusher said.

“With more stock available for rent, and the cost of renting rising at a pace above inflation over recent years, the capacity to pay rent is now impacting demand.

“Sydney remains the most expensive capital city to rent a home, with the median advertised rent unchanged over the quarter and 5.8 per cent higher over the year, taking rents to $730 a week.”

He said that, surprisingly, the median advertised rent in Melbourne, at $570 a week, was cheaper than all other capital cities except Hobart.

“Although the pace of rental growth is slowing and more stock is available for rent, supply remains low. However, we anticipate more balanced conditions in the coming months,” Kusher said.