WA Leads Way as Australian Population Rises 2.1pc

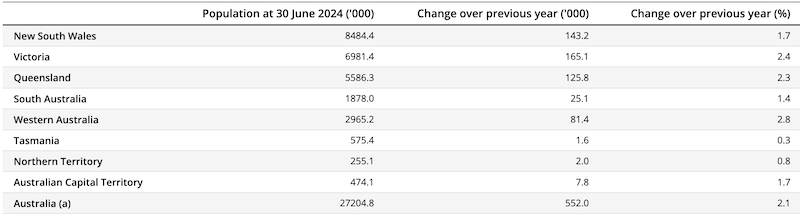

Australia’s population grew by 2.1 per cent in the year to the end of June as overseas migration continued to decline.

According to the figures released by the Australian Bureau of Statistics (ABS), the population was 27.2 million people, an increase of 552,000 people since the same time last year.

ABS head of demography Beidar Cho said there were 666,800 overseas migration arrivals and 221,200 departures.

“This means that 445,600 people were added to our population for the year to June 30, 2024, continuing a recent downward trend in net overseas migration.”

Natural increase, which is made up of births and deaths, was 106,400 people, up 3.4 per cent from the previous year.

There were 289,100 births and 182,700 deaths registered over the period, with births dropping 0.7 per cent and deaths falling 2.9 per cent.

“Western Australia had the fastest rise in population, growing 2.8 per cent in the last year. This was followed by Victoria, which grew by 2.4 per cent, and Queensland which rose 2.3 per cent,” Cho said.

Tasmania had the least growth, with a 0.3 per cent rise in population over the period.

Annual population change at June 30

Meanwhile, home vacancy rates rose across November, driven by the east coast capitals.

According to SQM Research, residential home vacancies in Australia rose to 1.4 per cent last month as the total number of rental vacancies increased to 41,894 from 36,486 in October.

Sydney’s rental vacancy rate climbed to 1.8 per cent, with 13,093 rental homes now vacant.

Melbourne rose to 2 per cent, representing 10,755 vacant homes, while Brisbane recorded a modest rise to 1.1 per cent with 3918 properties now available.

The other cities recorded stable or minimal changes.

Canberra maintained one of the highest rental vacancy rates among the capital cities at 1.7 per cent, unchanged from October; Perth continued to exhibit strong demand with its vacancy rate holding at a low 0.6 per cent; and Darwin’s vacancy rate rose to 1.6 per cent as the region enters its seasonal lull.

Adelaide and Hobart remained steady at 0.7 per cent.

Vacancy rates in the CBDs recorded subtle shifts, with Sydney’s CBD vacancy rate rising from 4.7 per cent to 6.4 per cent. Melbourne’s CBD was up from 5.5 per cent to 5.9 per cent, and Brisbane’s also recorded a minor rise, from 2.3 per cent to 2.4 per cent.

During the past month to December 12, rental prices across Australia’s capital city asking rents showed varied trends.

In Sydney, combined rents decreased by 0.9 per cent to $830 a week, reflecting a softening in rental demand while Melbourne had a modest rise of 0.3 per cent, with combined rents now at $629, driven primarily by an increase in house rents.

Rental vacancies, November, 2024

Brisbane recorded a notable increase of 0.8 per cent, with combined rents reaching $663, signalling continued demand in the market.

Perth stood out with a significant rise of 2.3 per cent in combined rents, now at $732 a week, marking strong growth across houses and units. Adelaide experienced a smaller gain, with combined rents rising by 0.1 per cent to $610, showing steady market conditions, and Canberra’s rental market also had robust growth, with combined rents increasing by 0.9 per cent to $661.

Darwin’s combined rents increasing by 2.7 per cent to $618. Hobart followed suit, with combined rents rising by 2 per cent to $516 a week, supported by a sharp increase in unit rents.

Nationally, combined rents fell slightly by 0.5 per cent to $631 a week, while the capital city average remained unchanged at $722, reflecting the mixed rental market conditions across the country.

SQM Research managing director Louis Christopher said national rental vacancy rates had hit a three-year high.

“At this time of year, we normally record a seasonal increase in vacancies driven in part by university graduates completing their courses for the year and returning home, so the rise is in part due to seasonality,” he said.

“But there are also other factors that drove vacancies higher in November. Melbourne for example has risen back to 2 per cent which is getting close to a market in equilibrium. Sydney is now back at 1.8 per cent.

“While we still have rental shortages in our two largest capital cities, the situation has clearly improved from the very difficult days of 2021 to 2023.”

Christopher said he believed this was mainly due to the number of occupiers increasing per property, saying sky-high rents had forced many to make compromises in their living arrangements.

“Are we out of the rental crisis? No, not yet but there is a little bit of light at the end of the tunnel, notwithstanding another year of rapidly expanding population compared to our low building rate will keep the pressure on tenants in 2025,” he said.