Petrol Stations, Student Housing Top Commercial Deals Over 2019

The commercial real estate market has seen a significant increase in investment in "alternative" real estate assets such as petrol stations and student accommodation over 2019, with a number of high-profile acquisitions pushing commercial spending to record heights.

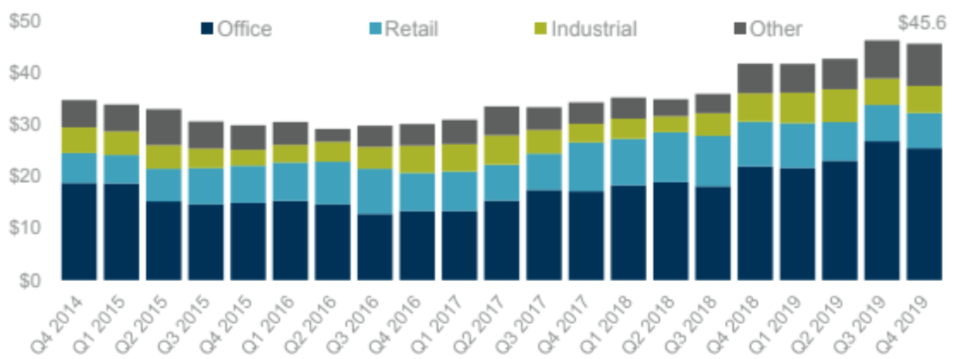

A series of trades in alternative assets helped propel the tally in commercial real estate deals for the 2019 financial year to a record $45.6 billion, a 9.2 per cent increase in transactions value over the previous year according to Cushman & Wakefield research.

The financial year saw a number of headline deals fall under the "other" sector.

Student accomodation giant Scape Australia secured Urbanest's $2 billion student accommodation portfolio while real estate investment giant Charter Hall outlaid $840 million for a 49 per cent stake in 225 BP fuel stores in a sale and leaseback deal that valued BP’s portfolio at $1.7 billion.

Telecommunications giant Telstra also unlocked $700 million of equity in August with the sale of a 49 per cent stake in a new property trust comprising a portfolio of 37 of the company's higher value exchange properties to Charter Hall.

Annual rolling investment volume

“While Australian commercial real estate yields have fallen to record lows, the compression has corresponded to the decline in interest rates and bond yields which has meant that relative to fixed interest assets, commercial property yields remain relatively attractive,” the report stated.

“Both domestic and foreign sources of capital are expected to continue to drive demand for Australian property.

“Office and industrial markets are likely to be preferred due to ongoing solid fundamentals.”

The office sector continued to dominated transactions with volume of $25.4 billion recorded for the year, up 15.9 per cent on 2018 levels.

Driving those office deals are record low vacancy rates in the Sydney and Melbourne office markets, which is underpinning growth in rents, creating upside expectations for for investors.

Driving those office deals are record low vacancy rates in the Sydney and Melbourne office markets, which is underpinning growth in rents, creating upside expectations for for investors.

Office investment volumes were highest in NSW, which recorded a total of $10.2 billion in the 2019 financial year.

Listed fund manager Dexus, the country's largest landlord, acquired 80 Collins Street in Melbourne for $1.476 billion while Charter Hall swooped in on a half stake in Sydney's Chifley Tower, worth $900 million.

Retail transaction volume for 2019 was down 21 per cent on 2018 levels, with the most notable transaction due to lowered demand and many assets trading below book value.

Lendlease sold a half share in Adelaide's Westfield Marion—the 11th largest shopping centre in the country—for $670 million to the property trust sponsored by Singapore Press Holdings.