Material costs will continue to increase but escalations will calm by 2026, according to the construction cost latest report from Altus Group.

The small, but welcome ease in construction cost escalation rates would happen as inflation began to soften from 2025, it said.

Brisbane and Perth are expected to benefit most from this escalation easing, with Perth maintaining a 5.5 per cent increase in 2025, before dipping to 5 per cent in 2026, Altus predicted.

Costs in Brisbane, which has been experiencing the biggest escalations of any state capital with a 7.5 per cent increase this year, would decline slightly to 7.25 per cent in 2025, with a steeper drop to 6.5 per cent in 2026, albiet from an elevated base.

Sydney and Melbourne would experience escalation declines to 4.75 per cent and 4.5 per cent respectively, before rising again in 2026 to 5 and 4.75 per cent.

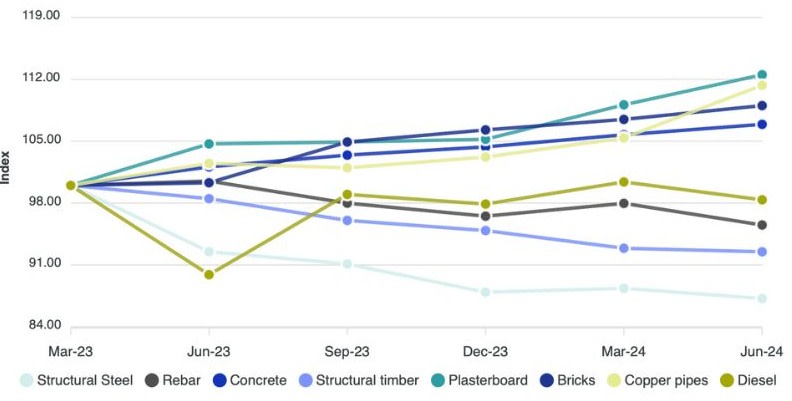

As Chinese demand for iron ore and manufactured steel decreased, a welcome decline in steel prices would positively impact costs, especially in industrial and infrastructure projects, given that global steel trading prices had fallen to their lowest levels since 2016, Altus said.

Structural timber prices were falling due to “sluggish market demand,” a downward trend that Altus predicted would continue.

While native logging was banned in Western Australia and Victoria in 2024, and Queensland is following suit in state-owned forests from January, this would lead to hardwood being replaced with more expensive composite wood alternatives.

In other areas, however, prices were set to increase further, with concrete rising 4.71 per cent in the year to date, plasterboard up 7.47 per cent and brick prices rising 8.7 per cent.

Input prices for housing construction, including land, materials, fees, permits, professional services and equipment, and the expenses associated with hiring construction workers increased by 0.4 per cent, a “softening” and a return to pre-pandemic levels, Altus said.

“Decreased demand for new construction has led to suppliers discounting products used in the initial stages of construction, like structural timber,” according to the quantity surveyor.

“These discounts have partially offset price increases in other areas.”

This included a 1.1 per cent input price rise for house construction, it said, with a “stark divide” in prices between regional and city projects emerging.

Output prices—those charged by the construction companies and contractors—continued to rise.

Over the past 12 months these construction costs had risen 6.3 per cent, after the most recent quarterly 1.3 per cent rise.

“Despite material input prices remaining flat, the overall growth in construction costs is primarily driven by ongoing labour shortages for skilled tradespeople, with high demand continuing to push output costs upward,” Altus said.

Construction wages increased by 0.8 per cent for the quarter and 3.9 per cent over the year.