Sydney and Melbourne House Prices Will Fall 20%: AMP

Property prices in Sydney and Melbourne will see a top to bottom fall of 20 per cent, with AMP Capital cutting its forecasts for the two cities and predicting further price falls.

In an update to the market on Thursday, AMP Capital chief economist Shane Oliver said that he now expects more price falls – downgraded from the initial 15 per cent fall Oliver forecast in August – and recommended property investors focus on higher yielding markets.

“For some time, we have been expecting top to bottom falls in Sydney and Melbourne prices of 15 per cent spread out to 2020, implying price declines around 5 per cent per annum,” Oliver said.

“However, the risks are starting to skew to the downside – particularly around tighter credit and falling capital growth expectations made worse by fears of a change in tax arrangements.”

Oliver said he now expects a 20 per cent decline in Sydney and Melbourne house prices, spread out to 2020 – taking prices back to first half of 2015 levels.

Related: Property Market Confidence ‘Collapsing’: Survey

Blaming credit conditions, an increase in supply and the “negative feedback loop from falling prices”, Oliver pointed to auction clearance levels of 7-8 per cent roughly consistent with price declines.

Corelogic clearance rate data – released the same day as AMP’s market outlook – reveals an auction clearance rate of 47 per cent, compared with 67.1 per cent a year ago.

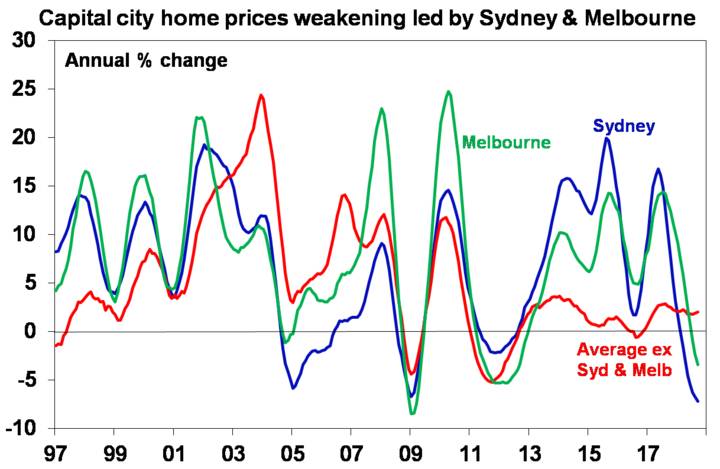

Australian capital city home prices have declined for 12 months in a row and are 4 per cent from their peak. Annual price falls in Sydney reached 6.3 per cent, while Melbourne declined 4 per cent.

House price crash ‘a risk but remains unlikely’

Oliver said the turning tide against property prices reflect a “perfect storm” of factors including poor affordability, credit curbs, rising supply, reduced sentiment and a fall in foreign buyers.

Reminding readers that the threat of a property crash has been “wheeled out endlessly over the last 15 years or so”, Oliver said that a crash (which he defined as a 20 per cent or more fall in national average prices) is unlikely.

“Our assessment remains that a crash is unlikely [unless] we see much higher interest rates or unemployment (neither of which are expected) or a continuation of recent high construction for several years (which is unlikely as approvals are falling) and a collapse in immigration.”

Meanwhile, house prices in Perth and Darwin are bottoming out, and prices in Adelaide, Brisbane, Canberra and Hobart – along with regional centres – are likely to perform better despite still seeing some impact from tighter credit.

“Overall, we now expect national average prices to fall nearly 10 per cent out to 2020 which is a downgrade from our previous expectation for a 5 per cent national average fall,” Oliver said.