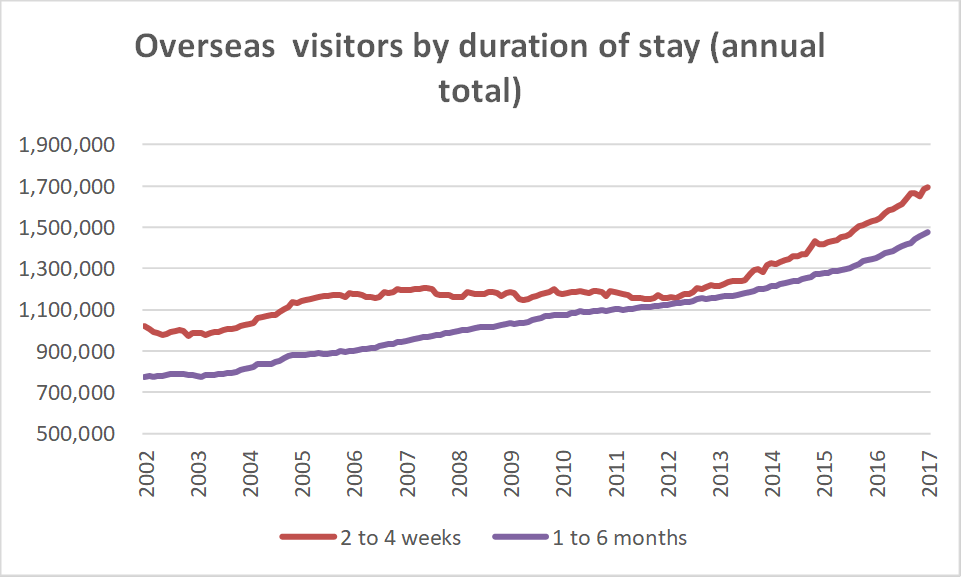

Source: ABS

Most recently, the Federal Government has made it easier for residents of China to make frequent stays in Australia, with a ten-year visa allowing visits of up to 3 consecutive months. The visitor visa (subclass 600) frequent traveller stream was introduced in December 2016. The visa has been introduced as a trial and numbers are limited.

Growth in the number of visitors who make a long stay will be having a greater impact on the economy – and making for unusual patterns of use for our apartments. Their use of housing might be slated to staying in a spare room, or couch-surfing. A potential source of accommodation would be apartments owned by the visitors or a family member of the individuals.

It seems likely that the surge in long-term stays is contributing to greater use of apartments in some locations, such that they aren’t entering the standard rental market, and that this is limiting any supply blowout.

The benefits to retail spending and demand for services are substantial. An extra 500,000 people staying for three months has a similar aggregated duration of stay to an extra 3 million standard tourists staying for just 2 weeks, but with a spending profile that is closer to that of residents. Not surprisingly, ABS retail data shows that spending for cafes, restaurants and recreation services are recording far higher growth rates than for supermarkets and department stores.

The nature of apartment use by long-term visitors is becoming more blurred as Australia becomes more integrated with Asia. It is hard to be definite, and the Census data won’t help. We can draw on anecdotal evidence, where an inner-city apartment is used by family on an extended basis, with its use – by students, visitors, business travel and family friends – waxing and waning over time.

The source of the emerging trend of growth in the length of stay is likely to be founded on properties owned by permanent migrants, and dual citizens with properties in Australia and elsewhere who are choosing to spend time in more than one country.

These residents may be spending a few months of the year in Australia and the rest in their country of origin. As migrants age and their children become independent they may choose to spend more time Australia. Six-month stays are permissible within any 12-month period. An apartment that is available as a holiday home may become an attractive option for older people with children living permanently in Australia.

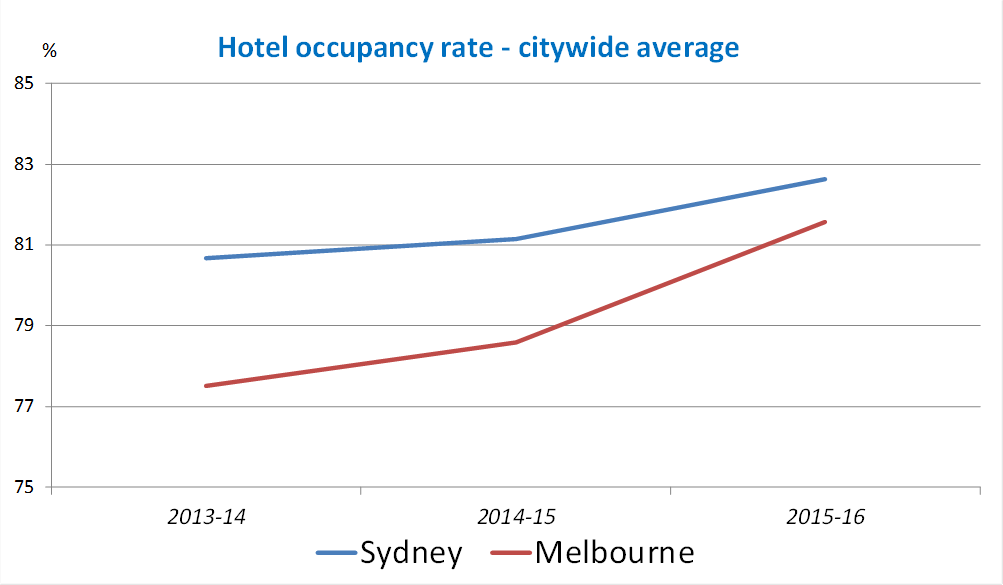

A key benefit of an apartment purchase is that hotels have become considerably more expensive over the past three years. Purchasing an apartment is more compelling as a substitute for hotel-stays by disparate members of an extended family.

Occupancy rates for hotel rooms have increased sharply over the past four financial years. Hotel room availability has increased, as has the number of nights that rooms have been occupied.

In Sydney, revenue per available room (RevPAR) has increased by 10% per annum over the past two years.

Occupancy rates for short term accommodation