Signs APRA's Investment Crackdown May Be Working

The Housing Industry of Australia has revealed the number of loans to owner-occupiers constructing or purchasing new homes during the three months to April 2017 quarter was stronger than a year earlier in five of the eight states and territories.

The largest increase was recorded in Queensland (+6.5 per cent), followed by Tasmania (+5.3 per cent), Victoria (+3.7 per cent), South Australia (+2.6 per cent), and New South Wales (+2.2 per cent). The largest fall was recorded in the Northern Territory (-27.2 per cent), followed by the ACT (-18.8 per cent) and Western Australia (-11.9 per cent).

APRA, Australia’s banking regulator, recently announced further measures to control building financial risks in the Australian property market, confirming months of speculation that an intervention was imminent.

The Australian Prudential Regulation Authority capped interest-only mortgage lending on March 31, telling lenders to limit higher risk interest-only loans to 30 per cent of new residential mortgages.

“Since December 2014, APRA, together with Council of Financial Regulator members, has closely monitored residential mortgage lending trends and the resulting impacts on the resilience of lenders, as well as the household sector more broadly,” it wrote in a statement.

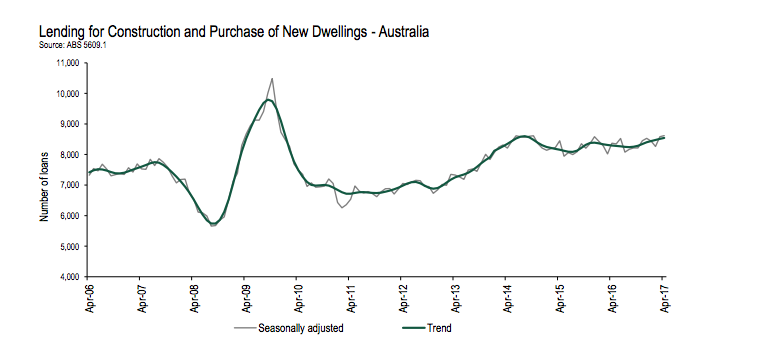

Source: HIAHIA's Senior Economist Geordan Murray said, “While housing finance figures released today show that overall lending slowed in April, the number of loans to households building new homes reached its highest level since 2015," he said.

“An increase in construction loans provided the majority of the uplift in the month – these types of loans typically relate to new detached houses.

“There has been considerable focus on the residential building cycle recently, particularly relating to an expected reduction in activity over the year ahead. However, commentary has often considered the residential building sector as a whole and overlooked the different cycles for detached house building and the apartment sector.

“Today’s result is a positive sign for detached house builders and supports our view that demand in this part of the market is likely to remain robust throughout the next phase of the cycle.

“The number of construction loans to owner-occupiers increased by 2.1 per cent in the month, and the number of such loans during the three months to April 2017 is 1.9 per cent higher than it was a year earlier.

“Loans to owner-occupiers purchasing ready-built new homes declined by 3.0 per cent in April, but lending in the April ‘quarter’ was still 6.0 per cent higher than a year ago.

“We continue to see some instability in the month by month flow of loans to owner-occupiers purchasing ready-built new homes, but lending for this purpose generally remains at elevated levels.

“This part of the home loan market is being affected by volatility due to the timing of apartment completions and settlements. This is likely to be a consistent theme over the remainder of the year.”