ASX Invests in $200m Electronic Property Settlement Market

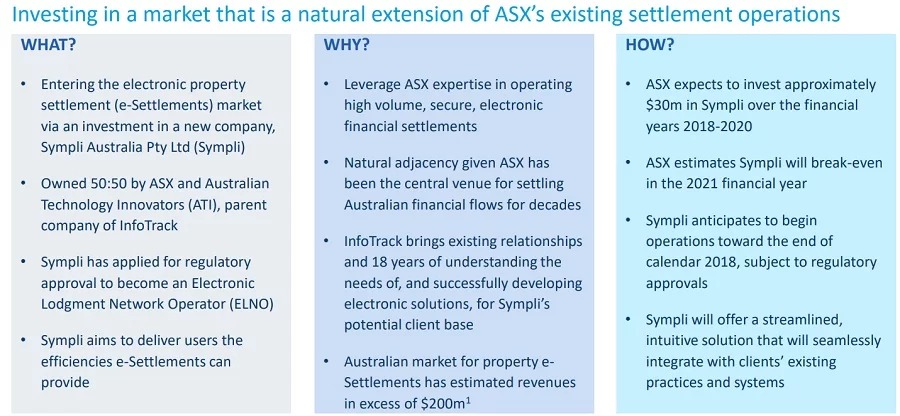

The ASX is partnering with technology group Infotrack to enter the $200 million electronic property settlement market.

In a move that augurs major changes in the property settlement landscape, ASX Limited has announced they plan to invest alongside Infotrack – Australia’s largest provider of eConveyancing technology and services – to create an electronic property settlement service.

It is investing $30 million over three years into Sympli Australia which it will equally co-own with Australian Technology Innovators, the parent company of InfoTrack.

Sympli has applied to become an Electronic Lodgment Network Operator with the regulator, the Australian Registrars’ National Electronic Conveyancing Council.

"Entering the electronic property settlement market is a natural evolution for ASX,” ASX chief executive Dominic Stevens said in the exchange announcement.

“We already settle approximately $70 billion in transactions electronically every day and have been the central settlement venue for the Australian financial market for decades.”

Subject to regulatory approvals, Sympli is expected to be operating before the end of 2018.

Property Exchange Australia is currently the dominant player in the digital conveyancing sector, and is backed by four state governments and the big four banks.

Related reading: Non-Bank Lenders, Tech Start-Ups Gain Market Share in Development Lending

New blockchain platform to enter service

For settlement of share trades the ASX is expecting to switch on the world’s first industrial-scale blockchain in financial services between September 2020 and March 2021.

The new technology will replace CHESS (Clearing House Electronic Subregister System) — which is the current platform for clearing, settlement and other post-trade services for Australian stocks.

The system will be tested to handle up to 10 million transactions per day. The ASX currently processes around 5.4 million transactions each day.