Auction Clearance Rates Lift As Housing Credit Stalls

Following a soft previous week of auctions around the country, possibly influenced by the ANZAC Day public holiday and school holidays, some renewed buyer interest returned to the east coast auctions market this past week.

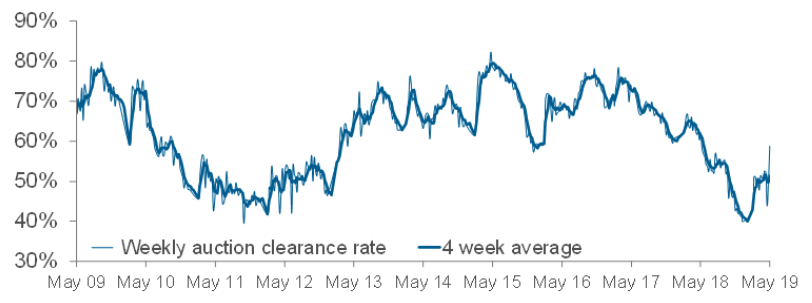

According to preliminary data released by Corelogic, 58.8 per cent of capital city homes that went under the hammer sold during the week, a welcome improvement on the 54.6 per cent initial estimate offered seven days earlier.

Once all results have been collected, with close to 498 outstanding, a final clearance rate closers to the low 50 per cent range is anticipated, a far cry from the 62.1 per cent recorded for the same week one year prior.

In the week prior, the preliminary estimate of 54.6 per cent was revised down to show a final clearance level of 50.4 per cent after encouraging preliminary reporting rates of 72.4 per cent.

Related: Auction Clearance Rates Fell 20% Over the Past Year

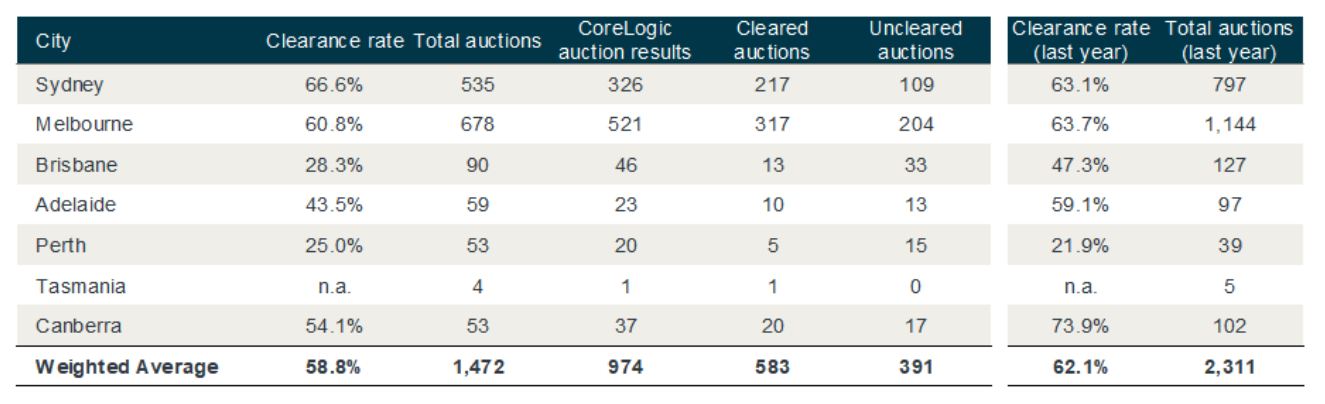

Capital city auction statistics (preliminary)

A total of 1,472 homes taken to auction across the combined capital cities this week, increasing from 1,026 over the previous week, while remaining significantly lower than the same week last year when a total of 2,311 auctions took place.

In Sydney, the preliminary auction clearance rate from 535 homes listed was 66.6 per cent, compared to the previous week where 332 auctions were held across the city resulted in a final clearance rate of 52.4 per cent.

This time last year, 63.1 per cent of the 797 Sydney homes auctioned were successful.

Melbourne returned a clearance rate of 60.8 per cent, lifting from the week prior although to a lower volume of stock.

Brisbane was the only city to see a fall in both auction volumes and the clearance rate week-on-week, with a clearance rate of 28.3 per cent from 90 listed auctions.

Across the remainder of the capitals, sub-50 per cent preliminary clearance rates were reported during the week.

Year-on-year, all capital cities saw a fall in auction volumes.

Related: Sydney and Melbourne Downturn Only at Halfway Point: BIS

Weekly clearance rate, combined capital cities

Despite the improvement in clearance rates, home prices across the five mainland capitals continued to fall.

Sydney property values have plummeted 14.5 per cent and Melbourne's values have dropped 10.9 per cent since they both peaked in 2017.

According to Corelogic’s daily hedonic index, prices fall by 0.2 per cent in average weighted terms, largely reflecting declines of 0.3 per cent in Sydney and 0.2 per cent in Melbourne from seven days earlier while median prices in Brisbane eased by a little over 0.1 per cent.

Further afield, prices in Adelaide and Perth were essentially unchanged from late April.

Credit growth at its lowest level on record

The weakening market remains bound to the banks with credit offered to owner-occupiers growing at the slowest annual pace on record.

According to RBA data, housing credit grew by just 0.25 per cent over March after adjusting for seasonal patterns an increase of 3.99 per cent over the year, the lowest level since records began in 1977.

Credit provided to owner-occupiers grew by 0.35 per cent during the month, leaving the increase in 12 months earlier at 5.65 per cent.

Total credit extended to Australia’s private sectors grew by 0.3 per cent, the largest gain in five months.

Annual credit growth for personal use has fallen in annualised terms in each of the past 39 months.