Australia Is No Longer the Preferred Choice for Chinese Investment

Australia is continuing to lose Chinese buyer interest to other parts of the world as increased taxes and banking restrictions continue to bite.

Chinese buyers continue to retreat from Australia's investment market due to stamp duty and scrutiny from the Foreign Investment Review Board, while back in China, capital controls, diplomatic relations and security concerns also have buyers nervous.

The fall in Chinese investment, which was much larger in the US and Canada, falling over 2018 by 83 per cent and 47 per cent respectively, has highlighted the difficulty most Chinese developers and individuals are experiencing in getting money out of the country to buy new properties.

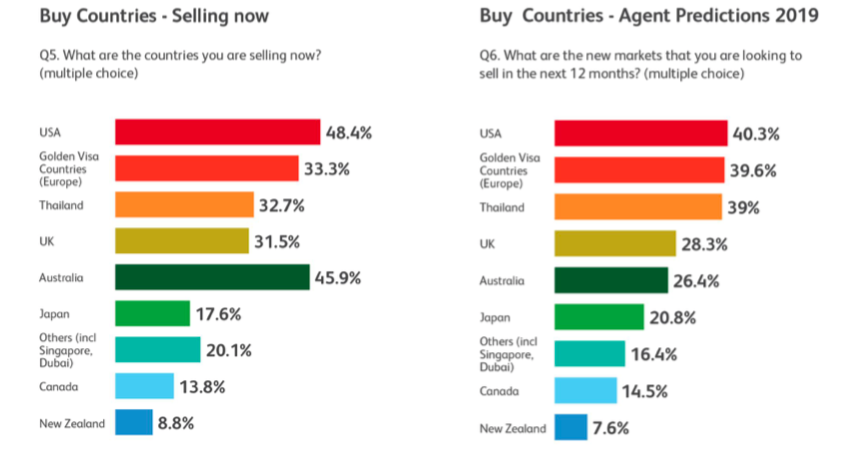

Investorist, a business-to-business, off-the-plan property website, found that half of the 160 Chinese real estate agents surveyed in January said they were still selling Australian properties but only half said they would continue to do so by the end of 2019.

Related: Chinese Buyers ‘Increasingly Sensitive to Upfront Costs’: UBS

“Understanding Chinese property investment trends over the past 12-24 months could be likened to how water flows: it moves along the path of least resistance,” Investorist chief executive Jon Ellis said.

“So countries which offer the ‘least resistance’ in terms of taxes, foreign investment regulations, pricing and conducive immigration conditions are most attractive for Chinese agents sourcing properties for clients.”

“Thailand is a good example, with 39 per cent of Chinese agents saying they were selling Thailand for the next 12months, up from 24 per cent in 2017,” Ellis said.

"Golden Visa" countries like Greece and the US, where permanent residency visas are given by a country to individuals who invest, often through the purchase property, remain top of the list for Chinese investors.

Chinese investors are also following its government's plans for infrastructure expansion with the One Belt One Road initiative link countries along the old Silk Road routes proving prosperous for eastern European nations.

Chinese President Xi Jinping announced the One Belt One Road initiative in 2013 and has since spent close to $150 billion a year in the 68 countries participating.

US cities like New York, Miami, LA and Houston have also continued to draw Chinese investment, while UK property also found popularity as the pound’s value falls in the lead up to Brexit.

Related: Chinese Developers Double Down on Australian Property

Where Chinese investors are buying

China losing interest in large projects

According to research undertaken by KPMG and the University of Sydney Business School, Chinese investment in Australia fell by 36.3 percent or $8.2 billion in 2018, a far cry from its peak high of $31.9 billion in 2016.

Healthcare was the most popular sector for Chinese investors, with commercial real estate falling to second position.

“Despite Chinese global outbound direct investment actually growing by 4.2 percent in 2018, Australia has felt the pinch of a significant reduction, reflecting the impact of policy changes in China,” KPMG Australia head of Asia and international markets Doug Ferguson said.

“Our rate of decline has been accelerating and is now closer to the trend observed in the United States and Canada, where Chinese Overseas Direct Investment dropped by 83 per cent and 47 per cent respectively in 2018.”

The report shows that the overwhelming majority of Chinese corporate investment into Australia came from privately owned firms, which accounted for 92 per cent of the deals and 87 per cent of the funds invested.