Home Loan Finance Records Historic Fall

New home lending figures produced the largest monthly plunge ever recorded, with the Covid-19 shock starting to show its full impact on housing finance data.

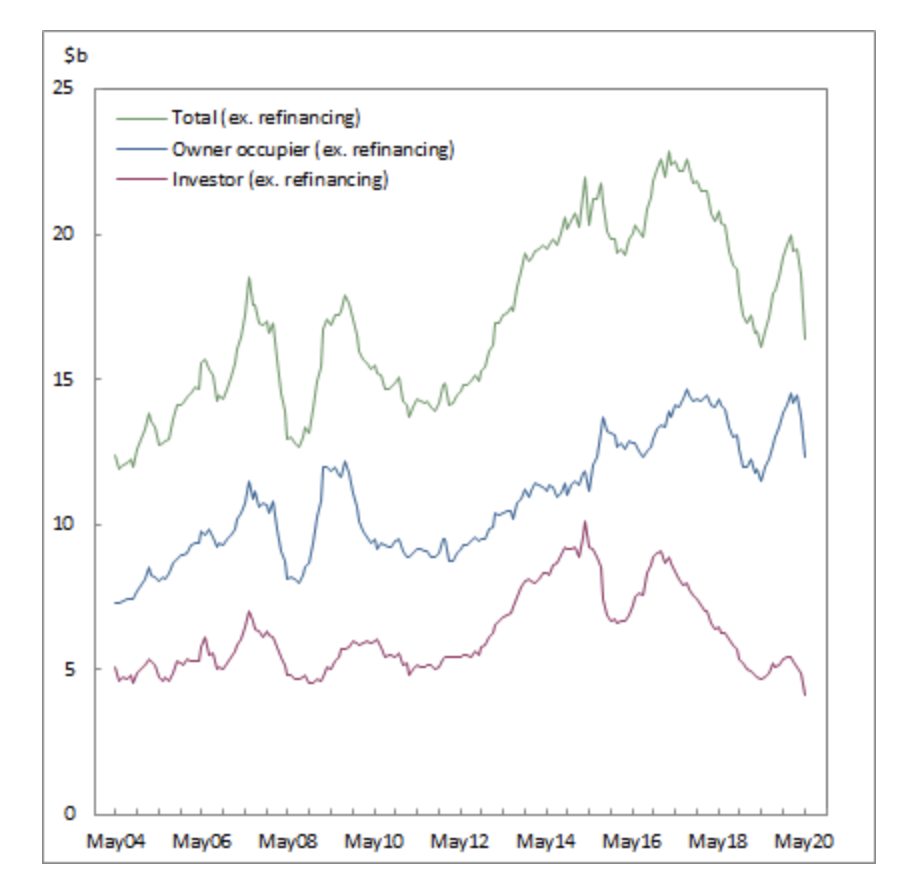

The value of new loan commitments for Australian housing fell a sharp 11.6 per cent in May, seasonally adjusted, driven by strong falls for housing loans in New South Wales and Victoria, according to the latest Australian Bureau of Statistics data.

The ABS figures, released Thursday, show the value of new loan commitments for owner-occupier housing fell 10.2 per cent, while investor housing fell 15.6 per cent in May.

ABS chief economist Bruce Hockman described Thursday’s figures as “the largest fall in the history of the series”.

“Driven by strong falls in the value of loan commitments for housing in New South Wales and Victoria,” he said. Smaller falls were reported for all other states except ACT.

New loan commitments for housing: ABS

New loan commitments, total housing (seasonally adjusted), values, Australia

NAB chief economist Alan Oster said, moving forward, the biggest impacts on Australia’s housing market will come from rising unemployment, job security and consumer confidence.

Oster forecast property price falls of around 10 to 15 per cent over the next year or so from peak to trough.

“While prices have held up slightly better than expected, they have now declined for two consecutive months across the capitals and we expect this to continue for some time yet,” Oster said.

“While the initial Covid-19 related restrictions on housing activity have eased, the economy has undergone a very large contraction, and while we appear to have passed the trough in activity, it will take time for the recovery to unfold.”

The ABS data shows investor figures have now dropped 11.9 per cent for the year, also driven by New South Wales and Victoria.

The number of first home buyer loan commitments fell 9.3 per cent in May, driven by NSW and Queensland with all other states except ACT recording falls.

Westpac’s Matthew Hassan says the volatility in housing finance is low compared to the more direct impacts of the Covid disruptions.

“Note that with all these numbers it should be remembered that total market turnover dropped 40 per cent during the March-April lockdown, recovering all of that loss through the May-June reopening,” Hassan said.

While reduced transactions in the housing market choked new loan activity, ABS says the value of existing owner-occupier loans refinanced with a different bank was by far the highest on record.

“As borrowers responded to reduced interest rates and refinancing offers,” he said.

With Melbourne entering lockdown, Hassan says weekly auction results, price updates and homebuyer sentiment will be the main metrics to keep a close eye on—given the lag in finance data—as a guide to housing market conditions.

New loan commitments for fixed-term personal finance increased 14.5 per cent in May, following a 24.8 per cent fall in April.

ABS attributes this rise was driven by a partial rebound in the value of finance for road vehicles.

Corelogic figures show housing values recorded a drop for the second consecutive month in June, with five of the nation's largest capital cities recording a decline in home values over the month.

Melbourne recorded a 1.1 per cent drop, Perth 1.1 per cent and Sydney 0.8 per cent over June.

While Hobart, Canberra and Darwin recorded a slight rise in values over the month.