Despite predictions of the death of CBD offices, Australian businesses are still signing leases for high-end office space, though they’re increasingly selective about what they’ll accept.

According to the January edition of the Property Council of Australia’s twice-yearly Office Market Report, the national CBD office vacancy rate remained stable at 13.7 per cent, from 13.5 per cent in the last report.

The combined CBD and non-CBD rate sits at 14.7 per cent even as the market absorbed more than 220,000sq m of new supply in the past six months.

Property Council chief executive Mike Zorbas said that “over the last 3½ years, positive demand for office space in our CBDs has been recorded in five of the last seven reporting periods”.

“We have continued to see the supply of new office space above or near the historical average, providing access to a wealth of new, high-quality office space in our cities,” Zorbas said.

“Vacancy levels continue to be driven by this large level of supply, as demand has remained positive.”

CBRE head of investor leasing Tim Courtnall said the Australian office sector performed strongly over the second half of 2024.

“While the market showed strong transaction volumes in quarter four across all major cities,” Courtnall said, “decision making remained slow”.

CBRE head of office and capital markets research Tom Broderick expects “national vacancy will peak in 2025 and begin to decline”.

Supply pipeline analysis shows 333,000sq m scheduled for completion in the next six months, exceeding the historical average of 237,554sq m.

The development pipeline extends across Sydney (83,048sq m), Melbourne (54,327sq m), Brisbane (43,700sq m), Canberra (87,011sq m), Adelaide (23,826sq m), and Perth (41,193sq m).

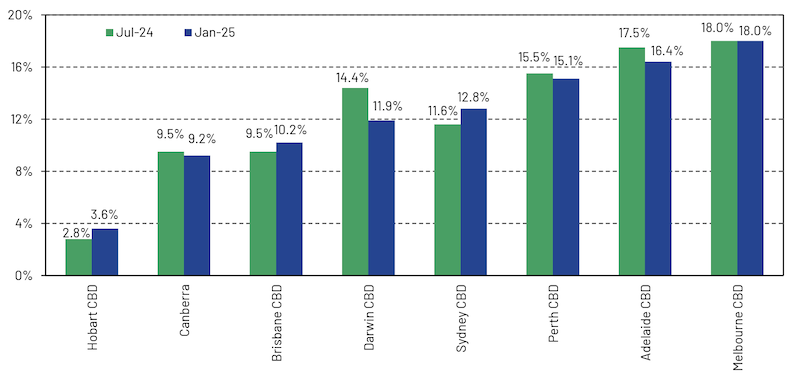

In NSW, Sydney’s vacancy rate increased from 11.6 per cent to 12.8 per cent following 164,552sq m of new supply.

“In the second half of 2024, we observed additional demand extending beyond the CBD core, particularly in Midtown and Western Corridor Precincts,” Cushman & Wakefield head of office leasing NSW Tim Stanway said.

CBD Vacancy Change: Six Months to January 2025

The city expects 277,048sq m of new supply by 2027, with about 50 per cent pre-committed.

Though it remained unchanged from the July 2024 report, Melbourne still holds the country’s highest vacancy at 18 per cent, with 252,627sq m expected by 2027 showing 26.9 per cent pre-commitment.

Cushman & Wakefield national director office leasing Victoria Marc Mengoni expects 2025 to be the year we “will see Melbourne’s office market rebound from the rising vacancy of the past two years, with new supply stagnant and a returned focus to quality backfill opportunities”.

Brisbane’s vacancy rate moved from 9.5 per cent to 10.2 per cent but its pipeline shows strong market confidence with 67.9 per cent of its 162,630sq m 2027 pipeline pre-committed.

Cushman & Wakefield manager office leasing Queensland Jack Neumann said, “With no new completions expected until the second half of 2025, we’re likely to see vacancy rates tighten to levels not seen in the CBD since 2012”.

Perth’s vacancy decreased to 15.1 per cent, with Cushman & Wakefield head of office leasing WA Roly Egerton-Warburton saying its “extremely tight labour market [means] major occupiers are upgrading to higher quality assets, with recent refurbishments, to help them compete for the best staff”.

Adelaide’s rate improved to 16.4 per cent, driven by demand for quality accommodation with proximity to amenities.

Smaller markets showed varied performance, with Canberra’s vacancy rates falling from 9.5 to 9.2 per cent, Hobart increasing from 2.8 to 3.6 per cent—remaining the lowest nationally—and Darwin recording the largest decrease from 14.4 to 11.9 per cent.

Cushman & Wakefield head of office leasing Tim Molchanoff said the “national leasing market continues to show a strong preference for high-quality properties, with tenants seeking better locations and a range of amenities”.

This preference is reflected in sublease vacancy rates, which decreased across both CBD and non-CBD markets, except in Melbourne and Brisbane.

Broderick said the supply outlook “has declined due to feasibility issues from high construction costs and interest rates”.

Knight Frank national head of leasing Andrea Roberts said that “fitout costs, construction costs and interest rate levels prove to be the headwinds to discourage tenant moves”.

Despite these challenges, building quality and location are becoming increasingly critical, with properties offering superior amenity and transport access significantly outperforming their competitors.

This trend is particularly evident in Sydney, where the new Metro has elevated the importance of transport connectivity.

Looking ahead, Sydney and Brisbane are expected to lead rental growth nationally.

There was a surge in CBD inquiries last month, particularly in Sydney, suggesting improving market confidence despite the headwinds.

Zorbas called for government intervention to address Melbourne’s office vacancy situation, which he said was “the highest CBD office vacancy in the country”.

“We need to see active leadership from the State Government to support the vibrancy of the CBD and help Melbourne remain one of the best cities to visit in the world,” Zorbas said.

Recent Australian Bureau of Statistics data shows the first decline in remote working since 2020, dropping from 37 to 36 per cent.

However, the 2024 National Working Families Survey reveals 76 per cent of workers won’t consider jobs without flexible arrangements, forcing developers to rethink traditional office designs.

This shift is particularly crucial given research by Fenizia and Kirchmaier showing remote workers achieve 12 per cent higher productivity than their in-office counterparts.