Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Australian Unity—better known for aged care, retirement living, health insurance and financial services—is making a play for the build-to-rent sector, filed concept plans for a giant 68-storey tower in Paramatta.

Although its Australian Unity Office Fund has made it clear this is simply a “potential alternate use”, it has none-the-less lodged a Secretary’s Environmental Assessment Requirements (SEARs) request before the NSW Department of Planning, Housing and Infrastructure.

Australian Unity—a mutual company with origins dating to 1840—declined to comment on the filing but a planning department spokesperson confirmed the build-to-rent proposal was before the government.

The project, which seeks 611 apartments, is planned for a 3940sq m site at 2-10 Valentine Avenue, on Parramatta’s south-east fringe.

The planning department spokesperson said it had asked for additional information to ensure the proposal met the requirements for a State Significant Development (SSD) application for a build-to-rent project.

In a letter to Australian Unity this month, department team leader Gabriel Wardenburg sought clarification on what type of residential uses were being proposed for the site.

“The SEARs request nominates co-living, build-to-rent and serviced apartments as the land uses, whilst the SEARs request letter only identifies build-to-rent,” Wardenburg wrote.

The letter also asks for justification regarding the calculation of gross floor area needed.

“The request for SEARs describes the site area as including both the existing commercial tower and the subject application site.”

According to CoreLogic, the property was acquired by real estate investment manager, developer and operator Investa Funds Management in November, 2007 for $65.5 million.

However, The Urban Developer understands Investa is no longer involved with the project.

In a half-yearly report released in February, Australian Unity Office Fund (AOF) investors were told a refurbishment of the 13-storey commercial building that sits at 10 Valentine Avenue is expected to be completed next month. During renovation the 16,000sq m of A-grade office space has remained vacant.

The report said that next door, at 2 Valentine Avenue, is an adjoining carpark with 94 carparking bays, licenced to the NSW Government for a five-year term.

However, shareholders were also told there was an opportunity to reposition 2 Valentine Avenue to build-to-rent via a design competition planning process with the Government Architect of NSW.

The competition process was expected to finish late last month.

“The proposal will consist of a maximum allowable gross floor area of about 37,000sq m on the southern end of the site,” the report said.

But, it added, the proposal may “pursue the state’s newly released affordable housing incentive”, which allows for an additional 30 per cent in residential floor space ration and height, in exchange for a 15 per cent affordable housing provision.

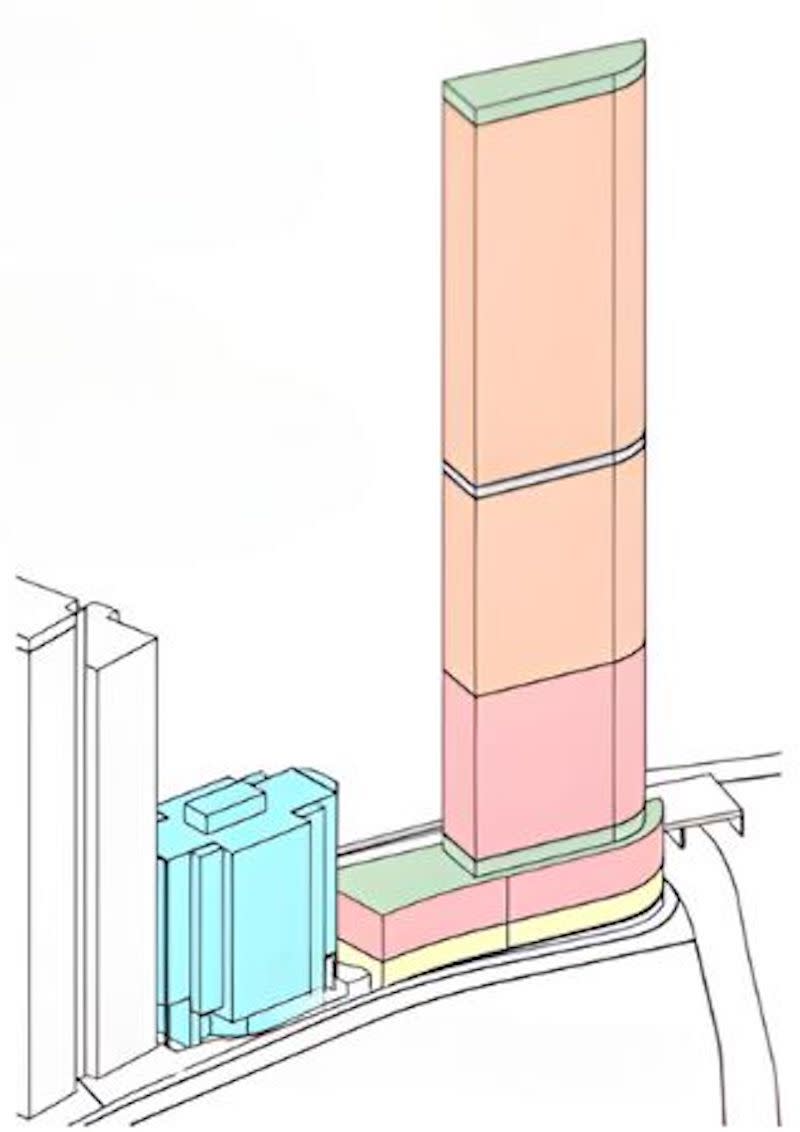

The early plans call for 283 co-living apartments (or studios), 141 single-bedroom, 156 two-bedroom and 30 three-bedroom units. A two-level podium would join the two buildings.

The report made clear there was “no certainty that any of these options or opportunities will be pursued by AOF (Australian Unity Office Fund)”.

“Each opportunity is subject to a number of conditions, including council approval,” it said.

However, the fund’s shift towards build-to-rent is likely to make the Parramatta site more attractive at a time when the sector is booming in western Sydney. According to online property monitor BCI Central, about $1.62 billion in build-to-rent is either in the planning process or begun construction in the area just this year.

Meanwhile, last month Australian Unity confirmed it was in discussions to sell a 14-level office tower at 468 St Kilda Road, Melbourne.

In April, the fund announced it was under contract to sell 150 Charlotte Street, Brisbane for $64.5 million.

And in January the fund sold 96 York Street, Beenleigh—about 40km south of Brisbane—for $29.70 million.