Geopolitical Risk and the Australian Commercial Real Estate Market

In light of the escalating situation in North Korea, Cushman & Wakefield have analysed how Australian commercial real estate (CRE) markets might be impacted in the event of a geopolitical crisis.

Reviewing data on major geopolitical events over the past 100 years, Cushman & Wakefield suggested that most recent conflicts - or events that have de-escalated short of actual conflict - have had little impact on Australian CRE.

If this remains the case, Australian CRE should remain attractive, supported by an improving economy and relatively attractive yields when compared to bonds and major international CRE markets.

Australian CRE and historic conflicts

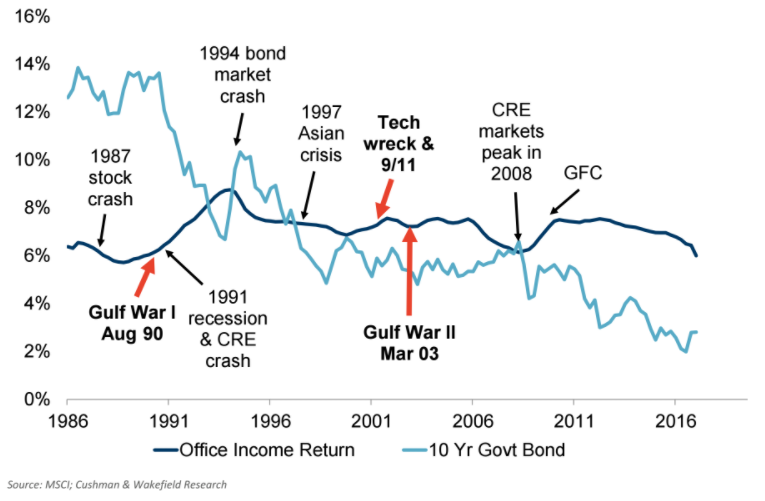

Since 1985, Australian office yields have been influenced more by the domestic economy than conflicts such as the two Gulf wars or the 9/11 terrorist event.

Table: Office income return and historic conflicts.

During Gulf War I (August 1990 to February 1991), yields did increase though this coincided with an Australian recession and CRE crash when vacancy rates in many Australian CBD office markets rose to over 20%. After the 9/11 terrorist event, CBD office market vacancy rates and office income returns recorded little change. Similarly, there was little change to yields after start of Gulf War II.

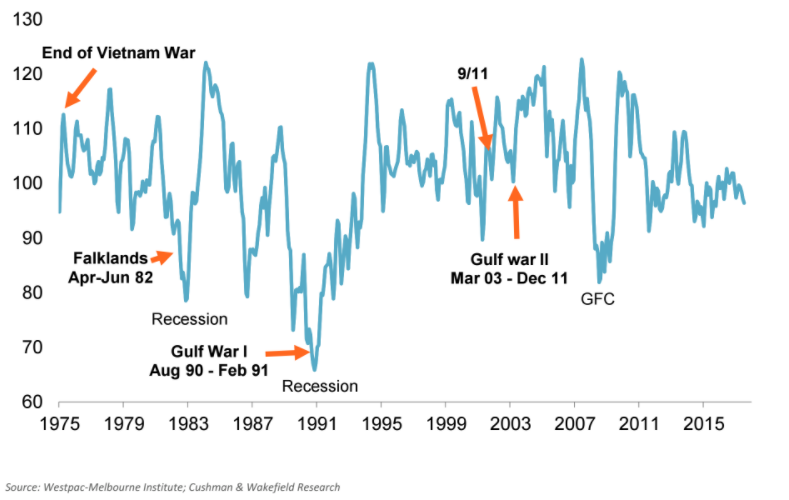

While CRE yields have recorded little change due to conflict in recent decades, sentiment has been hurt in the short term.

Table: Consumer sentiment and historic conflicts.

There was a notable jump in consumer sentiment at the end of the Vietnam War, which then dips when the Gulf and Falklands wars commenced as well as after 9/11. However, the dips have been relatively short lived and also coincided with recessions in the early 1980s and 1990s.

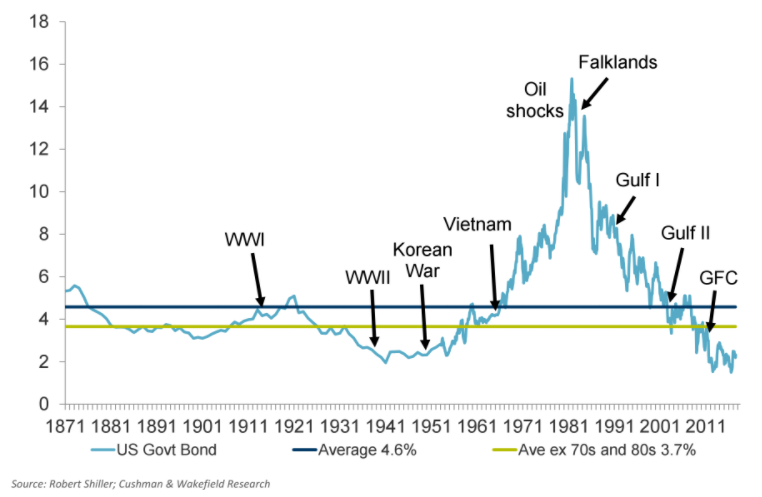

US Bond Yield and historic conflicts

A key driver of investment demand for Australian CRE has been relatively attractive yields compared to alternate investments such as bonds. While Australia's historic CRE yield series is relatively limited, US government bond data is available back to the 1870s.

Table: US long bond yields and historic conflicts.

During the major conflicts of World Wars I and II, US bond yields were relatively stable. However, yields dipped in the months after both Gulf wars commenced and post 9/11 as investors initially sought the relative security of US government debt. Stable or lower bond yields suggest CRE should remain relatively attractive to investors.

However, a reduction in CRE income through an economic slowdown could negatively impact demand.

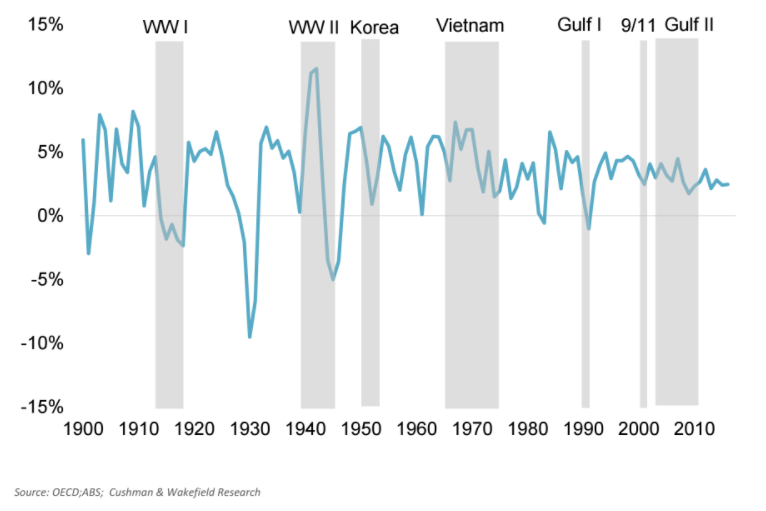

Australian GDP and conflict

Tenant demand, vacancy and rental growth depends on economic growth. Australia's GDP, between 1900 and 2016, has suffered during prolonged periods of conflict. GDP falling by an average of 1.4% pa during World War I.

Table: Australian economic growth and historic conflictsEconomic growth was more volatile during World War II. Initially dipping to 0.3% in 1939 and then experiencing strong growth averaging 8.2% pa from 1940 to 1943 before slipping to average -4.2% pa over 1944 and 1945. During the Korean War, GDP real growth averaged a solid 3.8% pa (but did dip to 0.9% in 1952) and averaged 4.4% during the Vietnam War (from the escalation of US participation in 1965 to 1975).

Australia has not experienced a recession since 1991, while most other advanced economies were negatively impacted by the tech wreck, 9/11 and the GFC.