Low Rates, Stimulus Will Cushion Coronavirus Hit: RBA

An expected recovery in residential construction, historic low interest rates and big infrastructure spending could support the economic fall-out from the impact of the Coronavirus outbreak, the Reserve Bank has said.

“The effect of the virus will come to an end at some point,” RBA deputy governor Guy Debelle said while addressing the Australian Financial Review Business Summit on Wednesday.

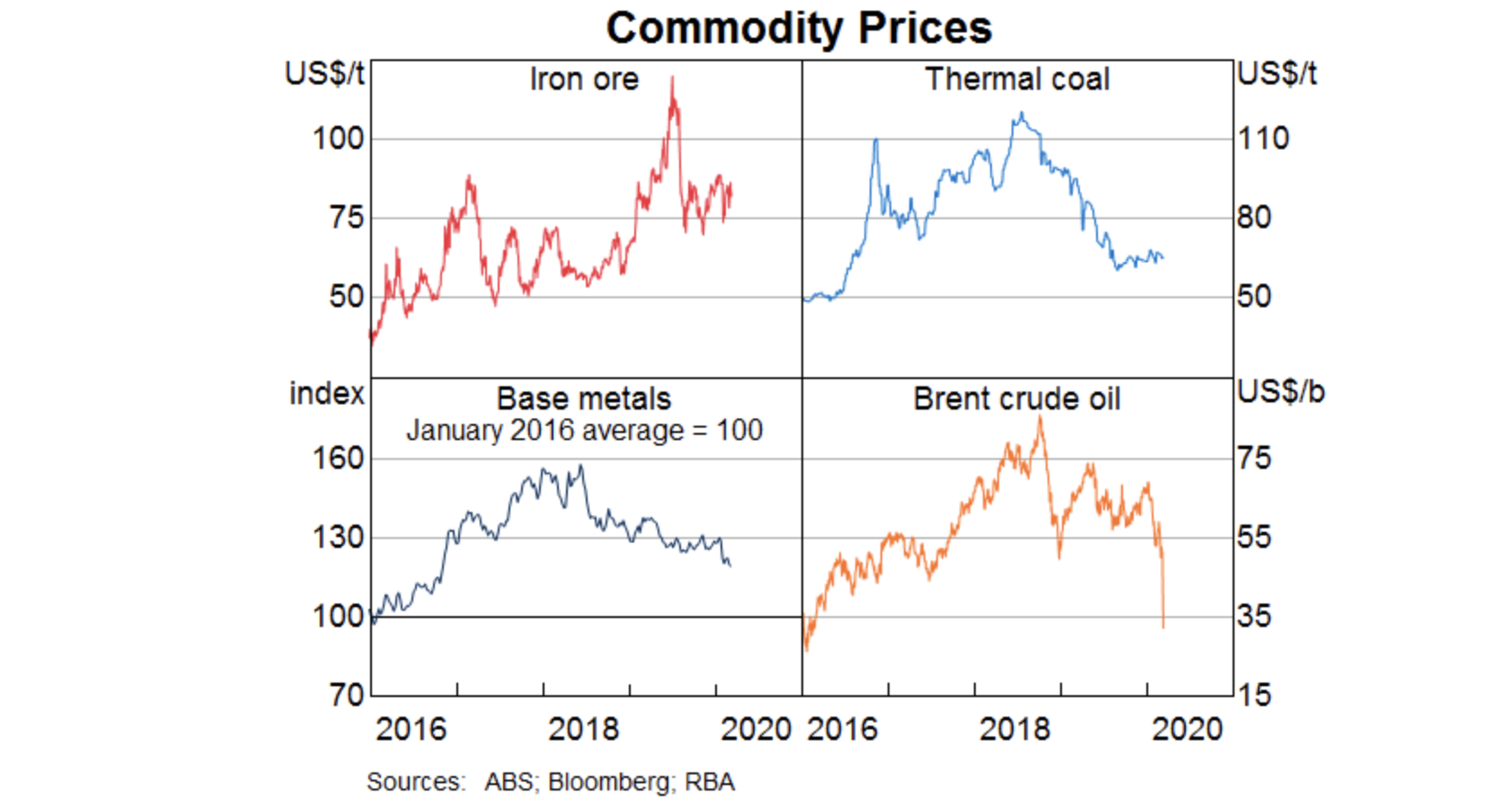

“Once we get beyond the effect of the virus, Australia’s economy would be supported by the low level of interest rates, the pick-up in mining investment, infrastructure spending and an anticipated recovery in residential construction.”

“The government has announced its intention to support jobs, incomes, small business and investment which will provide welcome support to the economy,” Debelle said.

Prime Minister Scott Morrison, who is expected to make an announcement on Thursday, has said government would continue to invest in infrastructure around the country ahead of announcing its economic stimulus package.

Debelle said the Reserve Bank is gathering information on supply chain disruptions impacting the construction and retail sectors, in particular.

“Clearly we are still only in the early weeks of March, so the picture can change from here. It is just too uncertain to assess the impact of the virus beyond the March quarter,” Debelle said.

Related: ASX Plunges In Worst Day Since GFC

The Reserve Bank cut the cash rate by 25 basis points to the historic 0.5 per cent low when it met last week, with the cash rate reduction passed on in full through to mortgage rates.

The cash rate has been reduced by 100 basis points since June last year.

Speaking on financial markets, Debelle added that there’s been “a large increase in risk aversion and uncertainty”.

“The virus is going to have a material economic impact but it is not clear how large that will be,” he said.

“The combined effect of fiscal and monetary policy will help us navigate a difficult period for the Australian economy.

“It will also help ensure the Australian economy is well placed to bounce back quickly once the virus is contained.”

Related: RBA On Banks, Rules Out QE

Debelle described the virus as “a shock” to both supply and demand.

“Monetary policy does not have an effect on the supply side, but can work to ensure demand is stronger than it otherwise would be,” he said.

“Lower interest rates will provide more disposable income to the household sector and those businesses with debt.

“Monetary policy also works through the exchange rate which will help mitigate the effect of the virus' impact on external demand.”

The Reserve Bank expects the global economy will be materially weaker in the first quarter of 2020, and in the period ahead.

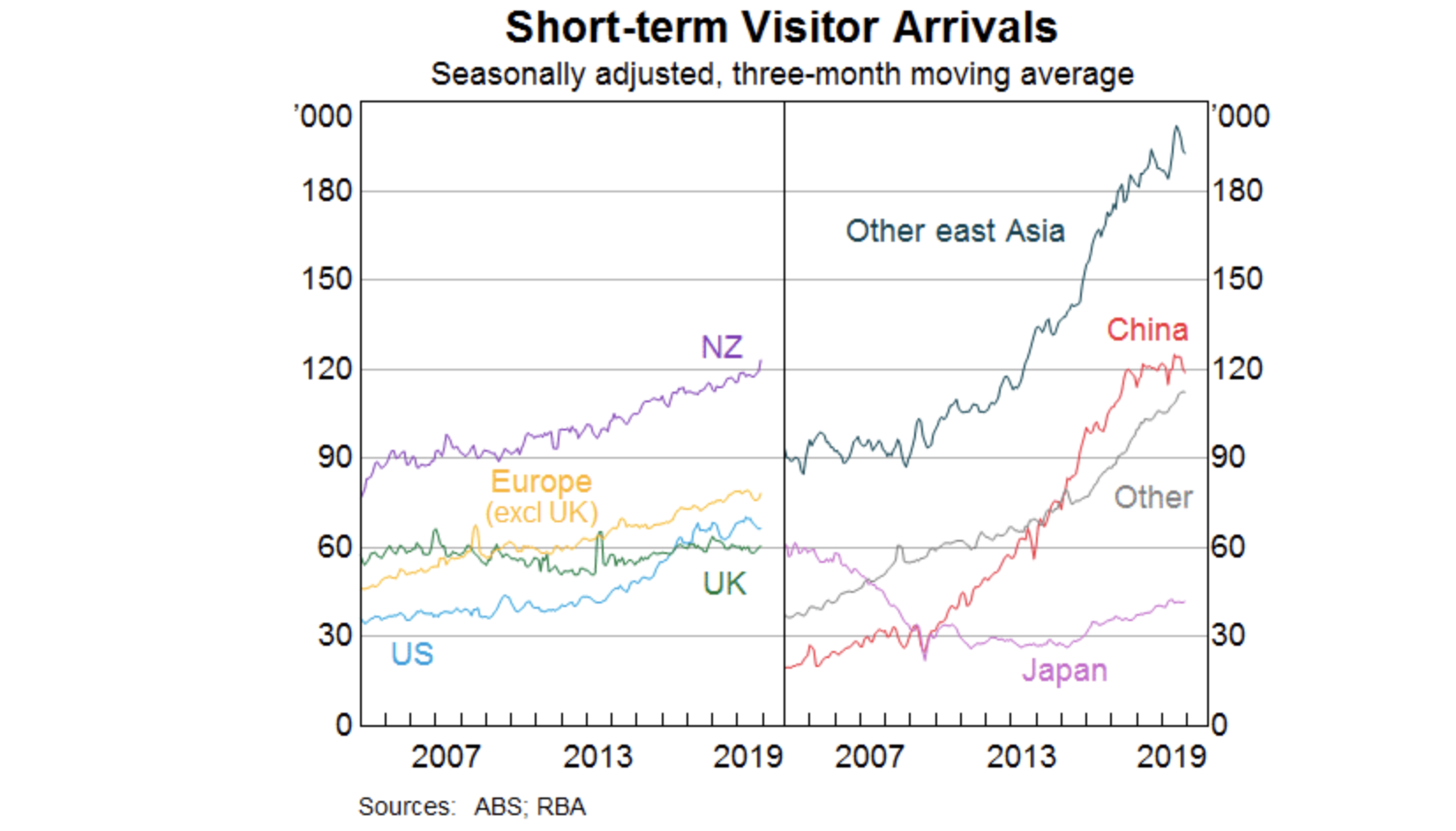

“In terms of the effect on the Australian economy, we have estimated the direct impact on the education and tourism sectors in the March quarter,” Debelle said.