Australian House Prices Slip for 11th Consecutive Month

Australia’s dwelling values have tracked downwards for 11 consecutive months reflecting the nation’s weaker housing market and the ongoing implications of tighter lending conditions, according to Corelogic.

Melbourne and Sydney, where dwelling values rose rapidly, now lead the housing market slowdown as the housing correction continues.

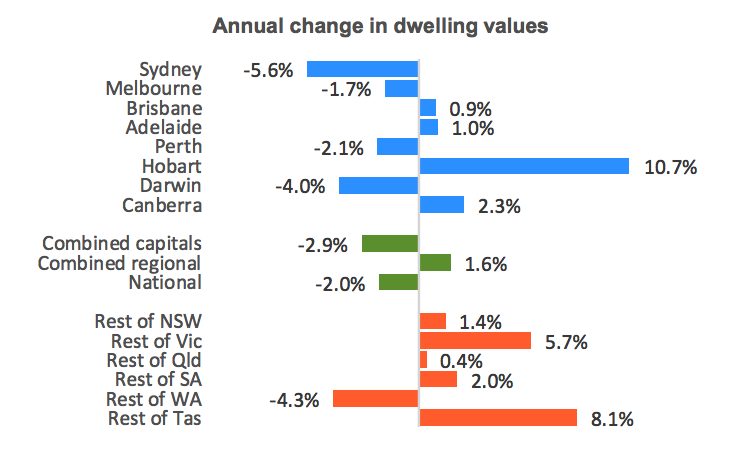

Corelogic says Sydney and Melbourne are now home to Australia’s weakest housing markets, dropping by 3.5 per cent and 3.3 per cent respectively over the first eight months of this year.

Sydney’s 5.6 per cent annual fall is the sharpest since March 2009, while Melbourne’s annual fall of 1.7 per cent is the worst in five years.

The two capital cities make up 60 per cent of Australia’s housing market by value and 40 per cent by number.

Related: Australia’s Top Performing Suburbs Revealed

Corelogic’s Tim Lawless says the overall housing market weakness is heavily concentrated across the premium sector of the market.

Corelogic’s hedonic index recorded a 5.4 per cent drop in values across the upper quartile of the combined capitals over the past 12 months.

This in comparison to the middle market down only 0.5 per cent and the most inexpensive quartile increasing 0.6 per cent in values.

“The trend towards more robust housing market conditions for affordable properties can be seen geographically as well, with the top ten capital city sub-regions, based on an annual capital gain, generally located in more affordable areas such as Hobart, the outskirts of Melbourne and parts of Brisbane and Adelaide,” Lawless said.

“On the other hand, the weakest performing sub-regions are primarily located across Sydney as well as Melbourne’s prestigious inner East.

Lawless believes these stronger market conditions across Australia’s more affordable areas will likely result in a rise of first home buyers in the market.

“As well as changing credit policies focused on reducing exposure to high debt-to-income ratios.”

Over the three months to August, the Corelogic report found Adelaide was the best performing capital city (+0.5 per cent), and Melbourne was the weakest performing capital city (-2.0 per cent).

While Darwin recorded the nation's highest rental yield at 5.6 per cent and Melbourne the lowest at 3.1 per cent.

Five of Australia’s major capital cities recorded a fall in dwelling values over the month, whereas Adelaide (0.3 per cent), Darwin (0.1 per cent) and Canberra (0.5 per cent) were the only three to record an uptick for the period.