Can Bitcoin Revolutionise the Future of Real Estate?

A London mansion could make British property history. The multi-million pound mansion in the Notting Hill district is due to go on sale this month, with agents specifying they will favour offers made using the cryptocurrency Bitcoin.

Wealth management firm London Wall is selling the six-storey house in West London for £18 million ($30.35 million) and is hoping to close the sale using Bitcoin.

According to London Wall co-founder Lev Loginov, their aim in accepting Bitcoin as payment is to pioneer Bitcoin transactions for property in Great Britain.

We would like to be the first company to transact in Bitcoin. It can be done quicker, more efficiently and it is much easier to deal with than using banks, which are putting in unnecessary over-regulation,” he said.

Bitcoin is a digital currency that bypasses banks and mainstream financial systems that enables individuals to transfer value to each other and purchase goods and services.

Partner at London Wall, Ned El-Imad said that they hope it will start a trend in property, "We believe in the concept of bitcoin as a fair and transparent method of moving money around the world without having to rely on third parties."

EL-Imad also said London Wall hoped property purchases could be reformed through the use of blockchain, the technology that underpins bitcoin.

While the future looks bright for cryptocurrency there are still some obstacles to overcome, such as how to pay commission to real estate agents and stump duty, which in the case of this West London property would amount to nearly £2 million.

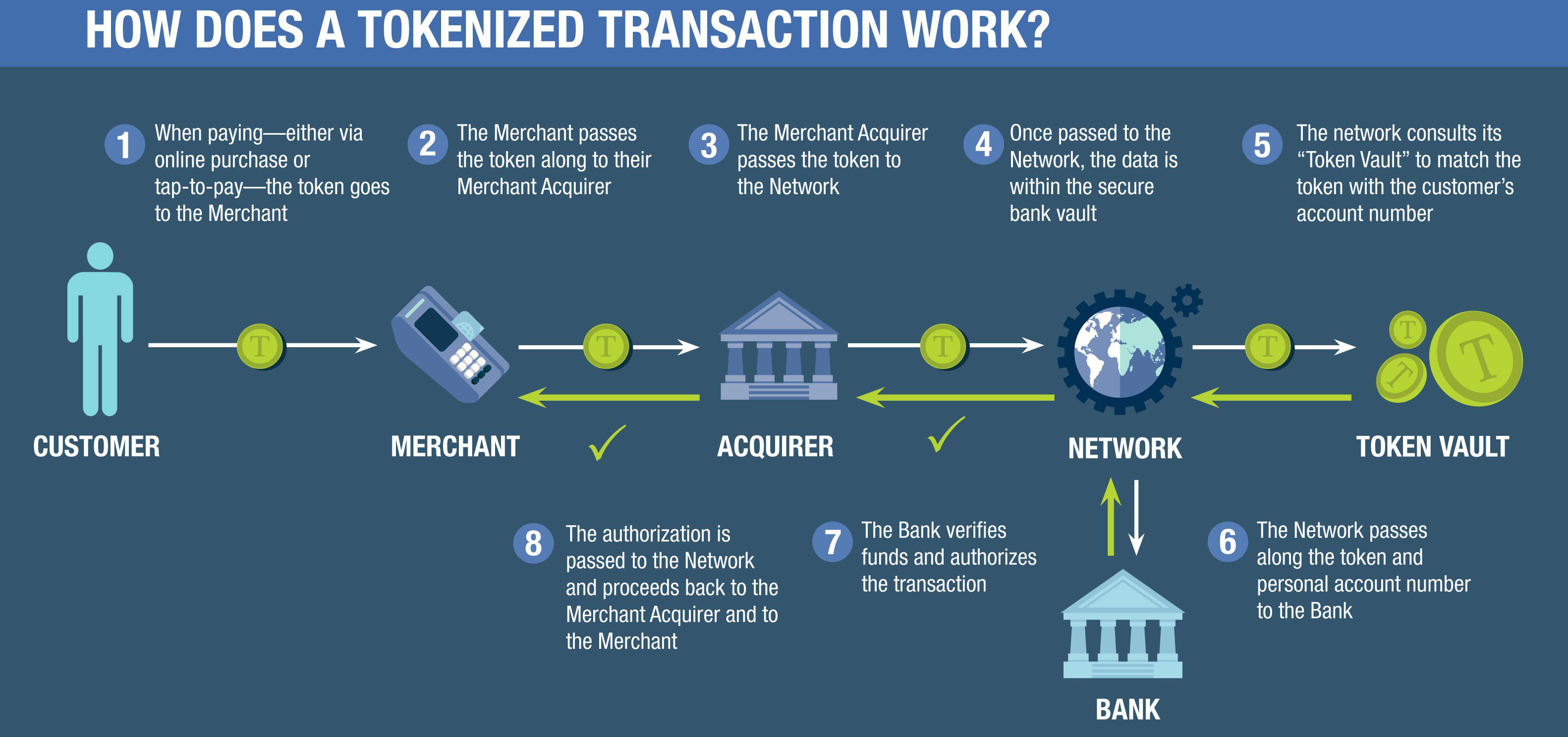

A significant number of companies and start-ups use blockchain-based solutions in the real estate industry with most offering some form of property tokenisation. The general idea behind tokenisation is that people can invest in real estate by purchasing digital tokens that represent real property.

These tokens entitle the holder to own a certain percentage of a future property proportional to the amount they have purchased. Contractors and construction companies can directly or indirectly sell tokens to raise funds for future projects.

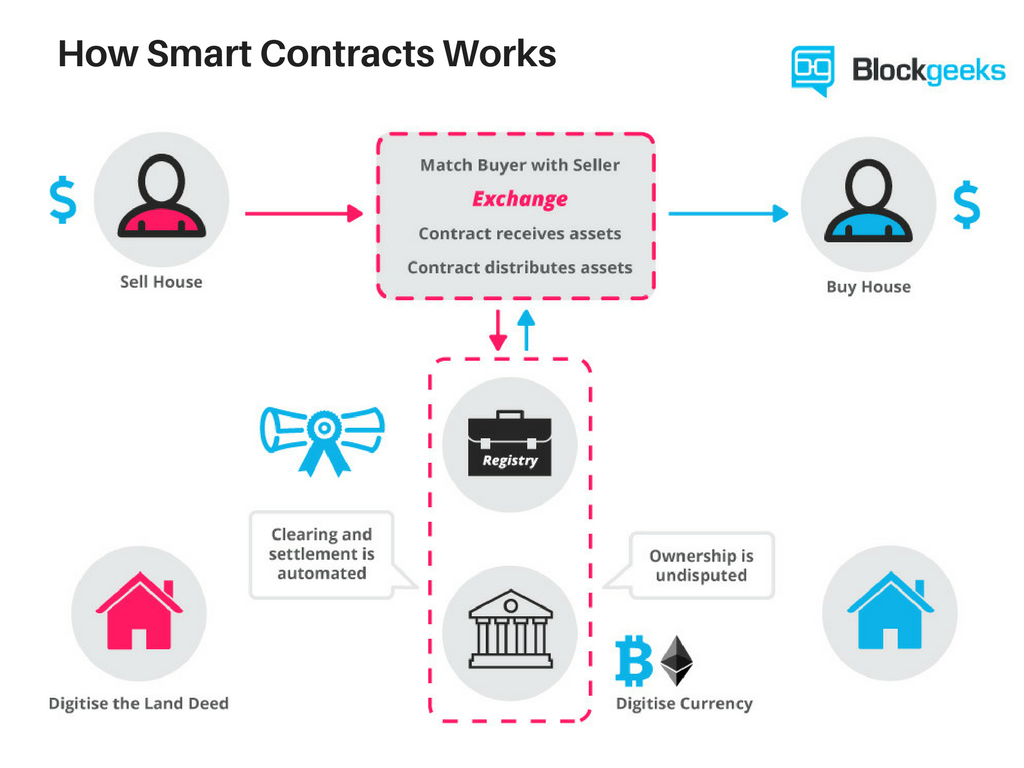

To help ensure that both parties hold their end of the deal, many real estate tokenisation systems often introduce smart contracts that regulate relations between both parties.

When the

Internet of Things is deployed, tokenisation can continue to move forward by making token holders the only ones capable of using the property they have purchased.

Tokenisation can provide many other advantages including easy distribution of profits from real estate, lowering entry thresholds for real estate investors and complete traceability of all transactions ensured by blockchain.

Tokenisation is occurring all around the world. One example covers only construction projects in London and its suburbs. By purchasing a token, the investor is entitled to a dividend on future revenues from the building. Once construction is over and the development is sold, the revenues are proportionally distributed amongst investors.

Another example of the tokenisation model is Ethereum smart contracts. These contracts enable brokers, customers, sellers, and the real estate agents to legally sign all transactions. The option is viable since the smart contracts are traceable making it possible to verify them. The idea is currently being tested in California, and if proven successful, it could potentially be deployed in other jurisdictions.

New cryptocurrency, backed by the real estate industry, is currently being developed. Brickcoin, is essentially a blockchain-based financial platform backed entirely by the stability of Real Estate Investment Trusts (REIT’s).

Brickcoin introduces the first real estate-backed cryptocurrency, with no frontiers or the need to invest large quantities -- people can invest in real estate in seconds and earning passive returns between three per cent and 25 per cent.

Despite the rising popularity of Bitcoin, property transactions are still rare due to the volatility of the cryptocurrency and any delay in converting into physical currency could be costly.