Commercial Yields Continue to Tighten in Brisbane CBD Office Market

Brisbane's office market has continued to strengthen, as mega-leasing deals continue to drive the vacancy rate in the Queensland capital down.

According to the latest research from Knight Frank, the improving economic environment pulled the vacancy rate down to 11.9 per cent, its lowest in seven years, and down from 14.6 per cent a year ago.

Brisbane's CBD market has experienced three consecutive six month periods of positive net absorption achieved, settling back into a more standard growth-based pattern of demand.

The state's economic growth, which has been bolstered by more than $12 billion earmarked for major project infrastructure over the next decade, is expected to moderate to 2.1 per cent for 2019 before improving slightly to 2.2 per cent for 2020.

The Brisbane CBD leasing market remains in the recovery phase with positive leasing enquiry and above trend net absorption.

Effective rental growth continued with prime and secondary effective rents growing by 1.2 per cent and 5.6 per cent year-on-year respectively to July 2019.

Investment volumes in the CBD office market are high, sitting at $2.86 billion over the year to September, roughly $1 billion higher than the corresponding period one year earlier.

Unsurprisingly, the balance between domestic and offshore buyers has flipped in the 2019 calendar, with offshore purchasing only representing 17 per cent of transactions compared with 73 per cent in 2018.

“Compressing by 23 basis points over the past year, Brisbane CBD yields are starting to move more in line with the Sydney and Melbourne CBDs,” Knight Frank partner Ben McGrath said.

“This has seen the yield gap between Sydney and Brisbane close from a recent high of 147 basis points in July 2017 to the current 95 basis points — below the 10-year average of 99 basis points.”

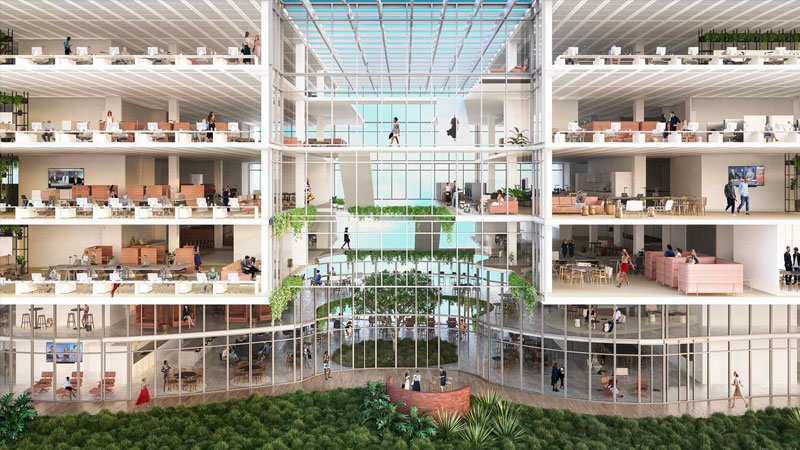

Driving this demand in Brisbane's resource-centred market are the public sector, professional services, education, construction, engineering and a resurgence from the mining sector, as well as an influx from global and Australian "co-working" organisations.

Co-working and serviced office tenants are also contributing directly to net absorption, accounting for 6 per cent of total leasing activity in 2018 and 2019, with WeWork continuing to expand its Brisbane CBD footprint.”

While co-working operators will provide a buffer of sorts for the sub-leasing market, these changing conditions will also pose a challenge for the sector that has grown rapidly in recent years

The finance and insurance industry accounted for 26 per cent of tenant activity over 2018 and 2019 due to the Suncorp pre-commitment to 80 Ann Street, followed by government and public administration at 22 per cent, and resources and energy at 10 per cent.

Forecast employment growth is expected to be a standout in 2019 with the Brisbane region to record 25,000-plus more jobs in the core office-based industries, according to BIS Oxford Economics.

“While 2020 is expected to be lower, the coming five years will average 10,500 office based jobs per annum,” Knight Frank partner Jennelle Wilson said.

Supply of new CBD office space will get a boost in 2020, with the expected completion in late 2019 of Shayher Group's Brisbane Quarter 300 George Street building, which will add a further 47,700sq m – equivalent to 2.4 per cent of current stock – to the market.

Vacancy is expected to tick slightly upwards to reach 12.5 per cent in January 2020.