Brisbane Leading the Nation in Property Performance Indicators, But Boom Talk Premature

New research from property data firm CoreLogic has indicated that Brisbane is leading the nation on most property performance indicators, but some experts are curbing talk of a imminent property boom in the Sunshine State.

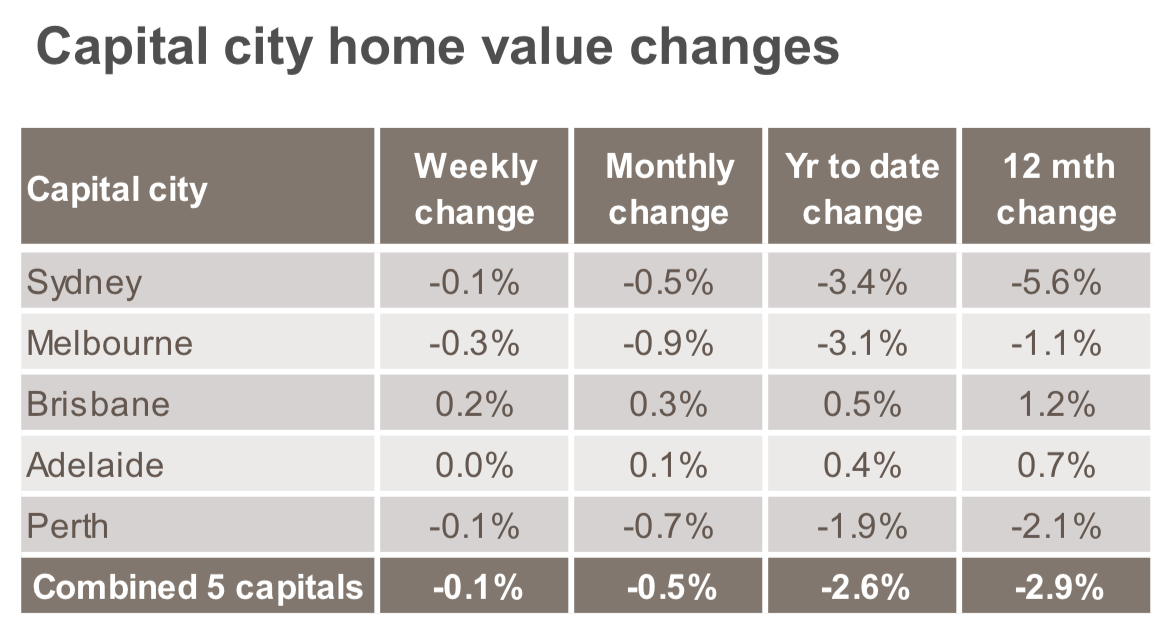

According to the CoreLogic Daily Home Value Index, Brisbane recorded a 1.2 per cent increase in the median house price for the 12 months to August 2018.

This compared to -5.6 per cent in Sydney, -1.1 per cent in Melbourne and a combined -2.9 per cent for the five capital cities across Australia.

While the results reflect a marked correction in the southern cities of Sydney and Melbourne, the gains in Queensland are being met with equal measures of enthusiasm and scepticism by the broader sector.

The latest BIS Oxford Economics report confirmed Brisbane as a 'surprise performer' with expected house price growth of 2- to 3 per cent to 2019-20, before greater growth of six per cent forecast in 2020-21.

BIS’ Residential Property Prospects 2018 to 2021 reports that a current oversupply of dwellings, particularly within the apartment market, will ensure the upside won’t be immediate.

Related: Brisbane House Price Strength Will Continue As Sydney, Melbourne Slows: BIS

According to PRDnationwide's Affordable and Liveable Property Guide, Brisbane has proven to be the most affordable and liveable capital city.

Brisbane's Algester was the standout suburb for both houses and units with the lowest entry price and highest rental yield, combining affordability and liveability given its low entry prices and proximity to supermarkets, parkland, public schools, a medical centre and the motorway.

“Liveability is gaining traction among home buyers and does attract a cost,” the report stated.

Related: Brisbane Is Australia’s Most Liveable Capital City: Report

But some experts are pouring cold water on talk of a immediate property boom.

Propertyology Head of Research, Simon Pressley, said that the Sunshine State capital continued to post less than stellar results because the wider economy is not doing enough of the heavy lifting.

“Brisbane has some good property market fundamentals, but we have to go way back to 2007 to find the last time that its property market produced double-digit price growth,' Pressley claims.

“Brisbane’s long-running underachieving property market is a reflection of a city with enormous potential but lacking boldness and a clear direction. Of course, that is not helped by the fact that Queensland had four premiers in just 10 years,” he said.

The situation may be starting to change.

Recent announcements by the State Government to invest $46 billion in major infrastructure projects, including the Cross River Rail, have experts predicting a spike in new job creation.

Economic forecaster Deloitte Access Economics said that the outlook for engineering construction in Queensland is better than it has been for some time.

Related: Queensland’s $46 Billion Infrastructure Boom

The State Government's State Infrastructure Plan (SIP) focuses on a range of infrastructure spending, including $11.6 billion of infrastructure investment to be rolled out in 2018-19, which aims to support up to 38,000 jobs.

This is supported by the Brisbane City Council and the Federal Government's $944 million investment in Brisbane Metro project which is now fully funded.

Other major projects include Brisbane Airport's second runway, Queen's Wharf and the Howard Smith Wharves redevelopment.