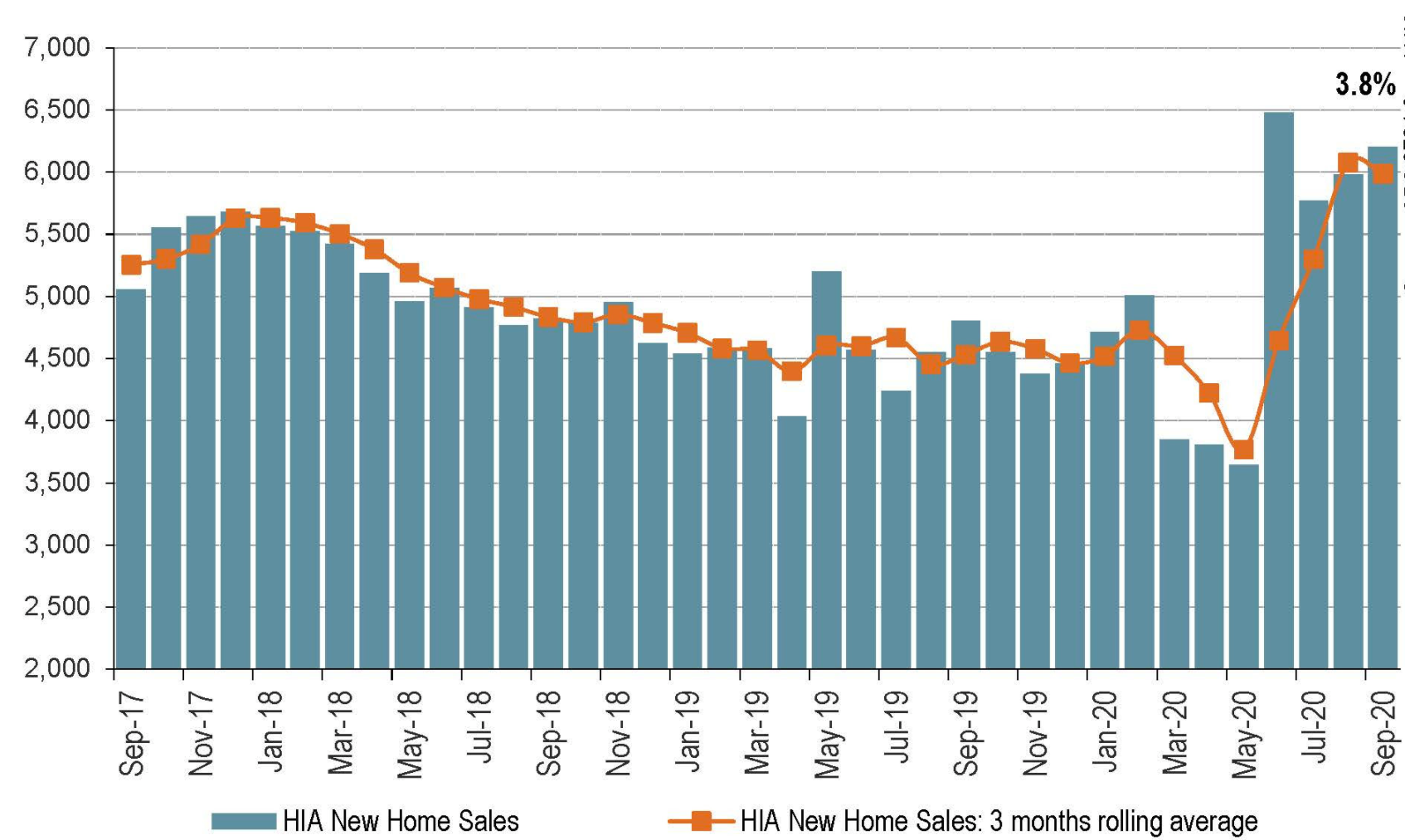

Budget Bounce Sees New Home Sales Surge 12pc

Ultra-low interest rates, the relaxation of responsible lending, state government hand-outs and the successful $670 million Home Builder package, have driven a dramatic recovery in new home sales.

The latest monthly figures from the Housing Industry Association, based on surveying its membership of large volume builders, shows sales are now 11.8 per cent higher, in the seven months since restrictions came into effect, than at the same time last year.

While no announcement on Home Builder was made in the budget, it did include an extension of the First Home Loan Deposit Scheme, with another 10,000 packages specifically for new homes, and with higher price caps.

First home buyers remain a key driver of plans to revive the property market as Covid-19 restrictions are eased, particularly in Melbourne and Sydney, the nation’s largest cities and traditionally the most active markets.

“The [Home Builder] program has brought buyers into the market that would otherwise not been able to purchase their first home for a number of years,” HIA chief economist Tim Reardon said.

“[However], the positive impact of HomeBuilder has varied across the states.”

Private new house sales

Across the country, new home sales increased by 29.7 per cent in South Australia in September compared to August 2020, followed by Victoria, the state hardest-hit by the pandemic and where movement remains restricted, which saw an increase of 16.7 per cent.

New South Wales new home sales increased by 6.1 per cent across the month and 9.7 per cent over the September quarter, leaving sales levels consistent with 2019.

Sales in Queensland and Western Australia both declined during the month by 4.2 per cent and 11.5 per cent respectively.

Despite the monthly decline in Western Australia, over the seven months to September, sales have increased in by 95.7 per cent compared to the same time last year—bolstered by a combination of state and federal government programs and as well as pent-up demand for housing.

“With the [Home Builder] program ending on 31 December for eligible sales, there is a very limited window of opportunity for prospective customers to purchase a new home, Reardon said.

“Delays in the processing of new home loan applications is the most significant constraint to getting these new building projects under construction with processing times for new home loans at around 2 months.

“Access to finance for new home construction has become exceptionally tight following new regulations introduced in recent years.”

Renewed consumer sentiment has been trending higher as the virus curve flattens and restrictions are eased or lifted.

The Westpac-Melbourne Institute Index of Consumer Sentiment surged by 11.9 per cent to a three-month high of 105 points in October, from 98 points in September.

The index is now well above pre-Covid levels and solidly in optimistic territory—with a reading of 100 on the index indicates optimists and pessimists are evenly balanced.

“Buying or selling a home is an extremely high commitment decision, so unsurprisingly, a positive consumer mindset has a direct bearing on housing market activity,” Corelogic research director Tim Lawless said.

“The latest sentiment reading provides another sign of improving housing market activity despite the headwinds of JobKeeper winding-down, expiring mortgage deferrals, stalled migration and slack in the labour market.”

According to August figures from the Australian Bureau of Statistics, new home buyers secured $16.3 billion in owner occupier loans for 12,000 properties, a 13.6 per cent surge, the largest increase since records were established 18 years ago.

Overall loan commitments were up 12.6 per cent, according to the seasonally adjusted data, but they were held back by the underwhelming performance of investor and personal loans.