The build-to-rent sector skyrocketed last year, according to fresh research, with its pipeline of projects growing by a staggering 89 per cent during 2023.

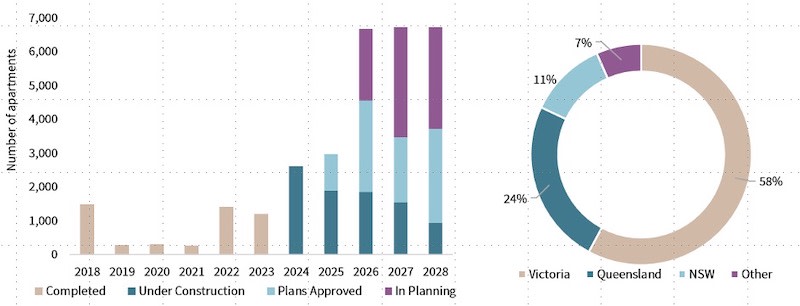

According to its Build-to-Rent Australia: Q4 2023 report, JLL is now tracking 38,721 apartments at various stages of development.

It found the number of apartments under construction increasing 73 per cent over 2023 to 9351.

More than 11,400 apartments were approved and awaiting construction, and a further 12,989 were in various stages of planning approval. Just under 5000 apartments were classed as operational stock.

Of those apartments in the pipeline, nearly 60 per cent were in Victoria with 24 per cent in Queensland and just 11 per cent in New South Wales.

JLL said a combination of low current rental vacancy, moderate build-to-sell supply levels and a rebound to record levels of migration and foreign student arrivals were supporting the underlying need for build-to-rent projects.

▲ A render from the rooftop terrace of the Fitzroy North build-to-rent tower.

Among those projects is the debut for development heavyweight Salta’s new build-to-rent platform Est, which marked the topping out of its Fitzroy North project this month.

Salta is owned by the rich-lister Tarascio family.

The tower at 249 Queens Parade comprises 94 one, two and three-bedroom apartments, and more than 1000sq m of “lifestyle amenity and shared communal spaces”.

These include a rooftop terrace and open-air pet park, a residents’ lounge, concierge service, resident-specific app, gymnasium, chef’s kitchen and entertaining area, flexible workspaces, and a music lounge with a collection of vinyl records.

Salta managing director Sam Tarascio said future Est projects would also have a focus on lifestyle, social connection and tailored amenity to cater to the growing demand for high quality, long-term rentals.

“Salta’s $3 billion move into the sector will bring our total pipeline of residential, office, industrial and retail development to more than $6 billion, building on the $3.5 billion of assets already under management,” Tarascio said.

“The sector is a natural extension of Salta’s business model that complements our existing portfolio and operational expertise and allows us to invest in a category of living that we believe has a strong growth trajectory.”

Not all beer and skittles

However, the JLL report said, it has not all been smooth sailing for the sector later in the year.

While better placed than build-to-sell to deal with construction cost and capacity issues, build-to-rent has not been totally immune from these issues, while also contending with higher bond yields in late-2023, which made capital raising for the sector difficult and inhibited further projects from beginning.

National institution BtR supply pipeline and pipeline by state

Despite these challenges, JLL living, capital markets, Australia, head Jack Bergin believes the outlook for the sector remains strong.

He said as more projects are completed this year, insights from occupancy and rental data will underpin the case for further future investment.

“The underlying drivers of build-to-rent in Australia and public sector support of the sector remain unequivocally strong,” Bergin said.

“Investors are not doubting this and are still showing a strong desire to be part of the sector’s emergence longer term.

“Bond markets have begun to regulate, and we will soon see the proposed changes to the MIT taxation regime enacted from July, both of which will provide investors with a lot more confidence to invest into the sector through 2024.

“Despite this, further regulatory support is still required to support project viability and unlock the full potential of build-to-rent to drive housing delivery across our capital cities.”

JLL residential research, Australia, head Leigh Warner said the tight rental market across Australia remained a strong backdrop for build-to-rent with rental vacancy estimated at 1.3 per cent nationally in December, according to SQM research, while strong growth in asking rents had been achieved during the past two years in all capital cities.

▲ Build-to-rent advantages extend to feasibility issues.

Long selling periods a plus

Warner said the increase in build-to-rent numbers also reflected the attractiveness of the sector relative to traditional build-to-sell projects in a difficult development environment.

“Long selling periods, particularly for larger build-to-sell projects, are highly detrimental in a market where construction resources remain stretched and finance costs uncertain, leaving developers very vulnerable to any rise in a project’s cost base,” Warner said.

“Having no selling period is a distinct advantage while project revenues are rising in a market of strong rental growth, which is much faster than end-sale prices are rising for built-to-sell projects.”

Bergin said that although project starts had been limited over recent quarters, there were several projects completed in late-2023 that had been well accepted by the market.

“While capital markets are generally challenging at present, the attractiveness of market fundamentals and the long-term growth potential of the sector will keep build-to-rent firmly at the top of investors’ priority list,” Bergin said.