Buoyant Property Market Fuels GPT Profit Lift

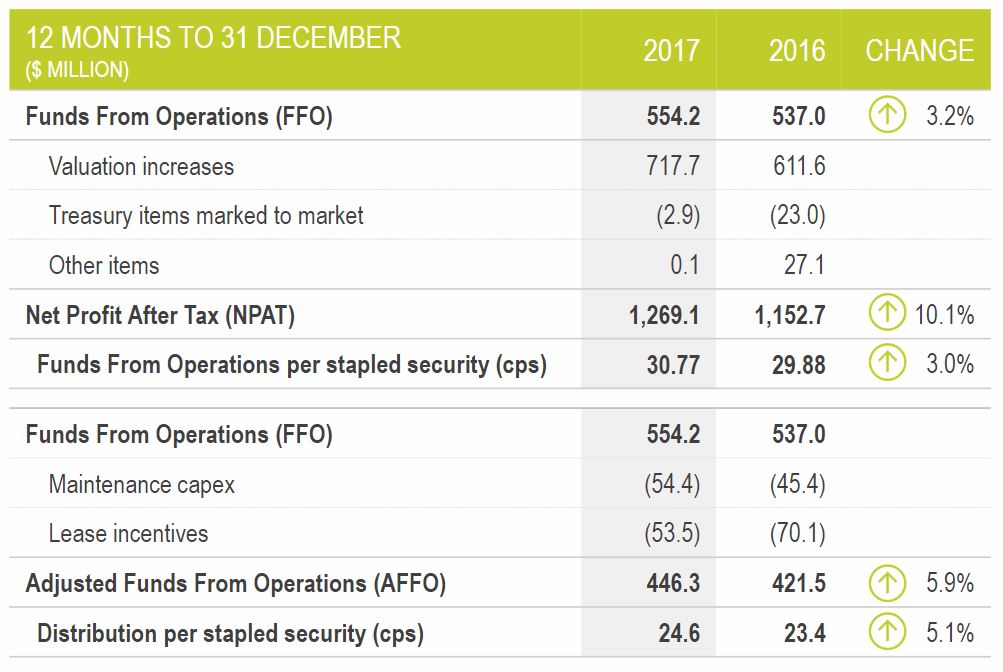

Rising rents in office markets and strong values for shopping malls has boosted GPT Group’s full-year profit by 10.1 per cent to $1.27 billion. The result included property revaluation increments of $717.7 million.

Funds from operations rose by 3.2 per cent to $554.2 million as the company collected increased income from its real estate assets.

The growth was driven by all three investment portfolios – retail, office and logistics and funds management, delivering combined comparable income growth of 4.4 per cent, with office achieving a particularly strong like for like increase of five per cent.

Related reading: GPT Group’s ‘Northern Gateway’ to Parramatta

GPT's assets under management, on its balance sheet and in its funds, increased by 12 per cent to a total of $21.5 billion. GPT Group owns the MLC Centre and Australia Square in Sydney, 111 Eagle Street in Brisbane, and Melbourne Central and Highpoint Shopping Centre in Melbourne.

“GPT’s balance sheet is in excellent shape which is important given the volatility we are seeing in the market at the moment. Global growth is accelerating, and we remain optimistic about the outlook for the Australian economy,” chief executive officer Bob Johnston said.

“For the office sector, our view is that conditions will remain favourable for at least the next three years in both Sydney and Melbourne. Very low vacancy rates and solid tenant demand should provide an opportunity for strong income growth.

The favourable supply and demand fundamentals also provide us with confidence in the development opportunities being pursued. “Overall we remain optimistic about the outlook and believe we are well placed to continue to deliver growth.”

Related reading: GPT Sells $500m Wollongong Shopping Centre

GPT provided guidance for funds from operations per security growth of three per cent for 2018 and also forecast distribution per security growth of around three per cent.

The company announced on Monday that former investment banker Vickki McFadden is set to replace long-serving GPT Group chairman Rob Ferguson on the board and as chairman.

Last week, GPT purchased a portfolio of four industrial properties at Sunshine in Melbourne’s west for $74 million.

Related reading: GPT Group Raise $400 million in US Debt