Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

While the Reserve Bank considers whether to gift Australians another cash rate hike ahead of the festive season, househunters could bag a bargain in three states.

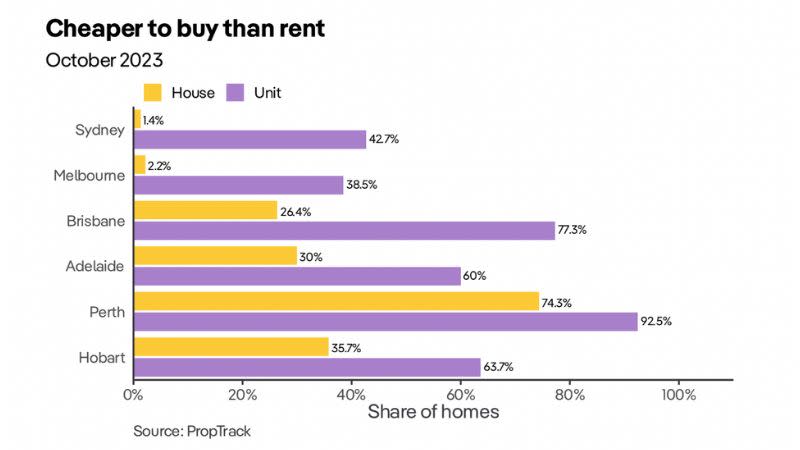

The latest PropTrack insights report shows Queensland, Western Australia and Tasmania remain landlords markets, where it is cheaper to buy than rent, particularly in the apartment sector.

Nationally, more than a third of houses are still cheaper to buy than rent at current prices, according to PropTrack senior economist Paul Ryan, and for apartments it is more than half.

Ryan said many of the capital cities where buying conditions were most favourable reflected recent apartment development and record rent growth.

“Favourable buying conditions remain despite a record pace of interest rate increases and home prices increasing 36 per cent since the pandemic,” Ryan said.

“This shows that there are still opportunities for buyers across the housing market.

“A record pace of rent growth—with advertised rents up 14.6 per cent over the past year—has offset higher buying costs in many regions.”

Regions with highest proportion of cheaper homes to buy

| STATE | REGION | % OF HOMES |

| NSW | Botany | 71% |

| Auburn | 63% | |

| Parramatta | 55% | |

| VIC | Melbourne City | 83% |

| Stonnington West | 48% | |

| Port Phillip | 47% | |

| QLD | Brisbane Inner | 80% |

| Beenleigh | 78% | |

| Brisbane Inner North | 62% | |

| SA | Playford | 84% |

| Gawler-Two Wells | 65% | |

| Salisbury | 65% | |

| WA | Kwinana | 95% |

| Gosnells | 95% | |

| Swan | 93% | |

| TAS | Hobart—North West | 70% |

| Brighton | 68% | |

| Sorell—Dodges Ferry | 38% |

But there were three key regions that Ryan said presented the best value.

“Buying conditions remain strongest in Queensland, South Australia and Western Australia, which points to continued upward pressure on prices in these regions,” he said.

“Looking to 2024, higher interest rates will challenge housing affordability for many. This may slow price growth and rebalance buying conditions across the market.”