Can Regional Housing Markets Benefit from Covid-19?

An emerging narrative around regional dwelling markets is that they may see increased demand as a result of Covid-19.

This is thought to be driven by the way the pandemic has forcibly introduced remote work for knowledge-based or clerical workers.

As employers and employees adapt to remote working conditions, physical proximity to a workplace may become a less important factor in home purchases.

In the June 2020 quarter, about three months into the engineered economic slowdown, Corelogic data showed regional centres have seen higher capital growth than the capital city regions.

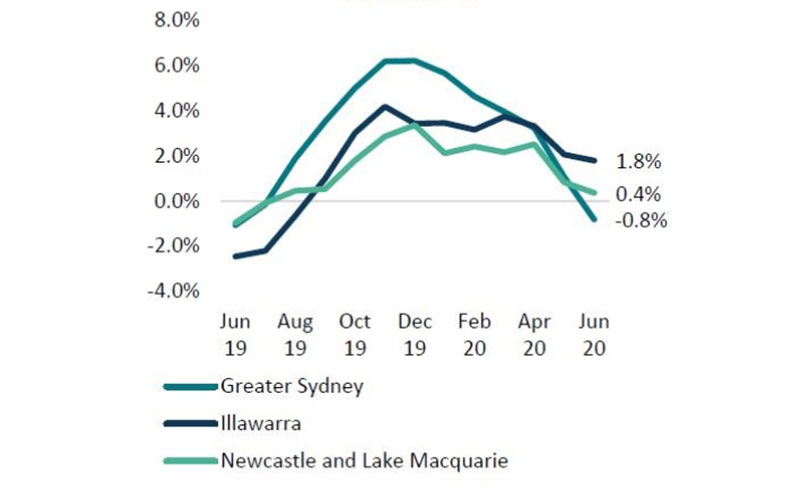

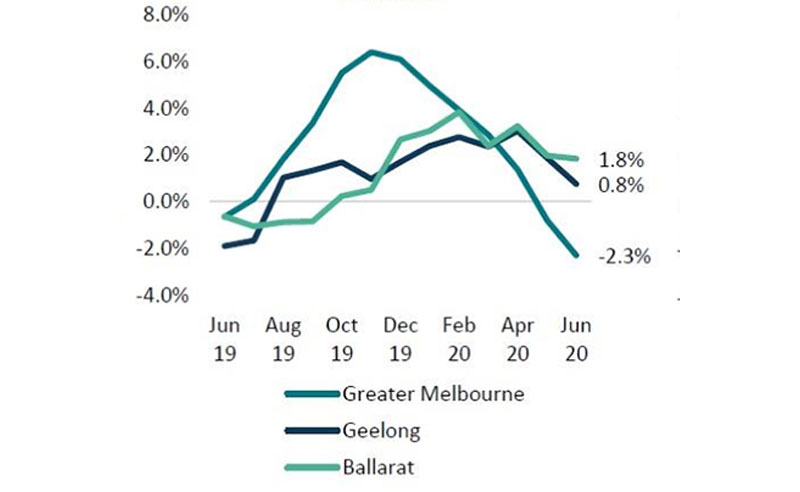

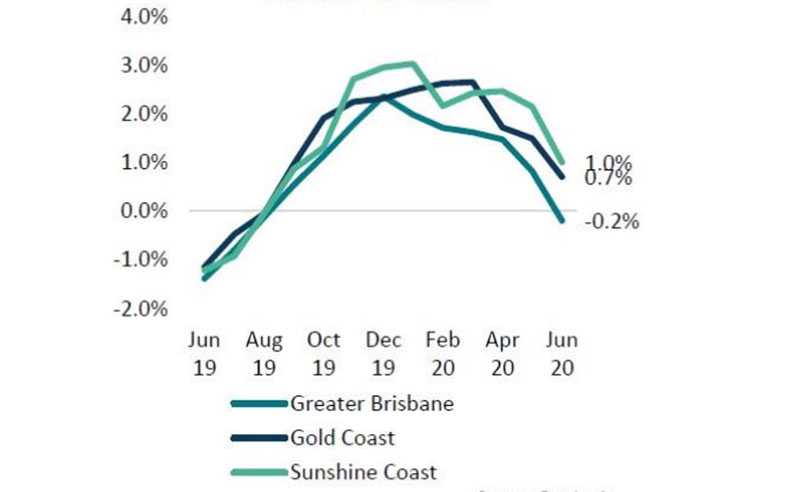

The charts included here show the rolling quarterly growth of Sydney, Melbourne and Brisbane, alongside quarterly growth of nearby major regional centres.

Rolling quarterly change in dwelling values: Sydney

^ Source: Corelogic

This more positive outcome is short-term, and is more likely tied to cyclical patterns than changes in demographic trends, which are typically a gradual phenomenon.

The charts demonstrate that even though regional centres have not seen price falls in the June quarter, growth rates have seen a slowdown in momentum.

Regional growth rates peaked around late 2019, and could nudge into negative territory later this year without significant improvement to economic conditions or a demonstrated shift in demand side factors like population growth.

Rolling quarterly change in dwelling values: Melbourne

^ Source: Corelogic

Illawarra and Newcastle, and Geelong and Ballarat, also saw a relatively weak upswing compared with the Sydney and Melbourne markets over the second half of 2019.

The relative stability of growth rates mean that these regional centres may not see as deep a downswing in the coming months.

Covid-19 and long-term demographic trends

Regional Australia is considered appealing for relatively low levels of density, less congestion, and typically lower price points for property.

The median dwelling value for combined regional areas of Australia was $394,570 at June 2020, 38.5 per cent lower than the combined capital city median of $641,671.

Rolling quarterly change in dwelling values: Brisbane

^ Source: Corelogic

One way to assess whether Covid-19 could exacerbate a tree-change or sea-change trend, is to examine population movements before the onset of the pandemic.

ABS internal migration data at the SA4 level sheds some light on this.

Areas with the highest levels of net internal migration over 2018-19 (where more people moved to an area from another part of Australia than departed it) are shown below.

These include the Capital Region of regional NSW, the Sunshine Coast, Melbourne–West, the Gold Coast and Ipswich.

Top 5 locations by net internal migration

| SA4 Name | Net interstate migrants | Region where most interstate migrants came from |

|---|---|---|

| Capital Region (NSW) | 9,103 | ACT (12,849) |

| Sunshine Coast | 6,804 | Wide Bay (2,141) |

| Melbourne-West | 6,518 | Melbourne-Inner (7,839) |

| Gold Coast | 6,315 | Logan-Beaudesert (3,281) |

| Ipswich | 5,704 | Brisbane-South (3,503) |

^ Source: ABS

From these examples, there was already a trend of movement from more suburban or metropolitan areas to regional areas.

But two of the highest levels of net internal migration are actually still within capital city bounds. Melbourne–West and Ipswich are technically in greater capital city regions, but see a large number of migrants from the inner city.

This may reflect both availability of developable land transitioning to large greenfield housing estates as well as cohorts such as inner-city renters and first home buyers making the transition to buy in more affordable areas that are still commutable to the CBD.

That is an important trend to consider, because it is a scenario where past migration may have been driven by affordability instead of preference for a regional lifestyle.

If that is the case, a mitigating factor to the draw of regional areas during Covid-19, is that dwellings closer to the city are also becoming cheaper, which may slow migration to the city fringe.

But affordability is not the only drawcard of regional Australia.

Parts of regional Australia may offer lower levels of population density, which is arguably desirable in the wake of a pandemic.

There have also been recent examples of people departing from higher socio-economic areas to parts of regional Australia.

Over 2018-19, an estimated 1,453 residents form the Sydney-Eastern Suburbs region departed for areas such as the Central Coast, Richmond-Tweed and the Gold Coast.

The normalisation of remote work amid COVID-19 is more likely to bolster regional migration than slow it.

But in the wake of the pandemic, the return to an office environment may still be desirable for some employees and employers.

Furthermore, it is important to note that the broad-based impact to housing demand from the pandemic could see prices fall in regional centres over the second half of 2020.

Price falls are unlikely to be as sharp as what will be observed in capital city markets, where more expensive, capital city markets have historically shown more volatility than regional Australia.