CBD Workers Slowly Return to Office

All CBD markets except Melbourne saw increases in office occupancy last month with Perth, Canberra and Brisbane recording the largest increases as Sydney recorded a subtle rise.

In a survey released by the Property Council of Australia, the CBD office occupancy results found that workers are slowly shifting back to their offices.

“This is encouraging news for the Australian economy given the critical role of CBD-based businesses in supporting jobs and economic activity,” Property Council chief executive Ken Morrison said.

“Including for all of those businesses which depend on CBD workforces for their viability.”

The quarterly survey comes as ANZ announced it is shifting to a permanent working-from-home policy. Although government and business leaders have urged that returning CBD workers are central to a city’s reactivation.

In September, prime minister Scott Morrison encouraged corporate Australia to follow the government's lead as it urged public servants to return to their offices in a bid to “get our CBDs humming again”.

“There is clearly scope for more people to return in every city, and it will be vital for the Victorian government to allow workers to return to the Melbourne CBD as an early element of its easing of restrictions,” Property Council's Ken Morrison said.

CBD office occupancy

| CBD | October | September |

|---|---|---|

| Adelaide | 73% | 67% |

| Brisbane | 61% | 52% |

| Canberra | 63% | 46% |

| Darwin | 73% | 70% |

| Hobart | 79% | 78% |

| Melbourne | 7% | 8% |

| Perth | 77% | 63% |

| Sydney | 40% | 35% |

^ Property Council of Australia

The Property Council of Australia survey collects responses from 102 members who collectively own or manage the majority of CBD office buildings, recorded a drop in government public health restrictions as the main reason affecting the current level of CBD occupancy.

Public transport concerns and workplace safety concerns are now the more pressing reasons, according to the results.

Lower office demand in flight to quality

The first global report to look at the impact of the future of work on real estate and cities over the next three-to-five years anticipates a strong focus on flexibility, demanded by both workers and corporates.

Released by The Urban Land Institute and EY, the research surveyed 555 real estate professionals worldwide, with the range of respondents including investors, developers, architects, planners and service providers.

The report, The Future of Work 2020: A global real estate players’ point of view, notes that increased flexibility is likely to lead to a flight to quality over quantity of office space as well as a move towards flexible and tailor-made leasing models.

“Flexibility is the consistent demand we are hearing. Employees expect it from their employers and corporates from their landlords,” ULI Europe CEO Lisette van Doorn said.

“At the same time, there is a strong focus on the quality and location of the physical space as a key element to attract and retain talent and expression of a corporate’s culture.”

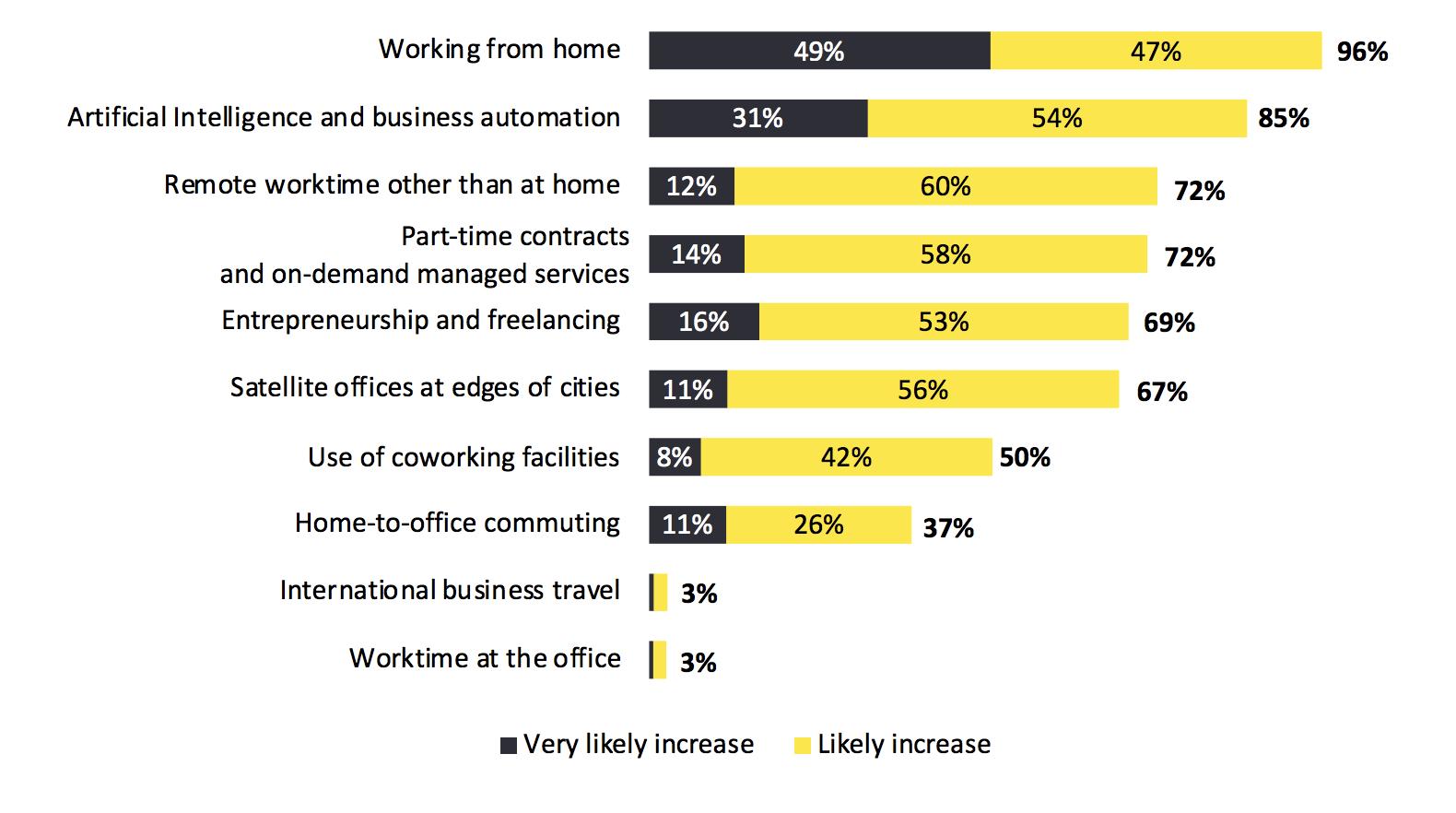

“Real estate professionals overwhelmingly expect increased remote working, including more home working (96 per cent), more remote working away from the home (72 per cent) and more use of satellite offices at the edge of cities (67 per cent),” the survey notes.

“The resulting ecosystem of workplaces will accelerate a blending of uses between residential, hospitality and office spaces, and a shift in language from ‘office’ to ‘workspace’.”

What will the future of work look like in the next three-to-five-year period, compared to pre-Covid?

^ Source: EY-ULI survey, 555 respondents, August-September 2020

Survey respondents continue to see the role of physical office space as central to creating a corporate culture (96 per cent) and recruiting and retaining employees (93 per cent).

Expected impacts on the real estate industry include increased demand for flexible office footprints (96 per cent), flexible lease contracts (66 per cent) and more widespread use of co-working facilities by large corporate occupiers (60 per cent).

More than half of respondents, 53 per cent, anticipate a decrease in the office space needed by their organisation, and only 37 per cent expect no change.

A clear majority of respondents, 94 per cent, saw an increasing demand for healthy building amenities and 81 per cent more space designed for collaborative work.

“While the total office space is likely to decrease, the quality of real estate will be even more critical,” EY Consulting associate partner Vincent Raufast said.

“The physical office space will play a key role in preventing a loss of corporate culture, less effective talent management, a higher staff turnover and a loss of creativity.”

Key changes forecast relate to easier access to online public services (93 per cent), the need to develop more efficient local supply chains (92 per cent), less need to commute (91 per cent) and increasing pressure to focus on social impact, inclusiveness and health for businesses and people (91 per cent).