Adelaide Office Market Top Choice for Foreign Buyers

No longer the “city of churches”, Adelaide is instead becoming the city of choice for foreign buyers, according to the latest research.

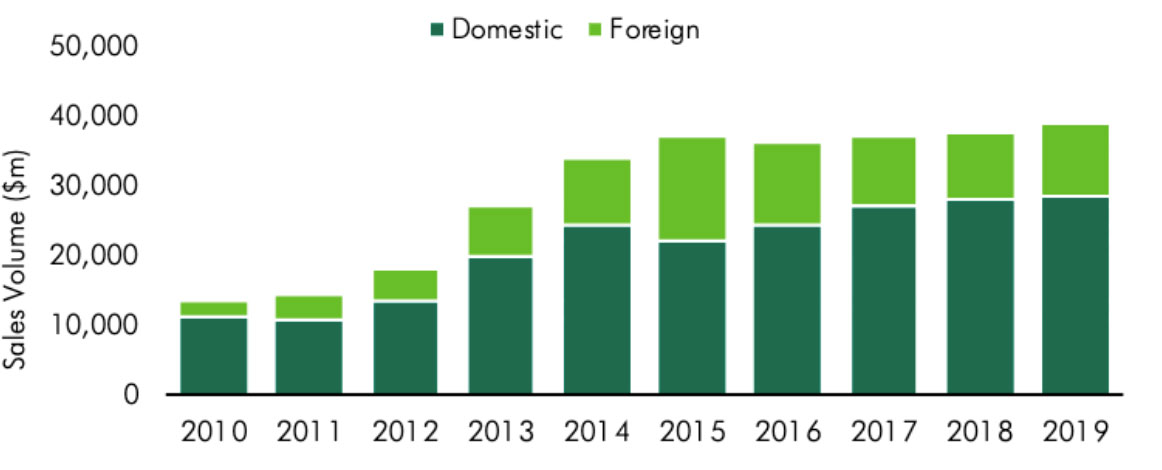

More than half the total sales in the South Australian capital last year—a record $1.04 billion worth of assets—were to foreign buyers, according to CBRE’s Market Outlook report.

Foreign buyer spending passed $1 billion for the first time, more than doubling the erstwhile record of $468 million from 2017 and the 10-year average of $450 million.

This also represented 51 per cent of the total spending in Adelaide, outweighing Australian buyers’ spend for the first time and representing a significant spike from 12.2 per cent in 2018.

Among Australia’s major markets, only Perth recorded a higher rate of spending by offshore investors (70 per cent).

The South Australian capital has become a favourite among international and interstate investors, offering affordability, attractive relative returns and a stable economic landscape.

CBRE’s capital markets director Ian Thomas said the city had found favour with both international and interstate investors thanks to its affordability, attractive relative returns and stable economic landscape.

“Offshore and eastern seaboard investors have become more and more active in the Adelaide market,” Thomas said.

The popularity of the city’s office market shows no signs of abating either, with the number of international office buyers doubling in the past five years, now accounting for 8 per cent of sales in the past 13 years, the report shows.

With office sales in the city exceeding $800 million in 2019, Thomas said the Adelaide office sector had been attracting capital from the United States, Europe and Singapore.

And despite the shadow of coronavirus clouding the global economic outlook, Adelaide is expected to maintain the nation’s highest prime office yields through to 2022, and the strongest five-year income and capital return forecasts.

“Against the headwinds of uncertainty around global economic policy, non-core locations such as Adelaide are providing greater security,” Thomas said.

The report also indicated a boost for the broader Adelaide economy thanks to a combined federal and state infrastructure spend of $12.9 billion during the next five years.

CBRE’s senior research analyst Aiden Bresolin said the city maintained a focus on innovative industries such as space travel, including plans for Lot Fourteen—the former Royal Adelaide Hospital site—as the centrepiece for the new Australian Space Agency headquarters.

“Funding for emerging and growth industries is set to create more than 4,000 jobs in Adelaide over the next five years,” Bresolin said.

With a total of 91,500sq m worth of new industrial supply expected to hit the market this year, the report predicts underlying occupier demand will continue due to restricted supply in the city fringe.