Sydney and Melbourne in Top Five Asia-Pacific Cities for Real Estate Investment

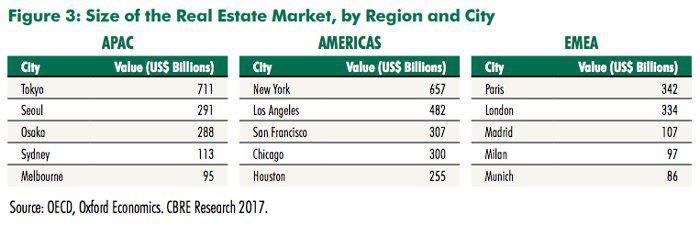

The global stock of investable real estate amounts to approximately $27.5 trillion, with Tokyo the largest single real estate market in the world with a value of US$711 billion of investable real estate.

New York ($657 billion) and Los Angeles ($482 billion) round out the top three globally. The US was the world's largest real estate market globally with a value of over $8 trillion.

CBRE's October 2017 report How much real estate? A global analysis, measures the relationship between city market size and capital flows into real estate for 122 cities around the world.

The research identifies a high correlation between the size of a city’s investment stock and the volume of investment into that city.

Asia Pacific’s five largest cities are Tokyo, Seoul, Osaka, Sydney, and Melbourne. Sydney and Melbourne list at fourth ($113 billion) and fifth ($95 billion) respectively.

Europe, the Middle East and Africa (EMEA) only had two cities in the top 10, London and Paris. The top 10 markets accounted for approximately 15 per cent of global investment stock.

The largest five cities in the Americas represent $2 trillion while in

Europe, the five largest cities amount to approximately $1 trillion (APAC 1.5$ trillion). The top 15 together amount to more than $4.5 trillion of investable stock, located in eight countries around the globe.

CBRE's researchers for the report, economists Richard Barkham and Dennis Schoenmaker point out that the amount of stock available in each market is relevant to investors pursuing a global diversification strategy -- and a true market-neutral portfolio must be weighted by city size.

However, for investors not pursuing full global diversification, it is still useful to know the relative size of the key global investment markets to ensure a reasonable portfolio balance.

Shibuya, Tokyo image copyright: sepavo / 123RF Stock Photo