China Still a Major Player in Australia’s Property Market

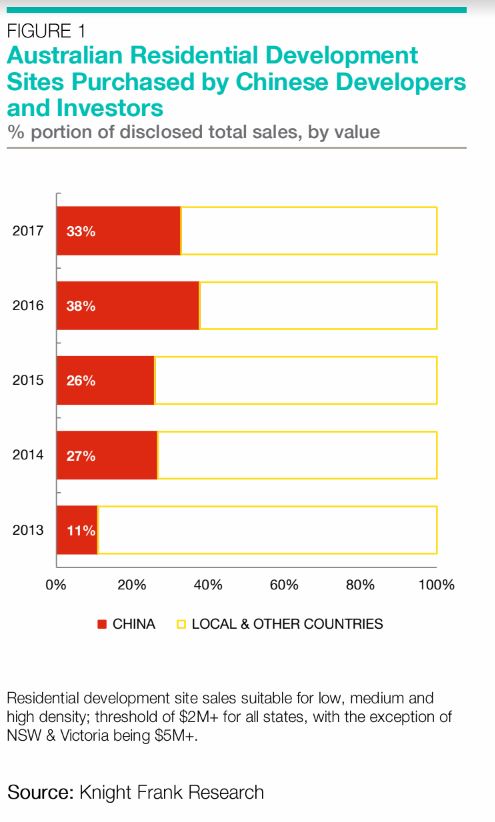

Despite Beijing’s restrictions on offshore company investment, China still has a healthy presence in Australia’s property market, taking a one-third helping of national development sites.

A recent report by Knight Frank revealed that Chinese investment activity in Australia during 2017 equated to AUD$2.02 billion in development site sales, with the average site taken off the market measuring 21,785 square metres.

Tighter capital controls imposed by the Chinese government and tougher restrictions on mortgage lending by local banks has eased Chinese demand for Australian property over the past year.

Knight Frank’s head of residential research Michelle Ciesielski said this share of sales to Chinese buyers has tripled since 2013, but decreased from the 38 per cent recorded in 2016.

Over the past few years both Australian and Chinese governments have kept lending regulations and property development investment on the agenda.

Related reading: What Will Chinese Investors Do Next?

Ciesielski said that despite regulations by Australian and Chinese governments, interest in the Australian market has persisted.

“In Australia, APRA has encouraged local financial institutions to impose stricter controls, while in China the government has attempted to moderate capital outflow with China’s Central Bank imposing new rules for companies which make yuan-denominated loans to overseas entities.

“However, in mid-2017, this was relaxed somewhat – resulting in a boost to market confidence.” Ciesielski said.

Chinese developers have continued to dominate foreign investment in residential development sites across Australia. Many are now well-established in the local market.

“This share of sales to Chinese buyers has tripled since 2013, but decreased from the 38 per cent recorded in 2016,” Ciesielski said.

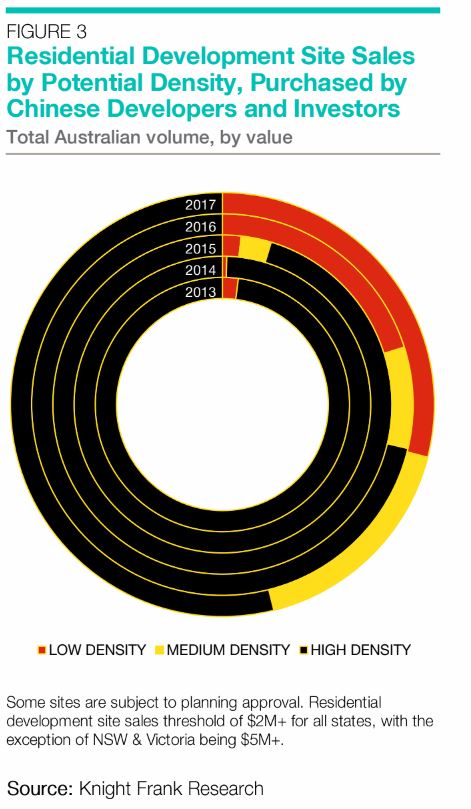

As Chinese developers gain experience in higher-density projects across the major cities, there has been diversification in many of their portfolios to include medium and lower-density sites.

Related reading: Chinese Interest in Australian CRE Falls Following Regulations on Outbound Investment

“These lower-density projects have also become more popular with local developers – especially in NSW with the draft Medium Density Design Guide being released, identifying the ‘missing middle’ to encourage more low-rise, medium-density housing to be built,” Knight Frank head of Asian markets Dominic Ong said.

“This type of project also tends to have less hurdles with the imposed tighter lending restrictions, and overall, lowers the delivery risk to the developer.”

Sydney and Melbourne continued to be favoured by Chinese investors, and for new developers coming into Australia, transactions will be reliant on the ability to transfer their funds.