Commercial Deals Verge on Record Levels

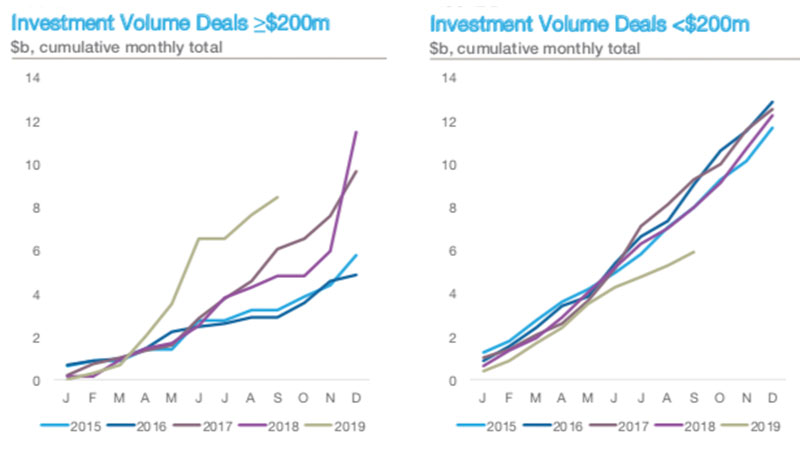

Large deals have played a greater role in driving activity in Australia's commercial market, with current transaction volumes running slightly ahead of the record levels seen in 2017.

According to the latest research from Knight Frank, office property investment volumes totalled $14.3 billion at the end of September, compared to $12.7 billion for the same period last year.

Investment volumes for office deals of $200 million-plus have totalled $8.4 billion in Australia in 2019 to date, accounting for around 60 per cent of deals—a historically high share.

Investment activity for deals less than $200 million was more subdued, with transaction volumes totalling $5.9 billion over the nine months to September, compared with $7.9 billion for the same period in 2018 and $9.2 billion in 2017.

Large deal activity was most pronounced in Sydney driven by a strong leasing market and limited office vacancy, combined with strong demand for new office developments.

Deals were bountiful despite an additional 63,000sq m due before the end of 2019 and over 131,000sq m entering the market in 2020.

Investment volumes for $200 million-plus deals in Sydney totalled $5.5 billion over the nine months to September, accounting for 66 per cent of the $8.4 billion total.

Large deals to date in 2019 are the third-highest this decade after 2012 and 2018, when they accounted for 79 per cent and 67 per cent of deals respectively over the whole year.

Notable deals in 2019

• Blackstone’s acquisition of the Scentre Portfolio ($1.5 billion)

• GIC’s 25 per cent stake in Lendlease International Towers Sydney Trust ($1 billion)

• Dexus’ acquisition of the office component of the 80 Collins Street development ($947 million)

• Charter Hall’s purchase of 242 Exhibition Street ($830 million)

• Charter Hall’s 50 per cent stake in Chifley Tower ($900 million) and 201 Elizabeth Street ($630 million)

• Dexus’ purchase of a 50 per cent stake in the MLC Centre ($800 million)

• GPT’s acquisition of a 25 per cent stake in Darling Park Towers 1 and 2 ($531 million)

• Arrow and Starwood’s acquisition of Zenith Towers ($438 million)

• Investa’s purchase of a 50 per cent stake in 135 King Street ($340 million)

Sydney CBD vacancy rate hit 3.7 per cent in the six months to July 2019 due to withdrawal of stock, yet rose to 4.6 per cent over the previous quarter, up from 4.1 per cent in the previous quarter.

The uptick was due to backfill space becoming available through relocation activity into a new development.

Net absorption—the industry term for the overall take-up of space —was also negative for the first nine months of the year.

However, rental growth has started to normalise, more recently in response to a pick-up in office development activity and a positive outlook for new office supply.

“Some private and smaller investor groups have been impacted by a tightening of credit availability, and this has reduced liquidity for smaller and mid-sized deals over 2019,” Knight Frank chief economist Ben Burston said.

“If the economy recovers as anticipated in 2020, sustained capital growth and improving confidence are likely to spur a return to higher levels of liquidity in this size bracket.”

Capital growth for office property assets has moderated from elevated levels, with strong tenant demand and a scarcity of supply, pushing investors to chase for high-quality opportunities.

“Lower interest rates are likely to drive further yield compression, prolonging the property price cycle.”

“This is driving demand, and recent large deals reflect a desire to rebalance portfolios ahead of this next phase.”

Outside Sydney, the increase in investment activity for larger deals has not been as marked but still been solid over the year, with transaction volumes currently running slightly ahead of the record levels seen in 2017.