Commercial Real Estate Clocks Record Result

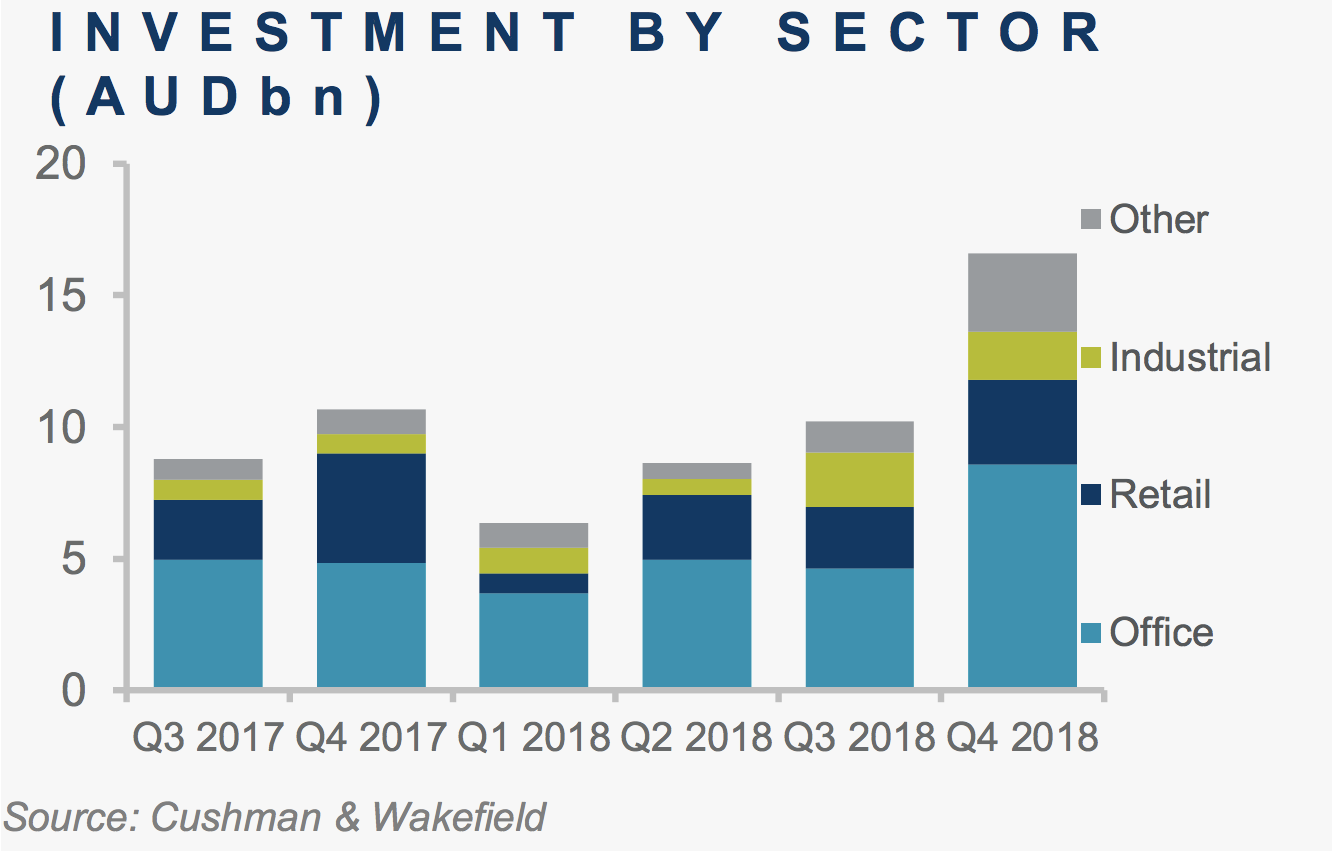

Australia’s weakening residential market continues to make the commercial sector an attractive alternative with a total of $16.6 billion invested in commercial real estate in 2018's fourth quarter alone.

Australia’s commercial real estate market performed strongly in Q4 with the $16.6 billion recorded investment figure the strongest quarterly result on record, the latest Cushman and Wakefield report reveals.

The MarketBeat report reveals this figure jumped 55 per cent in comparison to 2017's fourth quarter, which clocked $10.7 billion.

“This additional volume cemented 2018 as the strongest year on record, with $41.8 billion invested. It topped both 2014 and 2017 to be the first $40-plus-billion year on record,” the report said.

Related: Who were the Top Owners of Space Globally?

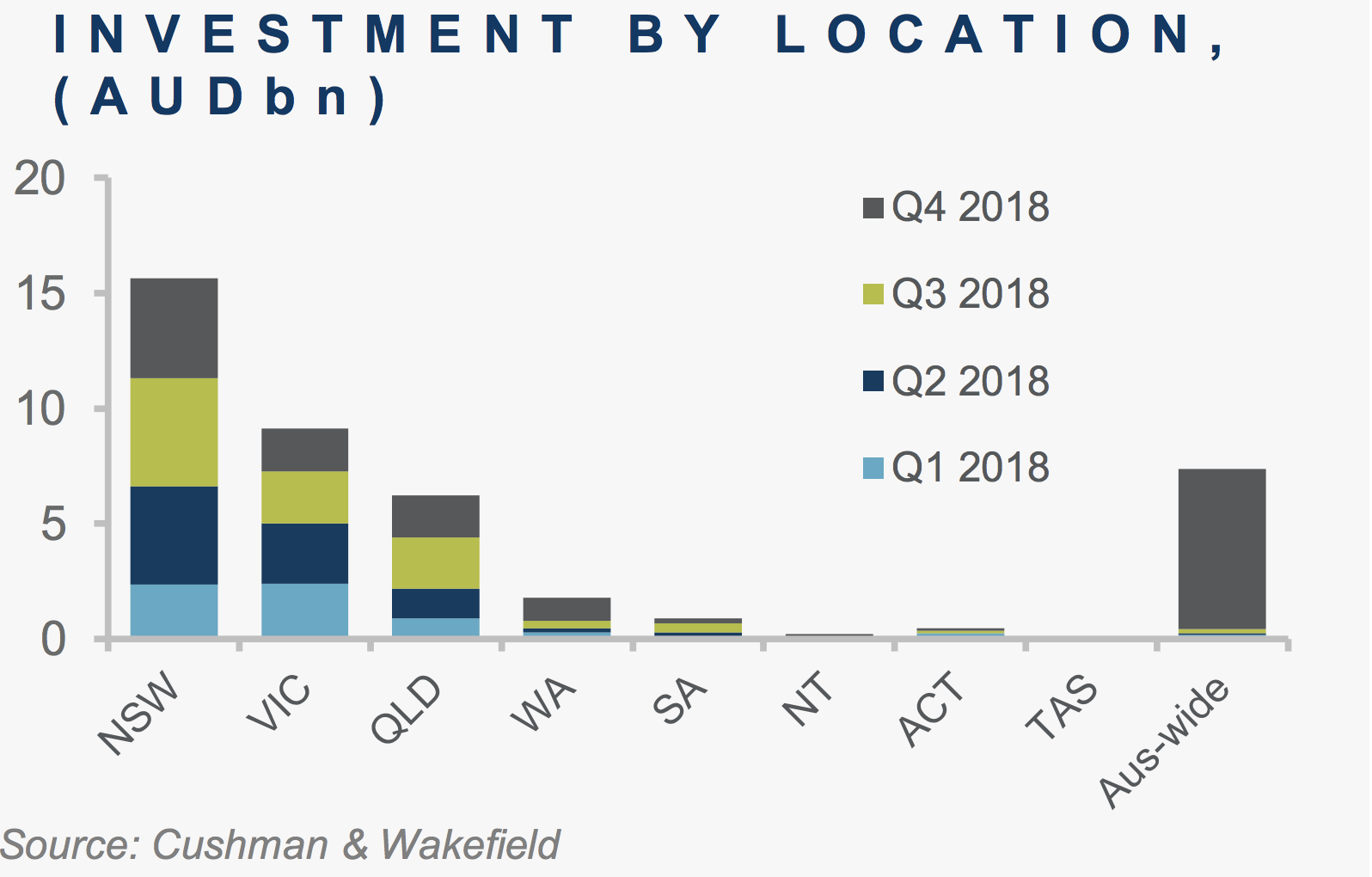

Commercial investment by location

NSW attracted $4.3 billion, or 26 per cent of Q4 investment volume.

Victoria recorded $1.9 billion and Queensland $1.8 billion.

For the year, NSW ranked first taking $15.6 billion, with Victoria ranking second at $9.1 billion.

“Australia wide transactions ($7.4 billion) totalled more than Queensland volume ($6.2 billion) which declined 14 per cent from 2017 levels.”

The report notes foreign investment figures at $17 billion (41 per cent of the annual total) was also the largest on record, surpassing a previous record set in 2015 at $15.4 billion.

“Offshore investors, led by Canada and Singapore, mainly targeted office assets, which accounted for $10.7 billion or 63 per cent of total annual foreign investment volume,” noted the report.

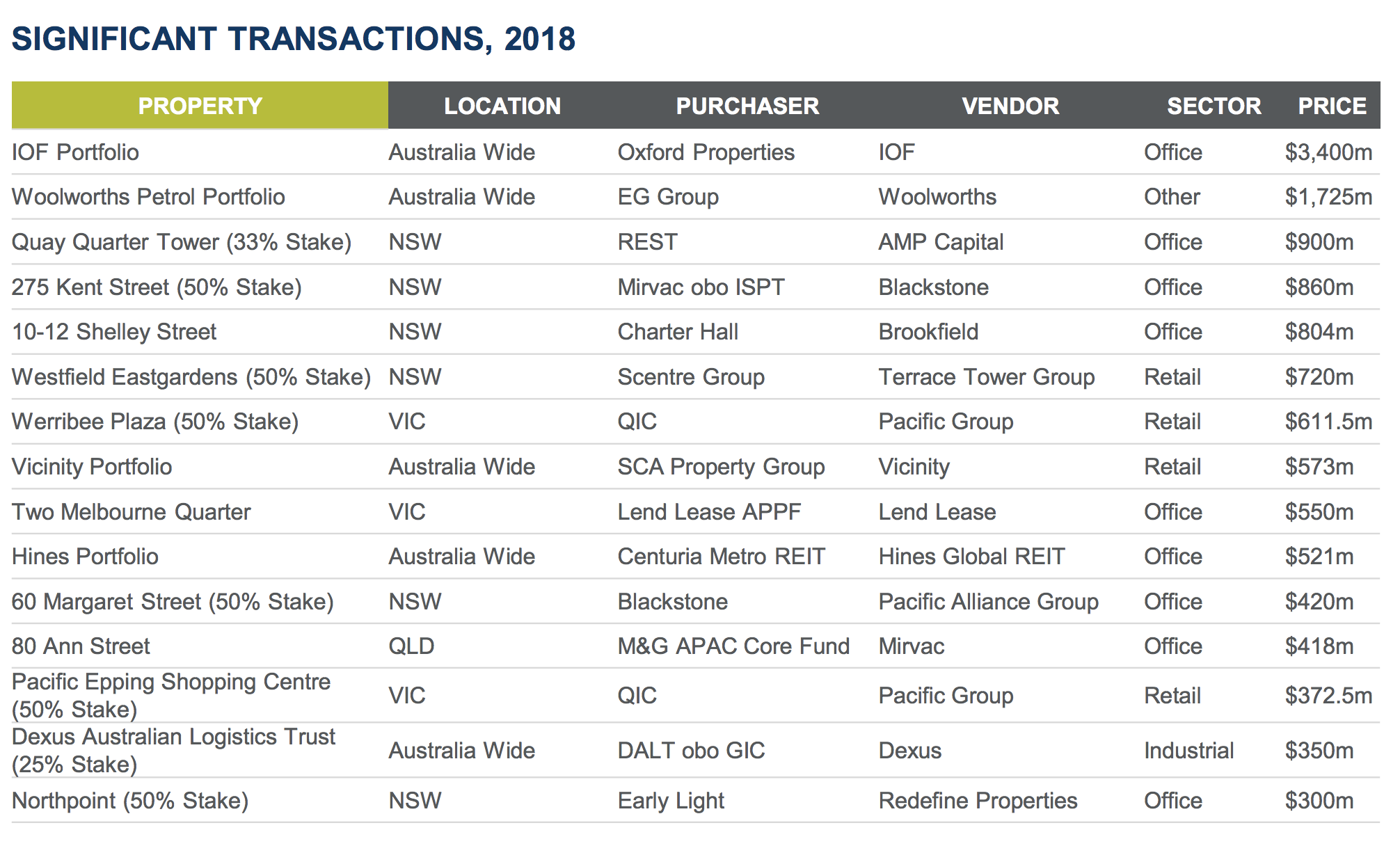

King of vendors last year were global property giant Blackstone and the ASX-listed Vicinity.

Blackstone offloaded $2.1 billion worth of assets across 12 transactions, while Vicinity sold $1.2 billion worth of assets across nine transactions.