Volatility in Apartment Market Leads Building Slump

Australia's construction sector is worsening, with staffing levels cut at the fastest pace in almost six years according to the latest Australian Performance of Construction Index.

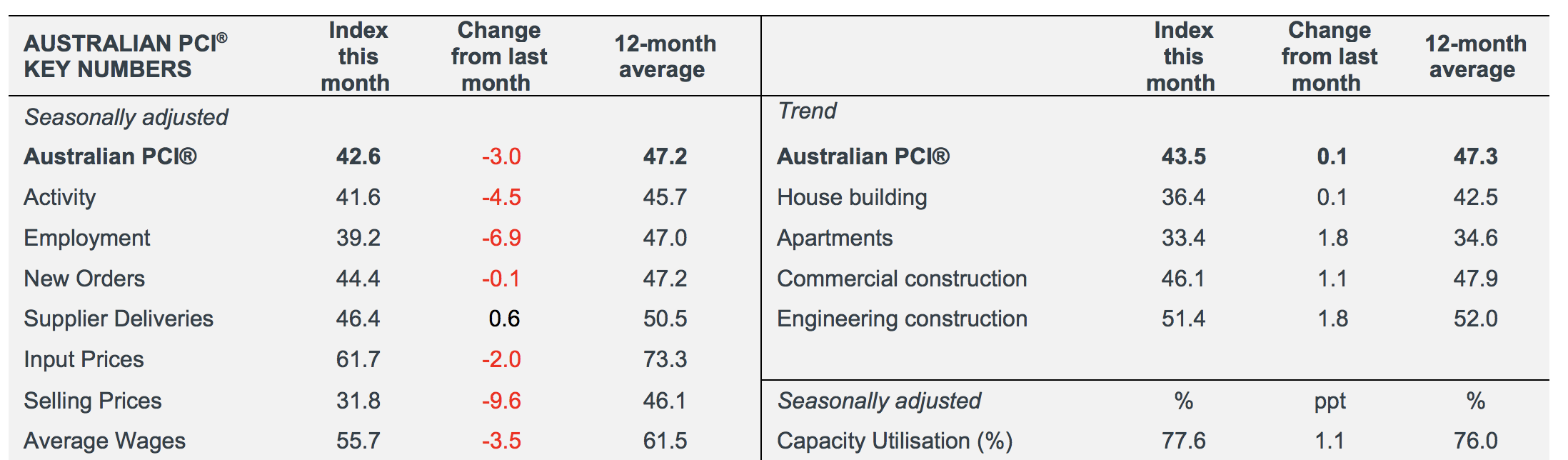

The downturn in the overall construction industry, Australia's third-largest employer, deteriorated in April with the index dropping by three points to 42.6 points in the month.

The housing and apartment sectors both remain in negative territory, along with commercial construction which recorded its ninth month of contraction.

Ai Group head of policy Peter Burn says employment fell further in April, at the steepest rate in almost six years.

“There are now strong signs that adverse conditions in the broader construction industry are flowing through to sections of the services and manufacturing sectors,” Burn said.

Weakness in the sectors was partially offset by expansion in engineering construction as a result of increased infrastructure projects shifting into the construction phase.

“Although engineering construction is likely to remain an area of relative strength for the industry on the back of spending on large-scale, long-term publicly funded infrastructure projects, there is little sign of any near-term improvement in overall industry conditions,” Burn said.

Related: Construction Downturn Slows in March, Apartment Building the Weakest Sector

Engineering construction expanded at a mildly positive rate, up 1.8 points to 51.4 points.

Apartment building was again the weakest performing sector, up 1.8 points to 33.4, while house building remained in negative territory, up 0.1 point to 36.4.

Related: Building Construction Shrinking at a ‘Concerning Rate’

The latest ABS figures show national dwelling approvals fell sharply in March by 15.5 per cent to 14,429 after a stronger February result.

The ABS stats releases last week, show this was heavily led by volatility in the apartment market with attached dwelling approvals down 29 per cent on the prior month, while house approvals were down a slight 3 per cent.

Analysing the ABS approvals figures, BIS Oxford Economics building and construction principal economist Tim Hibbert said the downwards trend is likely to continue over the remainder of 2019.

“With negative leads still coming through from property prices, turnover rates, housing finance and land sales,” Hibbert said.

Housing Industry Association economist Tom Devitt says the home building industry remains in a “delicate position”.

“Tighter lending conditions and weak consumer confidence, due to falling house prices, continue to constrain the market. The home building pipeline is shrinking as the number of new home approvals slows,” he said.

“As this pipeline of building work slows back to a new steady state, there will be an impact on employment in the building sector.”