^Source: Creditor Watch, July 2021

Across the country, the ACT was the worst performing state or territory while Sydney was the worst performing city, experiencing much higher rates of arrears than the other capitals.

Isolated cities such as Darwin and Perth were performing better than others with self-contained economies and mining boosting those areas.

Creditor Watch CEO Patrick Coghlan said a lot of smaller businesses were failing due to challenges with cash flow.

“With the Covid situation worsening across Australia, it’ll be interesting to see if the government income support for New South Wales and Victoria delays insolvencies in these states,” Coghlan said.

“Insolvencies across Australia have remained largely flat over the past year, particularly during the JobKeeper period.

“However, even regional businesses that mostly escaped the worst of the 2020 lockdowns are now facing the damaging financial impacts of the Delta strain.

“In the next 12 months, we expect there to be a roll through of postponed insolvencies now businesses are fending for themselves.”

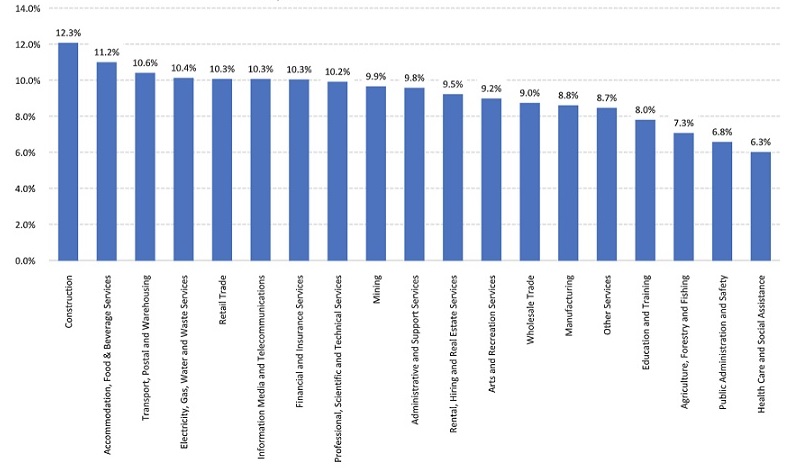

Currently a quarter of all insolvencies in the country were within the construction industry with tiny profit margins impacting companies big and small.