Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Property prices across most major cities are set to fall by as much as 20 per cent in the next 18 months, according to financial services giant AMP Limited.

The company’s chief economist Shane Oliver says cash rates are expected to top out at 2.6 per cent early next year, which would see average property prices across the country fall between 15 and 20 per cent, top to bottom.

Oliver said Sydney, Melbourne and Canberra are forecast to see falls of 20 per cent with the low likely be reached in the second half of next year.

“The fall in home prices this cycle could well see some cities—notably Sydney and Melbourne—reverse all or much of the boom in prices since their 2020 pandemic low,” Oliver warned, “which will likely see a rise in negative equity for recent low deposit buyers.”

Brisbane, Adelaide and Hobart are likely to see 15 per cent declines, with Perth and Darwin dipping 5 to 10 per cent.

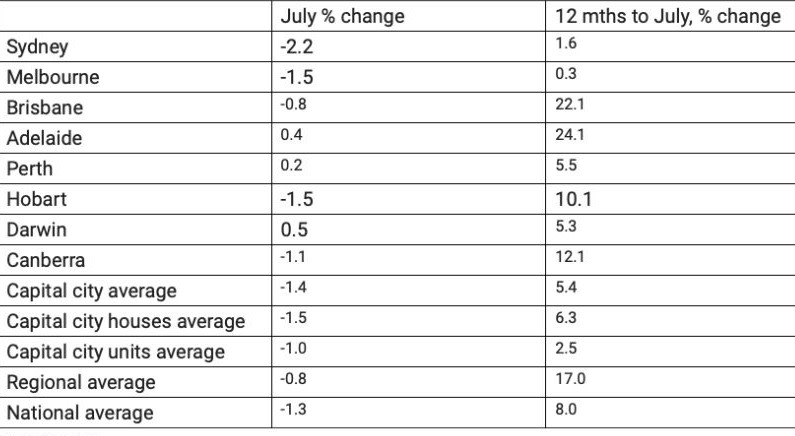

The economist was commenting on the latest figures from property data company CoreLogic which show the country’s prices last month fell by an average of 1.3 per cent, marking a third consecutive month of declines.

In releasing the report CoreLogic’s research director Tim Lawless compared the rate of decline with the onset of the global financial crisis (GFC) in 2008 and the sharp downswing of the early 1980s.

Five of eight capital cities reported falls, with Sydney down 2.2 per cent and Melbourne 1.5 per cent. Brisbane also recorded negative growth (-0.8 per cent) for the first time since August 2020, while Canberra (-1.1 per cent) and Hobart (-1.5 per cent) were also down over the month.

Property prices decline

Lawless places the blame squarely upon the Reserve Bank of Australia’s (RBA) cash rate hikes.

“Due to record high levels of debt, indebted households are more sensitive to higher interest rates, as well as the additional downside impact from very high inflation on balance sheets and sentiment,” he said.

“The rate of growth in housing values was slowing well before interest rates started to rise, however, it’s abundantly clear markets have weakened quite sharply since the first rate rise on May 5.”

Regional property prices are weakening as well, with prices dropping 0.8 per cent in July—the first monthly fall since August of 2020. However, regional markets continue to outperform the capital cities, partly because of the exodus of people to the regions.

“The stronger growth reflects a significant demographic shift towards commutable regional markets, which is likely to have some permanency as more workers take advantage of formalised hybrid employment arrangements,” Lawless said.

“The boom is now well and truly over and the pace of decline in property prices is accelerating,” the AMP’s Oliver said. “As Sydney saw amongst the strongest gains on the way up and became one of the most speculative and most indebted markets its now leading on the way down.”

Oliver agreed the main driver of the slowdown was the surge in mortgage rates.

“Being able to borrow at a fixed rate of 2 per cent or less was a key driver of the boom in prices with fixed rate lending accounting for 40 to 50 per cent of new lending about a year ago,” he said.

“But with fixed mortgage rates now up nearly three-fold from their lows and variable rates rising rapidly this has substantially reduced the amount new home buyers can borrow and hence their capacity to pay.”

Oliver pointed to a host of other reasons for the downturn, including poor affordability, a rise in new listings in Sydney and Melbourne, a rotation in household spending from goods back to services, cost of living pressures making it harder to save for a deposit, and a collapse in consumer confidence.

“As a result, the rug has effectively been pulled out from under the property market,” said.

Real estate agents confirm buyers are growing more reluctant to pounce on sales and have reported offers on properties are down as much as 20 per cent as the residential market comes off the boil. Auctioneers say there are few bidders and less action, as buyers keep their hands in their pockets.

There are some who believe mortgage rates could hit as high as 10 per cent.

Speaking at The Urban Developer’s residential greenfield development summit last week, Research4 director Colin Keane said mortgage rates needed to be set at double the inflation rate, which is now at 6.1 per cent.

Meanwhile the Commonwealth Bank said new data showed a spike in the numbers of homeowners and buyers using its online home loan repayment calculator each month.

Early in May, which marked the first time this year the RBA increased the cash rate, visits to bank’s online calculator tool increased by 106 per cent compared to 24 hours earlier.