Three Million Apartments Await, Research Finds

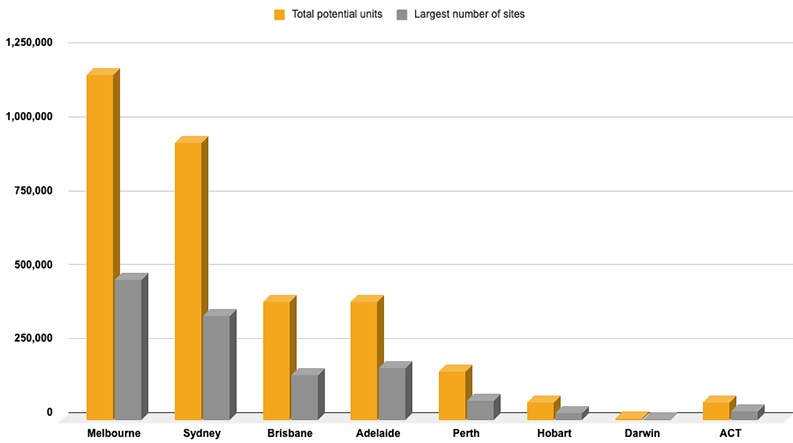

Australian capital cities have capacity for more than three million more strata units across almost 1.3 million sites, research by CoreLogic and Archistar has revealed.

The report identified Melbourne as having the highest development potential, with capacity for 1.16 million more units across 472,248 sites, followed by Sydney with potential for 934,428 units on 350,912 sites.

Brisbane, the third-largest opportunity, could accommodate 399,721 more units across 150,204 sites.

CoreLogic research director Tim Lawless said the findings aligned with National Cabinet’s housing targets.

“The challenge of delivering well-located new housing supply has been laid down by the National Housing Accord,” Lawless said.

“With a target of 1.2 million new ‘well-located’ homes nationally, all tiers of government are likely to be focused on identifying and fast-tracking strategic development opportunities.”

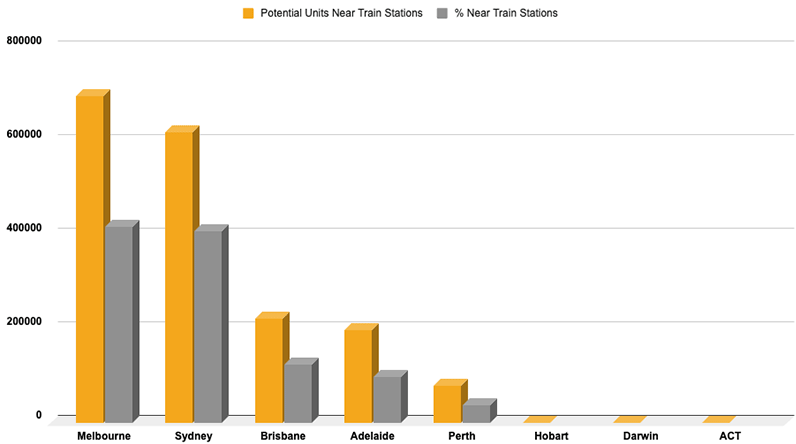

The research highlights that 57 per cent of potential sites are within 2km of existing train stations, with Sydney leading at 66 per cent of its identified sites near rail infrastructure, followed by Melbourne with 60 per cent.

Total potential apartments, percentage near train station

Victorian Premier Jacinta Allan’s plans for higher-density zones around 50 train and tram stations would target 300,000 new homes in metropolitan areas by 2051.

“We absolutely need more homes near public transport—near train stations and trams,” Allan said.

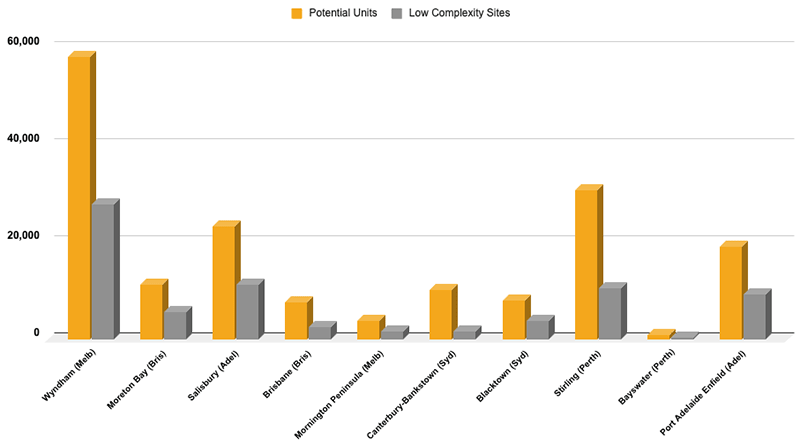

Of the total opportunities identified, 16 per cent are classified as ‘low complexity’ sites, featuring minimal slope, no heritage restrictions and low environmental hazard risk.

In Victoria, the Mornington Peninsula Shire presents the largest opportunity with potential for 98,367 units, though 54 per cent of sites are classified as high complexity.

Further north, Wyndham City offers 97,653 potential units, with 63 per cent of sites rated as low complexity.

NSW’s Canterbury-Bankstown region could accommodate 87,886 new units, though only 11.1 per cent of sites are considered low complexity.

Top 10 councils with highest potential, lowest complexity

Brisbane was identified as the city with the highest potential for infill strata development.

The report said that while the large land area of the Brisbane LGA has contributed to that number one ranking, “other factors such as a clear urban footprint and town plan that allows for strategic infill are also important”.

Just 5.1 per cent of Brisbane’s strata development sites identified were classified as low complexity, “suggesting that delivering new strata supply could involve longer time frames or cost”.

According to the report, these developments would typically take the form of townhouses, duplexes or triplexes rather than highrise apartments.

In South Australia, the City of Salisbury leads development potential with 72,571 possible units, with 33 per cent of sites rated as low complexity.

Western Australia’s City of Stirling could accommodate 30,624 units, though only 14.7 per cent of sites are considered low complexity.

Total potential units, largest number of sites

The remaining capitals—Hobart, Darwin, and Canberra—collectively offer potential for 121,457 additional units across 54,078 sites, with varying complexity levels and infrastructure.

Archistar co-founder Benjamin Coorey said that the “Missing Middle report identifies significant opportunities within our urban areas to address housing shortages through more diverse, medium-density developments”.

The research excluded highrise and mixed-use opportunities, focusing instead on medium-density development with an average of 2.5 units per site.

According to the report, these areas are prime for development and could help address housing shortages, but not without challenges.

“Governments are looking for ways to maximise opportunities for new well-located housing with a focus on strategic densification near transport nodes, maximising infill targets and ensuring an equitable supply of affordable housing options,” the document said.

“Identifying sites and development potential is an important component of delivering new housing supply, but the residential construction industry is likely to need further support to ensure supply can be feasibly delivered to the market at a price point that is appealing to consumers.”