Australian home values ended 2024 in negative territory, but it wasn’t near enough to drag the annual growth rate down.

Data from CoreLogic and PropTrack released this week revealed a flat end to last year with the former’s Home Value Index down 0.1 per cent nationally over December after peaking in October and holding flat in November.

It reported an annual national home value rise of 4.9 per cent.

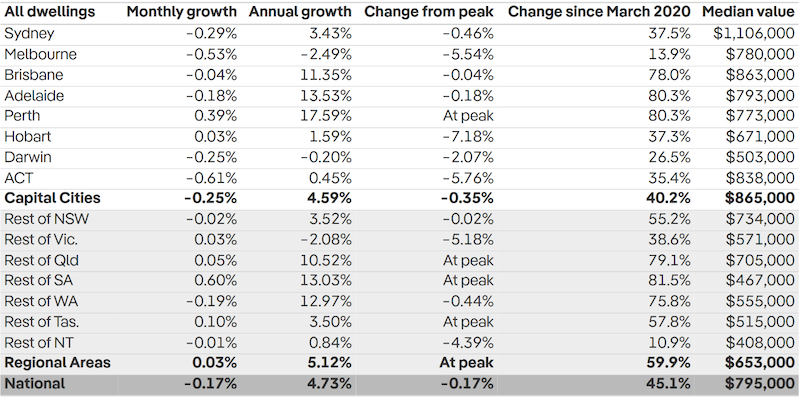

Meanwhile, PropTrack reported national home prices fell by 0.17 per cent for the month, which was up 4.73 per cent on the same period the previous year.

CoreLogic said the December decline in the national index brought the quarterly change into negative territory, also down 0.1 per cent, to mark the end of what had been a surprisingly strong and resilient period of growth between February, 2023 and October, 2024 – a period characterised by high interest rates, cost of living pressures and reduced borrowing capacity.

CoreLogic research director Tim Lawless said the decline in values was no surprise.

“This result represents the housing market catching up with the reality of market dynamics,” he said.

“Growth in housing values has been consistently weakening through the second half of the year, as affordability constraints weighed on buyer demand and advertised supply levels trended higher.”

The first half of 2024 saw national home values rise 4.1 per cent, before slowing to just 0.7 per cent through the second half of the year, with five of the eight capitals recording a decline in values between July and December.

Lawless said that the Australian home values rise of 4.9 per cent in 2024 equalled an approximate $38,000 increase in the median value of a home.

Three of the capitals recorded a decline in values over the year; Melbourne (-3.0 per cent), Hobart (-0.6 per cent) and the ACT (-0.4 per cent).

At the other end of the spectrum were the mid-sized capitals, with Perth values surging 19.1 per cent higher over the year, Adelaide up 13.1 per cent and Brisbane values 11.2 per cent higher.

“Although the mid-sized capitals recorded double-digit annual growth in 2024, it is clear these markets have passed their peak rate of growth,” Lawless said.

“The rolling annual change in Perth has eased from a cyclical peak of 24.7 per cent over the year ending July, Adelaide’s 12-month trend has slowed from 14.6 per cent in August, and Brisbane’s annual gains peaked in April at 17.0 per cent.”

December also marked a change in the quarterly capital city rankings, CoreLogic data revealed, with Adelaide overtaking Perth as the strongest market with values up 2.1 per cent in the December quarter, compared with a 1.9 per cent rise in Perth values and a 1.3 per cent increase in Brisbane.

“Extremely low advertised stock levels have continued to support strong growth conditions across Adelaide, with stock levels tracking -34 per cent below the previous five-year average in mid-December,” Lawless said.

“Perth, on the other hand, has seen a clear lift in advertised supply, which has provided buyers with more choice and less urgency, supporting a sharper slowdown in value growth relative to Adelaide.”

PropTrack said capital cities had led the price decline across December, falling by 0.25 per cent, while regional areas had displayed more resilience, rising by 0.03 per cent.

Canberra (-0.61 per cent), Melbourne (-0.53 per cent) and Sydney (-0.29 per cent) recorded the sharpest drops in prices of capital markets.

Perth defied the national trend, maintaining its position as the best-performing city with a 0.39 per cent increase in prices, while Hobart was the only other capital to record a rise in December (0.03 per cent).

Home price growth had slowed significantly over the past six months in Brisbane, which saw prices fall 0.04 per cent in December, the first drop in 25 months.

In Adelaide, home prices fell by 0.18 per cent in December yet remained 13.35 per cent higher compared to a year ago.

Prices across most of Australia’s regions were relatively stable in December, except for regional South Australia, which recorded an increase of 0.6 per cent.

“While December was the first month in which national home values declined in two years, price growth momentum had been slowing since March, 2024,” REA Group senior economist Anne Flaherty said.

“This slowdown has been seen across both capital city and regional areas, with outperforming markets such as Greater Perth also experiencing this trend.

“Contributing to the slowdown—and reversal—of price growth, the number of properties for sale has been relatively high over the second half of 2024, particularly compared to the same period in 2023.

“This has given buyers more choice and we’re seeing them take more time when purchasing.

“While the impact of stage 3 tax cuts which took effect in July bolstered borrowing capacities for some buyers, this has been counteracted by softer economic conditions.

“In particular, interest rate cuts that were originally anticipated prior to 2025 have now been pushed back.

“The best performing regions for home price growth over the past 12 months can primarily be found in Queensland and WA, which account for nine of the top 10 highest growth markets.”