Undersupply in Capital Cities Fuels Home Value Rise

Home values in Australia’s capitals have risen again, the eighth increase in a row, as undersupply drives prices higher—with one notable exception.

CoreLogic’s national Home Value Index (HVI) recorded a 0.8 per cent rise in September as the recovery trend continues.

The rise follows a 0.7 per cent lift in August, taking the quarterly pace of growth in national home values to 2.2 per cent.

Quarterly growth has eased from a 3.0 per cent gain in the June quarter, reflecting a slowdown as advertised stock levels rise, helping to take some heat out of the market.

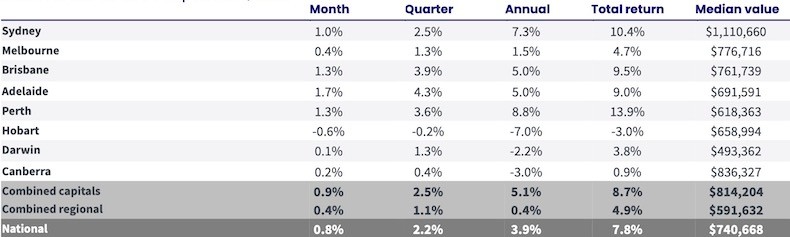

Annual growth was 3.9 per cent—5.1 per cent in the capitals and just 0.4 per cent for the regions.

Adelaide recorded the highest capital gain during the September quarter at 4.3 per cent, followed by Brisbane at 3.9 per cent and Perth at 3.6 per cent.

But the news is less bright in Tasmania, where Hobart’s values were down 0.2 per cent over the quarter, taking the southern capital to a new cyclical low.

CoreLogic research director Tim Lawless said the performance of the housing market in each city reflected the underlying supply dynamic.

“The three capitals recording the highest capital gain each have advertised supply levels that are around 40 per vent below their previous five-year average,” he said.

“Advertised supply levels across Hobart, where values are still trending lower, have been holding at above average levels since June last year and were almost 40 per cent above its five-year average.”

Change in home values at September 30, 2023

Since finding a trough in January, the national index has recovered by 6.6 per cent, however home values remain 1.3 per cent below record highs recorded in April last year.

Lawless said that at the current rate of growth, the national HVI should recover to a new nominal high by the end of November.

“We have already seen home values reach new record highs in in October, with house values currently only 0.6 per cent below their previous peak,” he said.

“Hobart and Canberra have the furthest to go before staging a nominal recovery, with home values remaining 12.4 per cent and 7.0 per cent below their cyclical highs from last year.”

Premium’s pace slackens

After leading the recovery cycle, the premium housing sector might be losing some steam, with the quarterly rate of growth across upper quartile home easing back to 2.3 per cent while the lower quartile growth rate accelerated to 3.2 per cent .

“This shift is partly attributable to the lower value capitals such as Perth and Adelaide recording a faster rate of growth, however even in these cities it is the lower quartile that has outperformed,” Lawless said.

In the more expensive cities, Sydney and Melbourne, the broad middle of the market is now recording the highest growth rate after previously being led by the upper quartile.

“Possibly we are starting to see renewed affordability challenges deflecting more demand towards the middle of the market where barriers to entry are lower,” Lawless said.

Regional markets are continuing to lag the capitals with every “rest of state” region recording weaker growth conditions relative to their capital city counterpart during the September quarter.

At a broad level, the combined regional markets recorded a 1.1 per cent rise in values through the September quarter which was less than half the gain across the combined capital city market (2.5 per vcent).

“Softer housing conditions across regional Australia looks to be more demand driven, with the estimated number of home sales 6.5 per cent lower than a year ago and 9.2 per cent lower relative to the previous five-year average,” Lawless said.

“In contrast, the estimated volume of home sales across the combined capital cities was 1.9 per cent higher than a year ago and 6.3 per cent above the five-year average.”

Most regional markets are also showing relatively low advertised supply levels which has been enough to place some upwards pressure on values.

However, regional Victoria and regional Tasmania were exceptions, where advertised supply is above average and housing values trended lower for the quarter.