Regional property markets have risen faster than capital cities in value growth, new data has revealed.

Over the three months to January, property values rose in nearly three-quarters of regional suburbs while almost half of city suburbs recorded declines, according to CoreLogic.

During the quarter, 72.6 per cent of regional suburbs recorded value increases, up from 66.2 per cent in the previous quarter.

In the same period, almost half (48.6 per cent) of capital city suburbs reported quarterly declines, up from 31.3 per cent in September.

Sydney and Melbourne were the hardest hit, with values falling in three-quarters of Sydney suburbs and nine out of ten in Melbourne.

Brisbane, Adelaide and Perth also notched quarterly declines as growth slowed in previously strong midsized capitals.

CoreLogic estimated the combined value of Australia’s residential real estate remained steady in January at $11.1 trillion, despite the mixed market conditions.

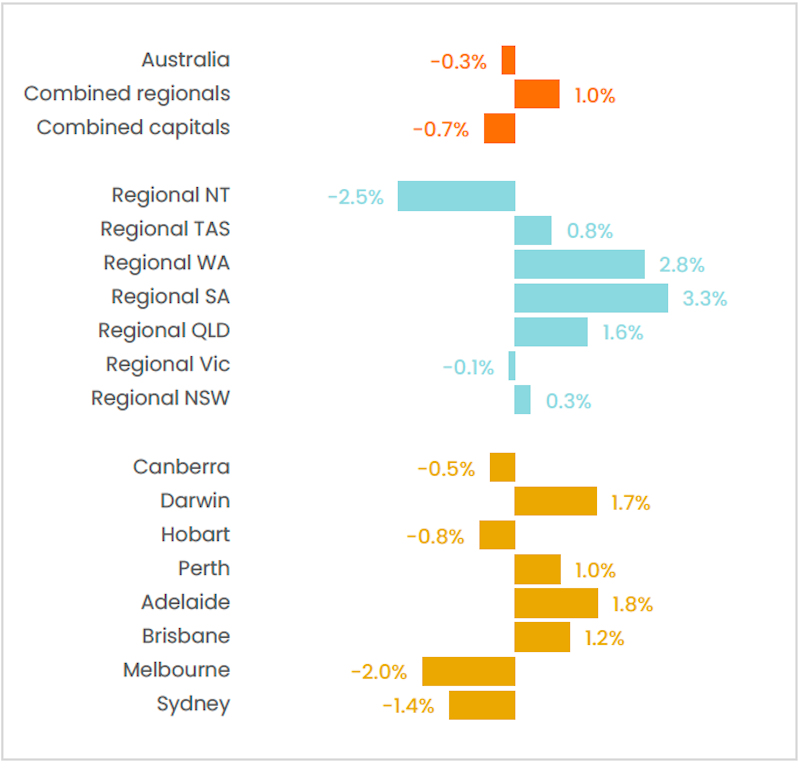

Nationally, home values fell 0.3 per cent over the quarter, with capital city values dropping 0.7 per cent while regional markets rose 1 per cent.

Home value changes, 3 months to January 2025

CoreLogic economist Kaytlin Ezzy said affordability pressures in capital cities had pushed more buyers into regional areas.

“After underperforming the capitals through much of 2023, the regions have regained much of the affordability advantage, with the capital city premium widening by around $50,000 over the past two years to around $240,000 in January,” Ezzy said.

“With demand skewing towards the more affordable end of the market, it’s not surprising to see value growth shift away from the capitals, towards the regions, as cash-strapped buyers look further afield for more affordable markets.”

Demand was strongest for lower-priced properties, driving the most growth in that segment.

CoreLogic data showed values in the most affordable quartile increased by 9.4 per cent last year, while the most expensive homes rose just 1.5 per cent.

The sustained trend of remote and hybrid work also played a role, Ezzy said, allowing more Australians to prioritise lifestyle over proximity to jobs.

“We’re almost five years on from the onset of Covid and it appears that remote and hybrid working arrangements are here to stay,” she said.

“With more people able to prioritise lifestyle over job location, the flow of internal migrants to regional markets has settled higher than the levels seen pre-Covid, helping to support housing demand.”

While regional markets have remained more stable, limited housing supply continued to be a challenge.

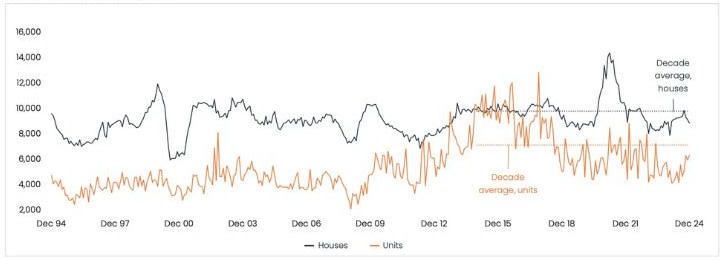

In December, home approvals edged up 0.7 per cent, with unit approvals rising 6 per cent while house approvals fell 2.8 per cent.

Over 2024, 170,000 homes were approved—a 3.9 per cent increase from 2023 but still 16.7 per cent below the decade average.

This was short of the 240,000 annual approvals the Federal Government estimated would be needed to meet its five-year housing supply target.

At the same time, sellers were having to negotiate harder, with median discounting rates widening.

Capital city vendors accepted a discount of 3.5 per cent on average over the past three months, while regional vendors saw discounting stretch from 3.6 per cent in May to 3.8 per cent in January as price growth moderated.

Despite capital city declines, CoreLogic’s data suggested the overall market was stabilising.

“At the national level, values held steady in January, with the 0.2 per cent decline seen in capital city values, cancelling out the 0.4 per cent increase seen in regional values,” Ezzy said.

New listings had an increase but remained below historical averages.

In the four weeks to February 2, there were 34,926 new properties on the market, 3.6 per cent lower than the five-year average and 3.7 per cent down on this time last year.

But listing numbers had rebounded from the early January slump of 15,169.

The data also found rental growth had started to moderate.

Australian rents rose 4.4 per cent over the past year, more than double the pre-Covid decade average of 2 per cent.

But the rate of increase slowed since mid-2024 with CoreLogic predicting rental growth would continue to ease in the coming months