Biggest Contraction Since the 1930s: RBA

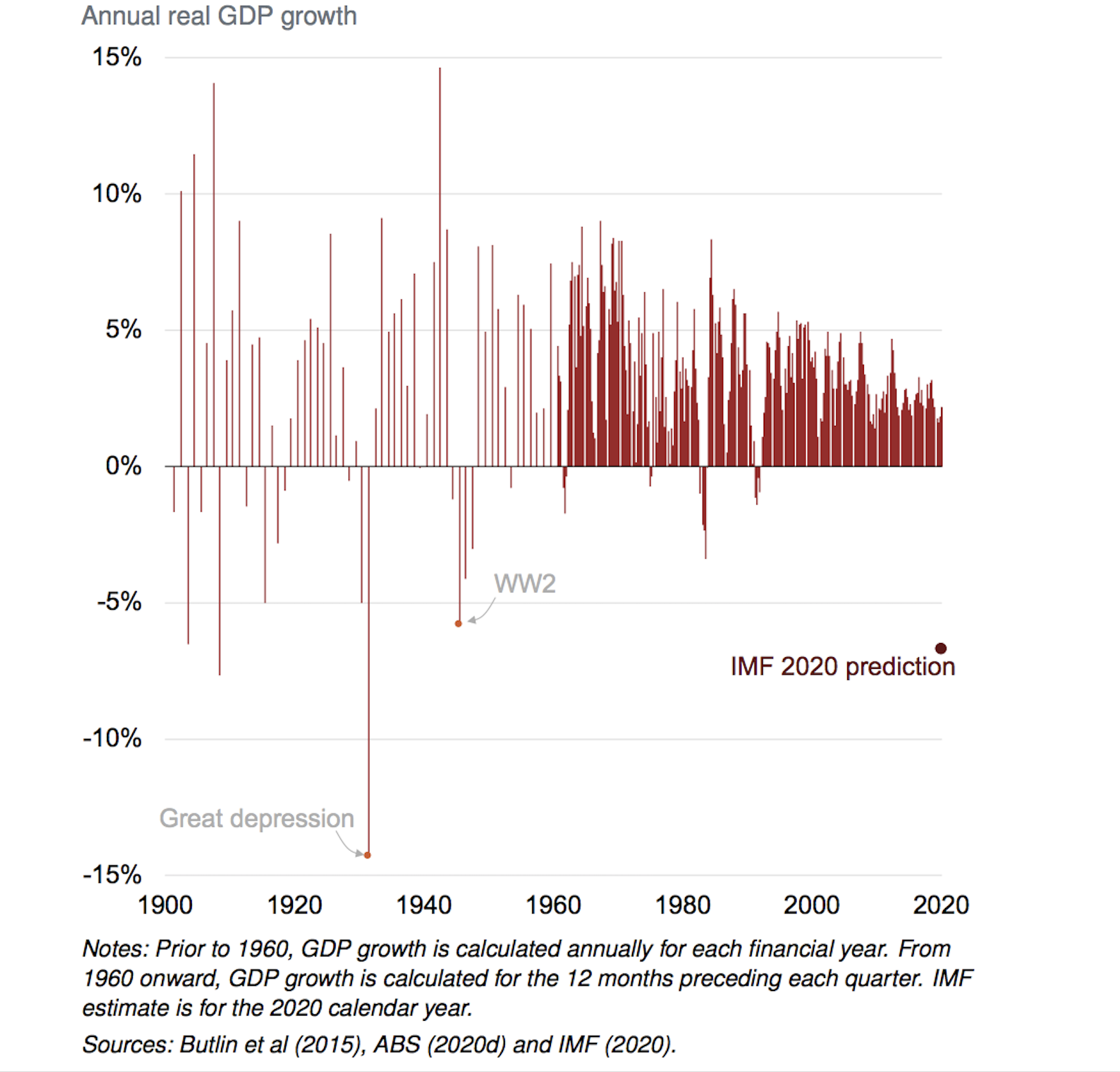

Australia has had almost 30 years of uninterrupted growth, but the economy is likely to suffer its biggest downturn since the 1930s.

The Reserve Bank of Australia has warned that the coronavirus pandemic could hit economic growth by up to 10 per cent over the first half of 2020, with most of this decline taking place in the June quarter.

“National output is likely to fall by around 10 per cent over the first half of 2020, with most of this decline taking place in the June quarter,” RBA governor Philip Lowe said on Tuesday.

“The unemployment rate is likely to be around 10 per cent by June, although I am hopeful it might be lower than this if businesses are able to retain their employees on lower hours.”

Total hours worked in Australia are likely to decline by around 20 per cent over the first half of this year, Lowe maintained confidence the economy would “bounce back” on the other side of Covid-19.

“Inevitably, the timing and pace of this recovery depend upon how long we need to restrict our economic activities, which in turn depends on how effectively we contain the virus,” Lowe said.

Grattan Institute research estimates that Australia’s unemployment rate could rise to between 10 and 15 per cent due to the Covid-19 related shutdown, with the latter figure the highest since the great depression in the 1930s.

“We calculate that between 14 and 26 per cent of Australian workers—1.9-to-3.4 million people—could be out of work in the coming weeks as a result of spatial distancing measures to contain the spread of Covid-19, if they aren’t already,” Grattan analysis by Brendan Coates, Matt Cowgill, Will Mackey and Tony Chen says.

“The longer this downturn goes, and the worse it gets, the less likely the labour market and the broader economy can spring back afterwards.”

Related: Wage Subsidy, Loan Deferrals Improve Outlook

The RBA governor said that the twin health and economic emergencies would “cast a shadow over our economy for some time to come”, but that if the restrictions could be lifted more quickly, with the virus being contained, a “stronger recovery could be expected”.

“Whatever the timing of the recovery, when it does come, we should not be expecting that we will return quickly to business as usual.”

Lowe said that if Covid-19 restrictions were lessened by mid-year, and are mostly removed by late in the year, except for the ban on international travel, the RBA could expect the economy to begin its “bounce back” in the September quarter, with GDP growth of 6 per cent to 7 per cent in 2021 after a fall around 6 per cent this year.

Lowe added that the unemployment rate would remain above six per cent “over the next couple of years” with wage growth expected to decline to below two per cent, and inflation is expected to remain below two per cent over the next couple of years.

‘Cheaper to service a mortgage’, Australia’s housing market

As Covid-19 hits all major economies simultaneously, what is different about this down turn from those Australia has seen before is a result of an enforced shutdown and not a crisis from a bust after a boom, AMP Capital chief economist Shane Oliver has said.

“It was not caused by anything fundamental in the Australian economy.”

“Because of that, I am hopeful that once the virus is under control, we can recover and reach a more normal functioning in a quicker way than we have before.”

Amid the economic uncertainty, Oliver says it's worth highlighting the potential opportunities for investors prepared to take a long-term view.

“For one, interest rates will be lower, the official cash rate is currently sitting at the all-time low of 0.25 per cent. This will mean it’s cheaper to service a mortgage,” Oliver said.

“The residential property market is also likely to take a hit, which could provide lower entry points for people who have struggled—particularly in cities like Sydney and Melbourne—with affordability.”

Last week, UBS revised its forecasts to a decline of at least 10 per cent in house prices over the coming year.

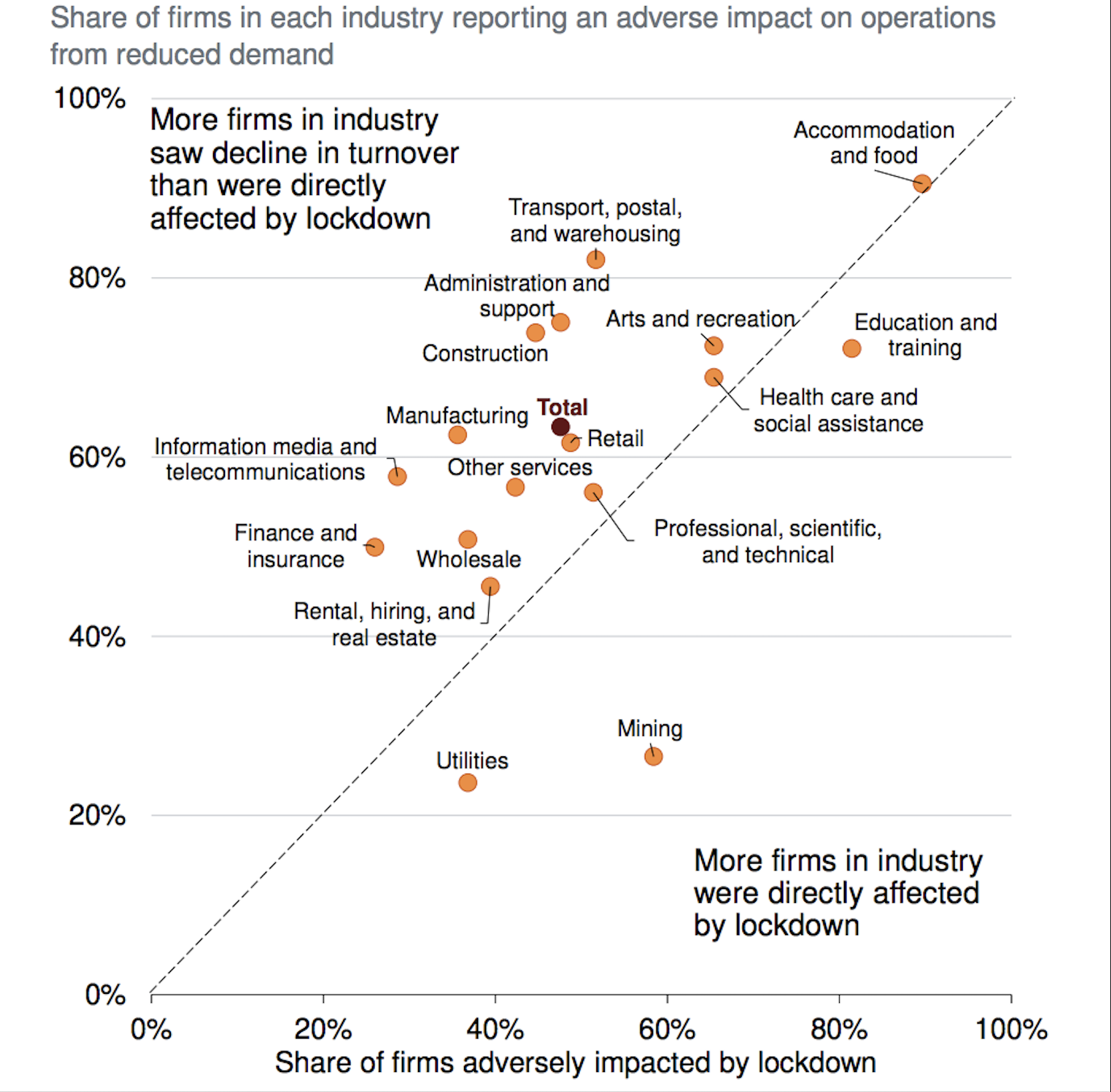

The Covid-19 induced economic crisis is expected to hit more than half of all workers in the hospitality industry, according to Grattan research, along with lower-income workers twice as likely as high-income earners to be out of work, and younger Australians and women expected to be impacted as a result of working in occupations most affected by the response to Covid-19.

Global recession and Australia

The International Monetary Fund forecasts a 6.7 per cent downturn for Australia’s economy, followed by a rebound in 2021 of 6.1 per cent, as of its mid-April update.

The IMF also forecasts the global economy to contract by 4.2 per cent in 2020, and grow by 4.6 per cent next year.

The OECD has forecast that direct economic impacts of shutdowns will wipe out between 20 and 30 per cent of economic activity in most advanced economies, roughly 2 percentage points of annual GDP for each month, with world trade to fall by 11 per cent over the 2020 calendar year.