Outlook on Construction Activity Turns Negative: Moody’s

Construction activity is expected to decline further in Australia during this year, following a 2.9 per cent drop in late 2019 according to Moody’s Investors Service and the Australian Bureau of Statistics.

For the first time since 2017 the global construction industry outlook changed to negative on the back of coronavirus disruptions, slowing economic growth, and low oil prices according to Moody’s analysts.

This comes off the back of the latest ABS report for December which showed the value of new residential building work done fell 4.3 per cent while non-residential work seasonally-adjusted fell 3.6 per cent following a rise of 8.2 per cent in the September quarter.

The impacts of the summer bushfires were yet to have an impact on the quarterly results which were expected to hurt the start of 2020.

Revenue for most construction companies was expected to decline in 2020 as Covid-19 related disruptions affected the economy according to Moody’s.

The analysts said in Australia construction activity was expected to decline even though the government has not mandated work stoppages.

Related: Construction Industry Calls for Further Covid-19 Stimulus, Relief

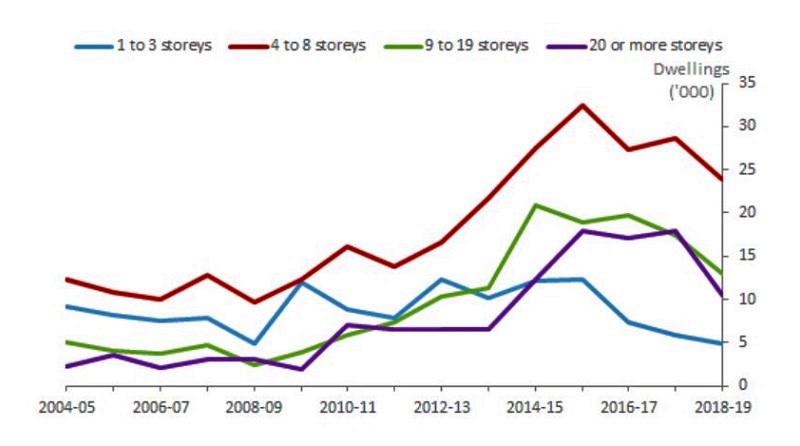

Residential construction projects started in Australia

Source: Australian Bureau of Statistics

“While we expect private construction activity to soften in the next 12 months, we expect the pipeline of infrastructure projects to proceed,” the report said.

“But we also expect continued delays in large infrastructure projects given supply chain disruptions and constraints on mobilising personnel at construction sites given social distancing laws and requirements for self-quarantine.”

They found energy and mining projects would fair better they were still likely to see delays and would have to deal with lower oil and commodity prices.

Contracting global economies would also affect future bidding opportunities and backlog growth with lockdown and social distancing raising the risk of project delays and cancellations.

However, Moody’s said in China construction activity had resumed on key infrastructure projects and the country was on track to recover much of lost domestic revenue.

This was aided by increased spending on infrastructure and strong order backlogs for companies.

Moody’s global outlook could change back to positive if rated companies revenue turned around in the next 12-18 months.